Allocating credit room, motivation for banks to compete

19:14 | 14/09/2024 Finance

State capital management needs to take into account the specific nature of credit institutions

16:54 | 09/08/2024 Finance

Banks are facing new challenges in 2024

13:28 | 30/01/2024 Finance

Credit institutions can immediately redeem sold corporate bonds

13:55 | 04/01/2024 Finance

Strengthen supervision to boost the insurance market

13:43 | 19/11/2023 Finance

Concerned about handling weak banks, restructuring credit institutions still has many difficulties

10:32 | 01/11/2023 Finance

Credit institutions expect positive demand for banking services

14:33 | 12/07/2023 Finance

Difficult to achieve the target, aggressively deploying the two percent interest rate support package

09:37 | 02/06/2023 Import-Export

Credit institutions allowed to reschedule repayment terms

17:06 | 25/04/2023 Finance

SBV works to mitigate potential risks for non-banking credit institutions

14:42 | 13/02/2023 Finance

Banking profit growth in 2023 is forecast to decelerate

12:09 | 20/01/2023 Finance

State Bank requires strict control of credit risk

14:19 | 05/01/2023 Customs

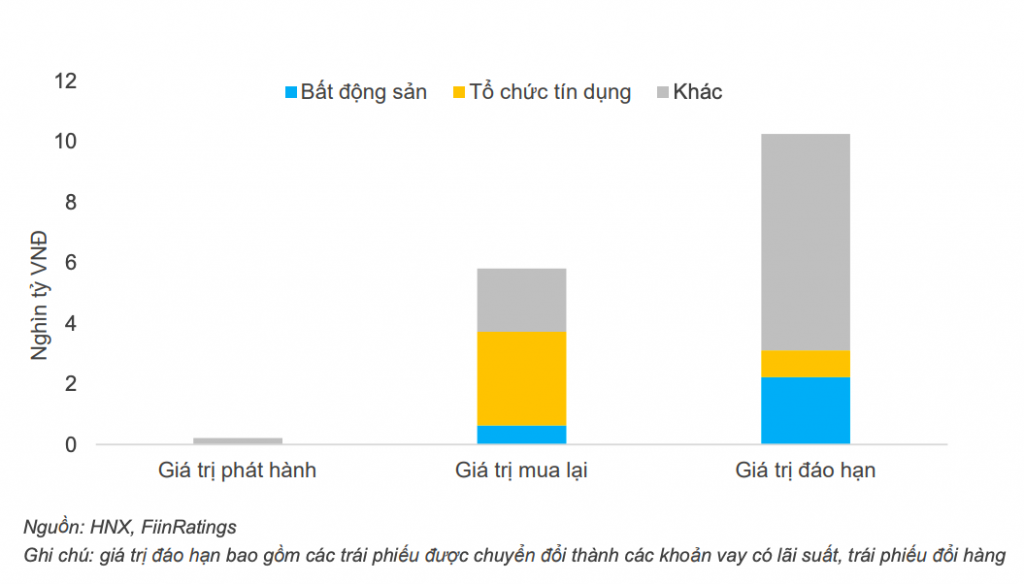

Credit institutions and real estate businesses continue to repurchase bonds

10:40 | 24/11/2022 Finance

Credit room has been eased, can enterprises solve the "thirst" for capital?

13:43 | 23/09/2022 Finance

The banking sector continues to promote system restructuring and bad debt handling

15:58 | 17/08/2022 Finance