Strictly managing businesses at high risk of using illegal invoices

|

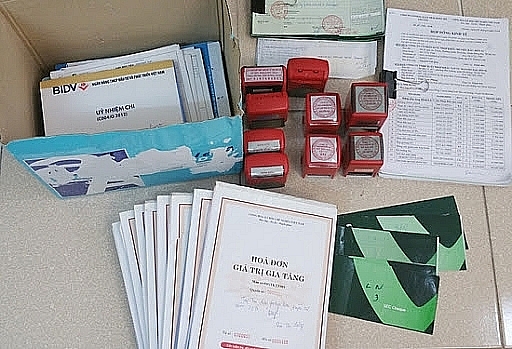

| Many cases of illegal trading of value-added invoices have been discovered |

Some enterprises have taken advantage of policies that allow them to issue invoices to use illegal invoices and buy and sell illegal invoices.

Therefore, the General Department of Taxation requested local Tax Departments to guide taxpayers to strictly comply with Law on Tax Administration and abide by regulations on the use of invoices; promote the dissemination of illegal trade of invoices and sanctions for each violation act so taxpayers avoid participating in invoice trading; coordinate with communication units to publicise information about firms that commit acts of buying and selling invoices, contributing to "warning" those who have been and are intending to violate the law on invoices.

The General Department of Taxation told all tax units to review and supervise enterprises at high risk of illegal printing, issuing, trading and using of invoices.

The General Department has issued official dispatches on solutions to prevent, detect and handle violations of the law on management and use of invoices; strengthen the review, inspection and detection of taxpayers showing signs of risks in management and use of invoices.

At the same time, collect information on taxpayers' data managed by tax departments and tax branches and information on taxpayers from other agencies like banks, Government Inspectorate, State Audit, other agencies; and from denunciation letters and media agencies.

In addition, identify violation signs of methods taxpayers use to buy, sell and use invoices like businesses that have issued invoices in large quantities but have suspended their operation or businesses that have notified of abandoning their business addresses but have applied for re-operation, showed large fluctuations in revenue, used many invoices but have not raised tax payable or paid tax that was not commensurate with the revenue; or firms that report zero volume of used invoices or unusually large number of used invoices.

The document also states tax units in charge of verifying the operation status of the taxpayer at the address registered with the tax agency according to regulations.

At the same time, work with each other to update information about taxpayers who do not operate at their registered address to publicly announce information about the enterprise that has issued invoices but escaped or suspended operations, or businesses illegally use invoices on tax websites and mass media to prevent violations of tax law and illegal trading of invoices.

| Hanoi: Successfully destroy the line of illegal trading VAT invoice |

In particular, official dispatches require tax units to review and evaluate businesses at high risk of invoices to carry out inspections.

Related News

Goods trading, being seen from Lang Son border gate

13:45 | 28/11/2024 Customs

Important step to soon upgrade stock market

10:21 | 03/10/2024 Finance

Foreign institutional investors allowed to buy stocks without 100 percent pre-funding -trading

09:07 | 22/09/2024 Finance

Risk prevention solutions for export processing and production enterprises

09:12 | 07/05/2024 Regulations

Latest News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance