The General Department of Taxation responds to information on “collecting tax for durian”

| Thailand mangosteen, durian, longan re-exported to China through Vietnam |

|

| The collection of tax arrears only applies to business households that purchase durian but fail to register their business and fail to fulfill tax obligations. Photo: Internet. |

Durian farmers not collected tax arrears

Recently, there have been reportsabout Dak Lak Tax Department imposing tax on the trading durian of traders and enterprises in Krong Pac district Dak Lak). The General Department of Taxation immediately responded to this issue.

According to the General Department of Taxation, per report from Dak Lak Tax department, the scheme on anti- revenue loss for trading durian in Krong Pac district was implemented under the direction of the Steering Committee on anti-revenue loss and outstanding debt collection of Dak Lak province.

To support localities, organisations and individuals engaged in trading durian in the province to comply with the regulations, Krong Pac District People's Committee has issued a dispatch guiding procedures for business registration for agricultural products.

Accordingly, traders who come from other areas to Dak Lak to buy durian and transport them out of the province are not required to pay tax inthe province but must present valid invoices and documents when transporting goods. If traders buy durian directly from farmers, the list of goods purchased from farmers is required, stating name, address, quantity and value of goods purchased from farmers subject to tax exemption. If the traders buy goods of the durian granary owners, the invoices issued by the owners proving the owners have fulfilled the tax obligations, are required.

According to the General Department of Taxation, most households doing business on this item have implemented business registration and tax declaration according to regulations. However, some business households have not yet complied well norcoordinated with local agencies to fulfill tax obligations. The competent authorities have based on provisions of Circular No. 219/2013/TT-BTC and Circular No. 92/2015/TT-BTC of the Ministry of Finance to impose tax for these business households.

The General Department of Taxation said the tax collection by the intersectional team of Krong Pac district for durian granary owners inKrong Pac district complies with regulations of law and is calculated according to the market price of this item rather than applying fix rate. This is not tax arrears collection of durian farmers and is applied to business households who buy durian without business registration and tax obligations.

Activities to combat revenue loss for agricultural product business have been regularly conducted by agencies over the past years. In Dak Lak province, the Steering Committee on anti-revenue loss and outstanding debt collection has implemented schemes on anti-revenue loss, including anti-revenue loss for durian business. These activities have ensured State budget revenue and fairness according to the spirit of the law.

Strengthen anti-revenue loss from agricultural business activities

According to the General Department of Taxation, for agricultural products, per regulations in Circular 219/2013/TT-BTC and Circular 92/2015/TT-BTC of the Ministry of Finance, goods that are farming products produced and sold by farmers, are subject to VAT. Business households purchasing agricultural products for sale have to pay VAT and personal income tax at the selling stage.

In addition, according to current tax regulations, business households that do not meet accounting regulations shall not pay tax according to the tax declaration method, but must pay tax under the poll tax method based on revenue. These business households shall pay VAT and personal income tax depending on the business line. Business households that do not register, declare and pay tax willbe subject to tax assessment as prescribed.

According to the provisions of tax law, the steering committeeson anti-revenue loss and outstanding debt collection of provinces and cities have deployed many management solutions, in addition to focusing on publicity for taxpayers to ensure they understand their obligations, also taking many measures to combat revenue loss, ensuring fairness in performing tax obligations.

Related News

Regularly check tax obligations to avoid temporary exit suspension

09:47 | 21/11/2024 Regulations

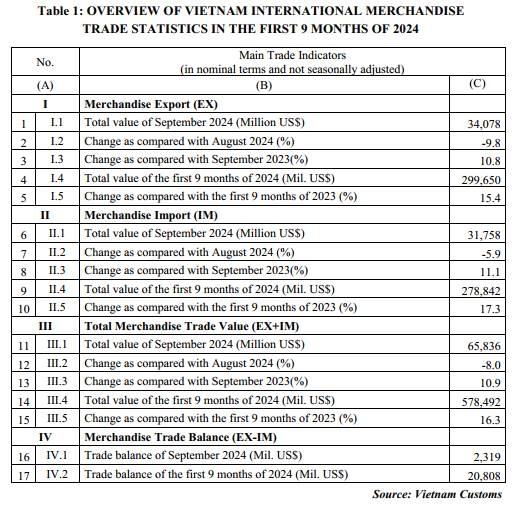

Preliminary assessment of Vietnam international merchandise trade performance in the first 9 months of 2024

09:22 | 20/11/2024 Customs Statistics

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance