State budget revenue in 2020 is higher than forecast

|

| The 2021 state budget estimate has been approved by the National Assembly. |

Making all efforts in the last two months of the year

In the 2020 plan, Vietnam sets the annual growth target of 6.8%, the state budget revenue will increase highly in the condition that the state budget revenue in 2019 has exceeded the estimate (9.9% - equivalent to VND134 trillion). However, at the regular meeting in November 2020, the Government assessed that this year's growth is only about 2.5% - 3%. Although this is a low level compared to the set target, Vietnam is still a bright spot and one of the economies in the region with positive economic growth.

The implementation of financial - budget tasks is extremely difficult because 2020 is a particularly difficult year due to the impact of the Covid-19 pandemic, natural disasters, storms and floods, affecting production and business activities.

On the one hand, all levels and branches have to implement many measures of tax exemption, reduction and extension to remove difficulties for businesses. On the other hand, they must increase spending on prevention and overcoming consequences of natural disasters and the pandemic.

On behalf of the Government reporting at the 10th session of the 14th National Assembly, the Ministry of Finance expects the 2020 budget revenue reduction to be around VND190 trillion. This figure is based on the results of working with localities in August – the time of the second outbreak in Da Nang and some other localities. However, as of December 24, 2020, the balance revenue reached 93.18% of the estimate; revenue only decreased by about VND103 trillion, lower than the level previously reported to the National Assembly.

Mr. Nguyen Minh Tan, Deputy Director of the State Budget Department, Ministry of Finance, said that the State budget tasks in 2020 are implemented in the context that the domestic economy is both seriously affected by the Covid-19 pandemic, and affected by natural disasters and climate change (droughts, hail, floods, widespread saltwater intrusion). In that context, the Government has submitted to the Standing Committee of the National Assembly and the National Assembly to promulgate many fiscal policies and solutions to ensure the "dual goal" - both preventing the pandemic and recovering and developing socio-economic activities.

“The pandemic has seriously affected production - business activities of enterprises and people's lives, combined with the implementation of tax exemption and reduction policies and budget revenues to support businesses and people, domestic revenue decreased. Besides, revenue from crude oil, balanced revenue from import-export activities, revenue from the equitization of state-owned enterprises were not as expected due to the negative impact of the pandemic, making the revenue estimate in 2020 decrease compared with the estimate. The Covid-19 pandemic also seriously affected production, business, and consumption demand of society, thereby affecting revenues, expenditures and the state budget balance in 2020. The Government is continuing to drastically and synchronously implement solutions, striving to achieve the highest level of state budget revenue estimate in 2020,” the representative of the State Budget Department said.

In November 2020, the Minister of Finance issued a directive requesting the General Department of Taxation and the General Department of Customs to focus on boosting budget revenue with the request “to strive to complete the revenue estimate, especially domestic revenue”.

In the last two months of the year, the Ministry of Finance also suggested the Government to direct ministries, central agencies and localities to continue to effectively implement economic stimulus and social security policies issued in recent years, promptly solve difficulties and problems in administrative procedures (tax, land for enterprises and the people); contribute to solving difficulties for production and business. At the same time, striving to disburse public investment capital to reach over 90% of the assigned capital plan in 2020, contributing to promoting economic growth and creating a stable source of revenue for the state budget.

In addition, the Ministry of Finance proposed to maintain the Steering Committee against tax loss and collection of tax arrears in order to direct the implementation of budget collection tasks in the area, ensuring correct, full and timely collection of revenues to the state budget according to regulations, including taxes and land rents whose time has expired and are extended to state budget payment according to regulations.

Thanks to these solutions, the state budget revenue by the end of November reached 83.4% of the estimate. At the regular meeting of the Government in November, the Ministry of Finance reported to the Government that the budget deficit for the whole year was about VND100 trillion (lower than the previous forecast of VND190 trillion).

Continue to increase proportion of domestic revenue

According to Mr. Nguyen Minh Tan, on the basis of the assessment of the ability to perform socio-economic tasks in 2020, it is expected that the world and domestic economic situation in 2021, the State budget estimate for 2021 is built on the basis of expected economic growth of 6% compared to 2020, the average CPI growth rate of about 4%; crude oil price is US$45 per barrel; with export turnover growth of about 5%.

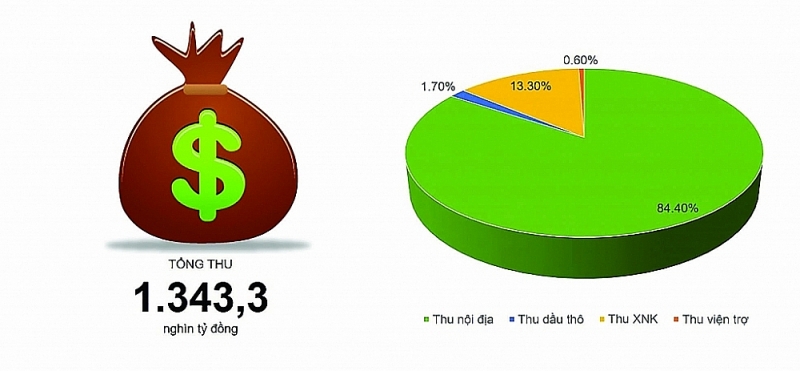

In which, the estimated state budget balance revenue in 2021 is VND1,343.3 trillion, up 1.5% compared to the estimate made in 2020, down by 11.1% compared to the 2020 estimate.

The domestic revenue is estimated at VND1,133.5 trillion, accounting for 84.4% of the total state budget balanced revenue, meeting the requirement that the proportion of domestic revenue is increasing in the structure. The State budget revenue (estimated at the rate of 83.6% in 2020; estimated implementation is 84.3%). It is estimated that crude oil revenue is VND23.2 trillion, accounting for 1.7% of the total state budget balance revenue on the basis of exploited output of about 8 million tons and estimated price of US$45 per barrel. Estimated balanced revenue from import-export activities is VND178.5 trillion, accounting for 13.3% of the total state budget balance revenue. The estimated aid collection is VND8.13 trillion.

In order to complete this estimate, the Finance sector also set out the main groups of solutions. In particular, continue promoting economic restructuring associated with growth model innovation, improving productivity, quality, efficiency and competitiveness, while developing the digital economy. At the same time, closely and synchronously coordinate monetary policy and fiscal policy from the stage of making policy to administration to ensure macroeconomic stability and control inflation in line with the set targets; step up the reform of administrative procedures, improve the business investment environment, and create favorable conditions for businesses to develop stably and compete equally.

In addition, continue to strengthen financial discipline, thoroughly combat waste, in accordance with the ability to balance the budget, associated with development orientations in each period, ensuring sustainability. The national financial security and safety; reform the financial mechanism of public non-business units and public service prices.

In particular, speed up the implementation of restructuring, equitization and divestment of state capital in enterprises; improve the operational efficiency of state corporations; implementing price management in accordance with the market principles, promoting equal competition among economic sectors, improving the efficiency of resource use, stabilizing major balances, and supporting growth; continue to develop and smoothly operate the financial market and financial services.

Related News

Vietnam’s trade activity declines in early November despite strong year-to-date growth

10:35 | 05/12/2024 Import-Export

Hanoi Customs partners with businesses to boost import-export activities

10:49 | 15/11/2024 Customs

State revenue collection poised to surpass annual target

10:11 | 12/11/2024 Finance

Da Nang Customs joins efforts to establish free trade zone proposal

10:56 | 15/11/2024 Customs

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance