Shifts in investment flows for export-oriented industries

A worker making products for export at a plant in Hanoi (Photo: VNA)

The country's textile, garment and footwear industries have long relied on imported raw materials, causing a current trend of foreign enterprises shifting industries to other countries, said insiders.

In response to concerns raised by deputy Pham Van Hoa of Dong Thap province at the 15th National Assembly (NA)'s question-and-answer on June 4, Minister of Industry and Trade Nguyen Hong Dien said: "Vietnam is no longer a haven for labour-intensive, land-intensive or low-productivity industries with cheap labour costs."

According to Minister Dien, over the past 10 years, textile, garment and footwear products have accounted for a significant portion of Vietnam’s export structure. The industry has contributed to the nation's growth in export value and helped create jobs and income for workers.

This was more prevalent in the initial phase, about 10 years ago, when it helped restructure the economy.

But the shifting of foreign enterprises in these industries to other countries is now considered normal, as Vietnam no longer offers the advantages that initially attracted these low-productivity industries.

Going forward, Dien emphasised that all of the country's exporting manufacturers must aim for greater control over raw material supply. Relying on imports would limit profitability, as it is essentially just doing processing work.

To address this, the Ministry of Industry and Trade (MoIT) has recommended the Government implement comprehensive national, sectoral and local master plans. In the industry and trade sector, four national plans have been developed covering energy, electricity, petroleum and mineral resources.

The ministry emphasised that the four national master plans are crucial to providing raw materials for Vietnam’s manufacturing and exports.

These resource-based industries can not only meet the needs of export-oriented manufacturing, but also contribute significantly to local and national budget revenues.

The authority said that all exporting manufacturers, not just in the textiles and garment industry, must strive to utilise domestic raw material sources. By tapping local minerals, these industries can achieve self-sufficiency in raw materials.

This would allow them to move beyond low-cost processing and increase the value-add of their exports, Minister Dien stressed.

Recent customs data shows the textile and garment sector facing challenges, with exports declining 11.4% year-on-year to 33.3 billion USD in 2023, while textile fibre and yarn fell 7.6% to 4.4 billion USD.

As a result, total textile and garment exports reached around 40 billion USD.

Meanwhile, Vietnam’s leather and footwear export value dropped 14.2% to $24 billion. Footwear exports, which make up the majority of the industry, dipped 15.3% to 20.2 billion USD, accounting for 5.7% of the country's total exports.

Exports of related products like handbags, suitcases, hats and umbrellas also fell, down 7.8% to 3.78 billion USD.

On the contrary, the industry still relies heavily on imported raw materials. The import value of raw materials for the textile, garment and leather-footwear sectors reaches tens of billions of dollars annually.

The localisation rate, or use of domestic raw materials, in these export-oriented industries is relatively low, currently estimated at 45-50%, according to the MoIT.

Southeast Asia and India stand to be net beneficiaries of companies persifying manufacturing capabilities to complement existing bases in China, a recent report from Jones Lang Lasalle (JLL), a global commercial real estate and investment management company, showed.

Particularly, Vietnam will grow significantly and be a hub with strengths extending beyond electronics manufacturing. Therefore, the investment wave is now turning to this industry.

The country's semiconductor industry is witnessing strong development, with numerous multi-million-dollar foreign direct investment (FDI) projects coming to invest.

Leading chip makers like Intel, Samsung and Hana Micron have made significant investments in Vietnam over the past few years.

Intel opened the world's largest chip assembly and testing facility in the country in 2021 as part of around 1.5 billion USD in total investment.

Samsung also revealed plans in 2022 to start producing semiconductor wafers in Vietnam by late 2023, while the Republic of Korea (RoK)'s Hana Micron inaugurated a $600 million manufacturing project in the country in 2023, with plans to invest over 1 billion USD by 2025.

Amkor Technology, another RoK semiconductor company, inaugurated a new $1.6 billion factory in Bac Ninh province. The facility specialises in the production, assembly and testing of semiconductor materials and equipment.

In early December 2023, a delegation from the US Semiconductor Industry Association (SIA), with top executives from leading US semiconductor companies such as Intel, Synopsys, Ampere Computing, Marvell and ARM, visited Vietnam to explore investment opportunities and support connections between businesses in the two countries.

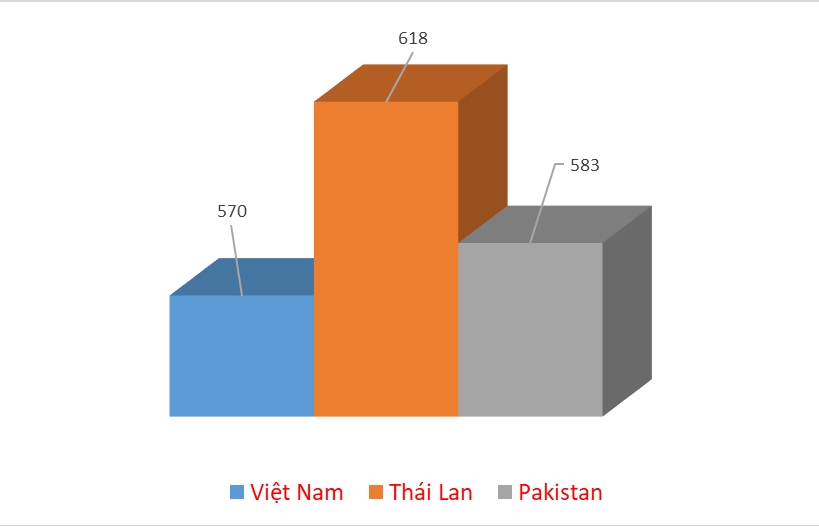

Statistic from the Ministry of Information and Communications showed that Vietnam emerges as major semiconductor exporter to the US, accounting for over 10% of total semiconductor chips imported into the market. It ranks third in terms of semiconductor chip export revenue to the US, trailing only Malaysia and Taiwan (China).

These investments by top global semiconductor firms highlight Vietnam’s growing status as an important hub for high-tech electronics manufacturing and its favourable conditions for attracting more FDI in the industry./.

Related News

Latest News

Vietnamese lychees become familiar to Thai consumers

15:11 | 22/06/2024 Import-Export

Vietnam Report announces top 10 reputable technology companies of 2024

15:10 | 22/06/2024 Import-Export

Geographical Indication certificates help increase value of Vietnamese farm produce

15:09 | 22/06/2024 Import-Export

Orders increase, exports in the first 5 months of the year continue to prosper

07:49 | 22/06/2024 Import-Export

More News

Import-export turnover reached nearly US$65 billion in May

13:47 | 21/06/2024 Import-Export

Russia’s Far East potiential destination for Vietnamese businesses: official

09:58 | 20/06/2024 Import-Export

Exports up 13.8% in first half: ministry

09:56 | 20/06/2024 Import-Export

Seafood businesses clearly point out barriers affecting exports

08:10 | 20/06/2024 Import-Export

Many exported seafood products have experienced high growth

08:09 | 20/06/2024 Import-Export

Export turnover increases over 14.9%

08:07 | 20/06/2024 Import-Export

Rice exports to China drop sharply

08:03 | 20/06/2024 Import-Export

Germany supports Vietnam’s garment industry in green transformation

14:20 | 19/06/2024 Import-Export

Tuna exports expected to grow by 20% in H1

14:15 | 19/06/2024 Import-Export

Your care

Vietnamese lychees become familiar to Thai consumers

15:11 | 22/06/2024 Import-Export

Vietnam Report announces top 10 reputable technology companies of 2024

15:10 | 22/06/2024 Import-Export

Geographical Indication certificates help increase value of Vietnamese farm produce

15:09 | 22/06/2024 Import-Export

Orders increase, exports in the first 5 months of the year continue to prosper

07:49 | 22/06/2024 Import-Export

Import-export turnover reached nearly US$65 billion in May

13:47 | 21/06/2024 Import-Export