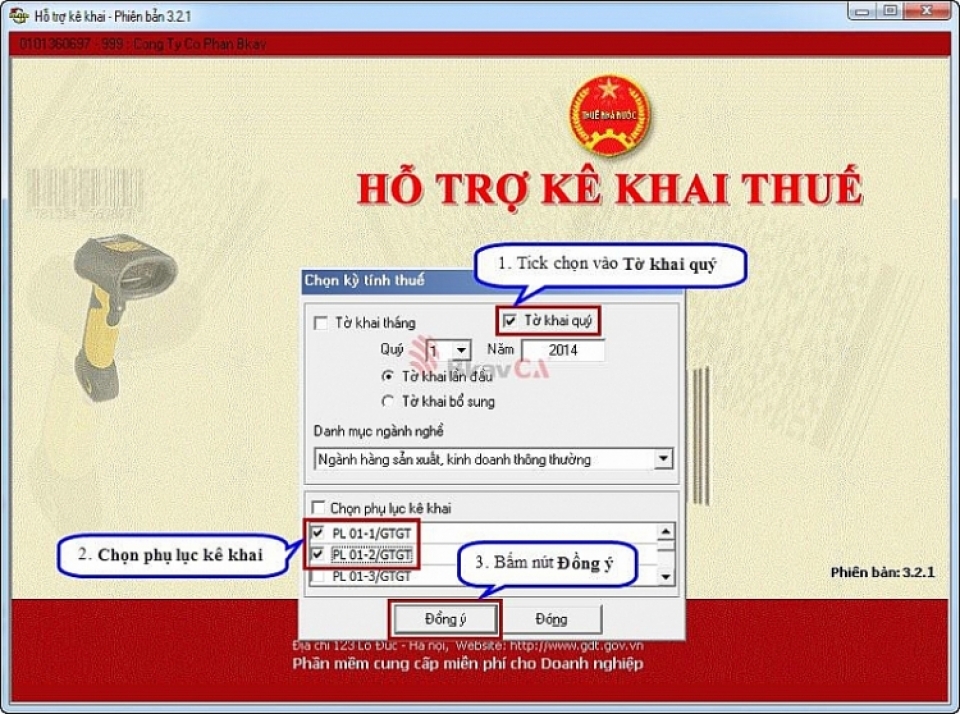

Upgrade the application of support declaration for personal income tax finalization

|

| This application is upgraded the function of printing barcode declarations of personal income tax finalization declarations. |

Accordingly, this application improves the function of printing barcode declarations of personal income tax finalization declarations.

For the function of printing annual financial statements (stipulated in Circular No. 200/2014/TT-BTC), the new version updated the correct codes of the indicators of the Balance Sheet (production costs, long-term unfinished business - code 241, unfinished basic construction cost - code 242), and at the same time updating the location showing the name "Chief Accountant" on the report of operating results.

For the function of downloading the table of personal income tax deduction, declarations for lottery and insurance companies (01/XSBHĐC), the new version has also updated automatically the calculation of the total criteria [12] when using the function of downloading table on the application.

Besides that, the version 4.1.6 updated the function of XML: no dump data of Table 05-2BK/QTT-TNCN.

The function of printing barcode declaration of personal income tax finalization (02/QTT-TNCN) also updated correct names of the indicators "Total temporarily paid tax, already deducted, paid in the period [36] = [37] + [38] + [39] - [40]”.

For the function of declaring the special consumption tax declaration (01/TTĐB), it is updated to remove the red warning error on the row of total at column 8 (indicator [I] plus the indicator [II]) on the declaration 01/TTĐB with column 7 in table II in Appendix 01-1/TTĐB).

The General Department of Taxation also announced clearly, from 23/3/2019, when establishing tax declaration dossiers related to the above upgrade contents, the organizations and individuals shall use the declaration functions at HTKK 4.1.6 application instead of using previous versions.

Organizations and individuals can download the installation and manuals using the HTKK application at the following address: http://www.gdt.gov.vn/wps/portal/home/hotrokekhai or contact directly the local tax authorities in order to be provided and assisted in the installation and using process.

Related News

General Department of Taxation continues upgrading the application of supporting declaration

15:56 | 28/05/2019 Finance

Ho Chi Minh Tax Department removes shortcomings on Personal Income Tax Finalization

14:27 | 27/03/2019 Finance

Enterprises have proactively finalized tax report soon

13:11 | 26/03/2018 Finance

Recommendation for security of Personal tax code

15:31 | 22/03/2018 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance