Steel exports face many risks from EU protection measures

| EVFTA contributes to pushing up steel exports to EU market | |

| Steel exports surge 78.1 percent in nine months | |

| Iron and steel exports witness big leap |

|

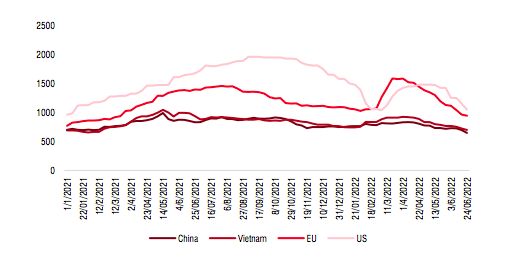

| HRC price movement. Source: Bloomberg |

Export speed is down

The steel industry update report just published by SSI Research shows that after increasing by 15% in the first quarter of 2022 due to pent-up demand, domestic finished steel consumption volume (including construction steel, galvanized steel sheet, and steel pipes) in April and May decreased by about 32% over the same period last year.

The significantly weaker demand could be attributed to a combination of three factors: high steel prices with rising costs of other building materials means construction activity is at a standstill; concerns about steel prices peaking, prompting distributors to suspend inventories and tightening management policies on capital inflows into the real estate sector.

Meanwhile, exports remained stable in the second quarter of 2022 with export volume of finished steel achieving an encouraging growth rate of 13% in the first five months of 2022.

However, the export channel tended to slow down in recent months, especially in the galvanized steel sheet segment, with monthly output about 30% lower than the peak in fourth quarter of 2021. According to SSI Research, the decline in output is due to reduced demand in key export markets (especially the US and EU), which accounted for 60-70% of the Vietnam galvanized steel exports in favourable conditions.

Galvanized steel companies such as HSG and NKG have received export orders until the end of July and August with an output of about 60,000 tons per month. However, the fact that export orders for 1 to 2 months in advance shows a slowing trend compared to the previous period when companies were able to sign about 3-4 months in advance.

In addition, exports in the second half of 2022 may also be negatively affected by protectionist measures imposed by the EU. The EU recently added Vietnam to the group of “other countries” with an import quota for this group of 2.1 million tons of hot-dip galvanized steel (HDG) from July 1, 2021 to June 30, 2022, and increase by 4% per year for the next 2 years.

According to the EU, Vietnam's HDG export output to Europe is estimated at 979,000 tons in 2021. With this adjustment, exports from Vietnam to the EU may decrease in the near future. However, the contribution from the EU market to Vietnam's steel exports has also decreased compared to the previous period due to the significant decrease in EU steel prices in recent months.

Falling steel prices put pressure on profit margins

SSI Research's report indicates that, due to weak demand, construction steel prices in Vietnam have fallen about 11% from their peak in March, while HRC steel prices have also fallen 25% from their peak at the beginning of April, according to the evolution of world steel prices.

In the world market, after skyrocketing 56% when the Russia-Ukraine conflict started, the price of HRC steel in the EU has now been about 35% below the level before the conflict. HRC prices in China and the US also fell 15-20% in the past three months due to less construction and manufacturing activity, amid worldwide inflation and especially due to weak demand in China in social distancing, adverse weather and slowing real estate market growth due to rising interest rates.

In terms of supply, global steel production has generally declined in the first months of 2022, with total estimated five-month production output down 6.3% compared to the same period. However, on a month-on-month basis, steel production in China has increased gradually over the past three months, increasing inventories at the factory and putting more pressure on steel price movements in the region.

From the above factors, SSI Research forecasts that the profit margin of steel companies will decrease in the second and third quarters of 2022. Specifically, HPG's 2022 net profit is forecasted to decrease by 23% compared to the same period in 2021, mainly due to the assumption of lower steel prices. Similarly, HSG's net profit is forecast to decreased by 67%; NKG down 39%.

However, the short-term decline in profit margins could be supported by lower input material prices. Specifically, coke prices have fallen 36% from their peak in March, while iron ore prices have also dropped 13% in the past three months due to reduced steel production (especially from China). While falling raw material prices may force companies to make provisions for inventories in the short term, cheaper input materials can help reduce companies' production costs in the coming quarters.

On the other hand, because the profit margin of Chinese companies has been reduced to a minimum, it is difficult for steel prices to fall in the near future at the same rate as in recent months. However, the recovery in steel prices is also relatively limited due to weak demand until China fully opens up its economy.

| Steel exports suffer severe drops due to COVID-19 The domestic steel industry is set to continue facing hurdles in the post-coronavirus period due to a ... |

SSI Research believes that the profit margin of steel companies is not expected to fall to the "bottom" in the period of 2018-2019, due to less pressure from increasing industry capacity and the debt ratio is now at a safe level.

Related News

Ho Chi Minh City achieves record state revenue of over VND500 trillion in 2024

10:33 | 10/12/2024 Finance

Multiple drivers propel positive growth in budget revenue

10:33 | 05/12/2024 Finance

Vietnam’s exports to the U.S. near US$100 billion milestone

09:46 | 21/11/2024 Import-Export

From the “abnormal” coffee price, worries about the new crop

09:46 | 21/11/2024 Import-Export

Latest News

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export

Việt Nam expects to officially export passion fruit to the US next year

18:55 | 22/12/2024 Import-Export

UK’s carbon tax to affect VN exports

18:51 | 22/12/2024 Import-Export

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

More News

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export

Agricultural exports in 2024 to exceed 60 billion USD?

13:53 | 22/12/2024 Import-Export

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Your care

VN faced with increasing trade defence investigations on rising protectionism

18:58 | 22/12/2024 Import-Export

Việt Nam expects to officially export passion fruit to the US next year

18:55 | 22/12/2024 Import-Export

UK’s carbon tax to affect VN exports

18:51 | 22/12/2024 Import-Export

Removing obstacles in granting certificates of exploited aquatic products

13:56 | 22/12/2024 Import-Export

Promoting agricultural exports to the Japanese market

13:55 | 22/12/2024 Import-Export