Stock market develops strongly as important capital mobilization channel for economy

|

| Opening Ceremony of State Securities Commission in 1997 |

Nearly VND2.9 million mobilized from 2011 to 2020

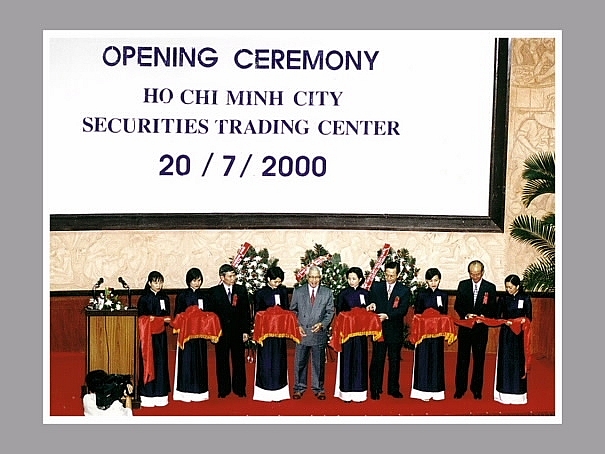

After the State Securities Commission was established in 1996, the Ho Chi Minh Securities Trading Center was opened in 2000, becoming the first centralized securities trading organization in Vietnam and the first trading session was held on July 28, 2020, marking the official birth of the stock market in the country. The corporate bond market was also formed in 2000.

The stock market also recorded the establishment of a Vietfund management (VFM) in 2003, Hanoi Stock Exchange in 2005, the Securities Depository Center in 2006 and the organization of the Securities Depository Center in 2009 and specialized government bond market (Government bond market).

By 2017, the derivatives market was put into operation, creating a new turning point for the stock market in particular and the financial market in general.

The Securities Commission said accompanying the development of the stock market in the past 25 years is the process of building and perfecting the legal framework on securities. In particular, the introduction of the Law on Securities 62/2019/QH14 with many new breakthroughs, replacing the former law, and a system of revised sub-law normative documents have contributed to perfecting the legal framework on securities and stock market.

As a result, the stock market has become an important channel to attract long-term investment capital for the economy and increased social investment capital.

Regarding the development of the stock market over the past 25 years, the Department of Market Development (State Securities Commission) said the Vietnamese stock market has continuously improved in structure, developed strongly to an important capital mobilization channel for the economy with mobilized capital of nearly VND2.9 million from 2011 to 2020, nearly 10 times higher than in the 2001-2010 period, contributing 19.5% of the total social investment and helping restructure Vietnam's financial system in a more balanced and sustainable manner.

|

| Opening Ceremony of Ho Chi Minh City Securities Trading Center in 2000 |

The total size of the stock market at the end of 2020 will reach 131.95% of GDP, accounting for 47% of the total assets of the financial system, approaching the bank credit scale in 2020 of 146.2% of GDP and much higher than 21% in 2010.

In which, the market capitalization surged to 84% of GDP in 2020, 2.6 times higher than 2015, 7.3 times higher than 2010 and exceeding the target of 70% of GDP in 2020.

Outstanding debt in the bond market made up 47.83% of GDP at the end of 2020, nearly three times higher than the outstanding debt in the bond market over GDP in 2011 and becoming an increasingly important capital mobilization channel for businesses and the Government.

In the first months of 2021, despite the Covid-19 pandemic, Vietnam's stock market made a strong breakthrough, continuously setting new records in both transaction index and value.

By the end of October 2021, the VN-Index rose 30.8% over year-end of 2020 to 1,444.27 points. The stock market capitalization rose over the year-end of 2020 to VND7,462 trillion. Market liquidity hit a record high of over US$1 billion per session.

"Launch pad" for many businesses

According to the Securities Commission, although it is newborn, the derivatives market has also developed rapidly. The average trading volume in 2020 was more than 14.2 times higher than 2017.

Vietnam's stock market also proves its strong attraction for domestic and foreign investors, reflected in the increasing number of investors from 3,000 accounts in 2000 to nearly 2.8 million accounts by the end of 2020. In particular, between January and October of 2021, more than 1 million new investors joined the market, bringing the total number of domestic investor accounts to nearly 3.8 million, exceeding more than 3% of the population.

“The quality of investors is increasingly improved. The active participation of foreign investors and institutional investors in Vietnam's stock market has contributed to improving the quality of corporate governance in accordance with international practices for listed companies. The stock market is considered a "launch pad" for many businesses to develop dramatically in both size and quality, becoming big names in the market," said the Market Development Department.

|

| Opening of the derivatives market in 2018. |

In the equitization of state-owned enterprises, the stock market plays an active role, creating favorable conditions for state-owned enterprises to be more open and transparent, contributing to realizing the policy of restructuring state-owned enterprises. Almost 652 enterprises conducted equitization and divestment in the 2011-2020 period with more than 5,718 million shares sold.

In addition, fairness and transparency in the stock market has been continuously enhanced. Vietnam's stock market is moving closer to international standards, becoming more modern and sustainable. This is reflected through its active participation in global financial initiatives.

Focusing on improving market quality

In the new period, the State Securities Commission said, the stock market in the 2021-2030 period is oriented to develop in a synchronous and unified direction in the overall financial market of the country, associated with economic growth model reform and restructuring; expanding the scale and focusing on improving market quality; conduct risk-based market management, ensure the safe operation of the market, protect the legitimate rights and interests of investors.

Medium and long-term solutions to help the stock market develop in a balanced, transparent and stable manner have been developed. Accordingly, new regulations and policies of the Securities Law and guiding documents will be put into practice to support businesses, protect the legitimate rights and interests of investors and create a driving force for Vietnam's stock market to develop sustainably.

The restructuring of the stock market with the restructuring of four major pillars, including: market restructuring; commodity base; investor base; securities trading organization will be further enhanced.

For the development of goods, the State Securities Commission will continue the policy of encouraging all types of enterprises to conduct initial public offerings (IPO) in association with listing, registering for trading on the stock market, creating a supply of good shares through reviewing IPO conditions associated with listing on the stock exchange.

In particular, the key goal is to establish a centralized trading market for corporate bonds and a market for enterprises with high growth potential.

Furthermore, the State Securities Commission continues to unify solutions, striving to soon upgrade the stock market from marginal market to emerging market to better attract the attention and investment of foreign organizations; strengthen the capacity of supervision, management and enforcement of state management agencies for the stock market according to international practices and standards and strictly handle violations to build a transparent and sustainable stock market.

The State Securities Commission also said that it will complete and put a new information technology system into operation at the Stock Exchanges and the Vietnam Securities Depository Center in order to modernize the infrastructure for management and monitoring of transactions and clearing for the whole market.

Related News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

More News

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Ministry of Finance stands by enterprises and citizens

15:30 | 13/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance