Revenue from services helps the bank to grow

|

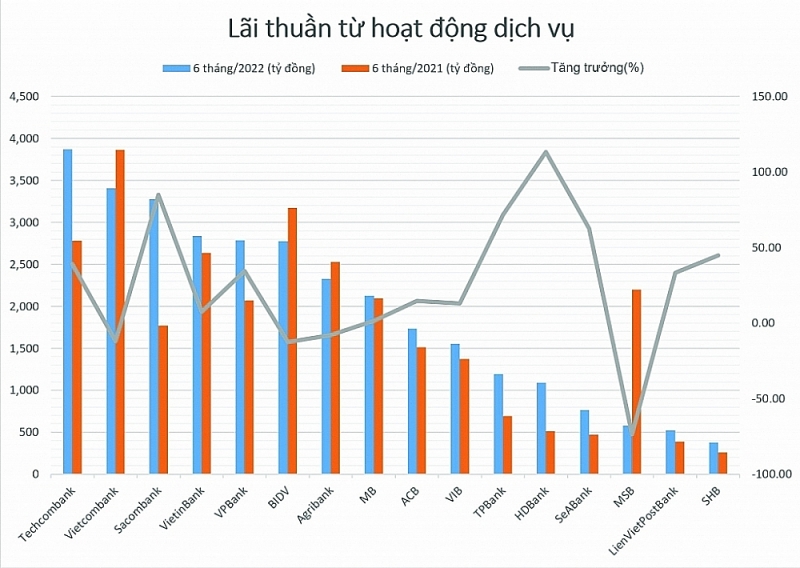

| Comparison of net profit from service activities of several banks. Chart: H.Diu |

All grew strongly, except for three big banks

As in previous years, in the first half of 2022, the business results of banks recorded positive numbers.

In addition to credit income thanks to the economic recovery, businesses are eager to borrow capital to return to operation, non-interest activities also have positive results, increasing the proportion in the income structure of banks.

According to the analysis of VCBS Securities Company, non-interest income tends to increase in proportion in the first half of 2022, accounting for an average of 27%, in the income structure of banks.

The main contribution to this revenue was the strong growth of fee income in private banks (37% yoy) and contraction in state banks (-16.5%) due to this group accepting to sacrifice transfer fee income in order to improve demand deposit (CASA).

All banks recorded positive growth in fees for payment via digital banks and fees from cards when the number and value of online transactions increased rapidly in the first six months of the year.

Specifically, according to VPBank's semi-annual financial statements, consolidated operating income reached VND31,600 billion, up 37% over the same period. In which, income from service activities increased by 34.5% over the same period, contributing to total income of more than VND2,787 billion in the first half of the year.

VPBank's report said that the number of customers registering to use VPBank NEO increased sharply by 63% over the same period, with 96 million transactions recorded in the first half of the year, equivalent to an increase of nearly 80% compared to the same period in 2021.

Meanwhile, card revenue also grew steadily, with total credit card spending in the first six months increasing 22% y/y. In addition, revenue from other activities of the bank also increased impressively by nearly 700% over the same period, thanks to increased revenue from other financial derivatives.

This result has contributed to the bank's pre-tax profit up to more than VND15,300 billion, an increase of more than 70% over the same period.

For other banks, net profit from service activities in the first six months also recorded a significant increase. Techcombank's net profit from service activities reached nearly VND3,870 billion, up nearly 40% over the same period last year; TPBank reached VND1,192 billion, up 71.7%; SHB reached nearly VND380 billion, up 45%; HDBank reached more than VND1,090 billion, doubled over the same period; Sacombank reached nearly VND3,280 billion, an increase of nearly 85%.

MSB alone fell sharply by 73.6% to VND580 billion in the first 6 months of 2022 because it no longer recorded abnormal income from insurance distribution fees like 2021.

However, with state-owned banks, such as Vietcombank, BIDV, Agribank, and VietinBank have all announced free transfer transactions on digital channels, thus it has significantly affected payment fee revenue.

Therefore, net profit from service activities in the first six months of Vietcombank was at VND3,405 billion, down 11.9% over the same period in 2021; at BIDV was VND2,778 billion, down 12.5%; Agribank reached VND2,328 billion, down nearly 8%.

Particularly at VietinBank, thanks to the good growth in revenue from trade finance fees and insurance commissions over the same period; although net profit from payment activities decreased, net profit from service activities in the first 6 months of the year of this bank still increased by 7.5% over the same period, reaching VND2,838 billion

Always a potential revenue source

The trend of shifting income from credit activities to non-credit activities is becoming clearer in banks. According to experts, although most banks are offering free online transactions, this will be a great source of revenue when the online payment trend is developing very strongly in Vietnam.

Sharing the same view, a representative of VietinBank said that the service fee exemption and reduction policy affects the fee collection results from payment activities in the short term, but it is an important solution to promote the growth of CASA ratio and expand the customer base and bring long-term effects to the bank in the future.

At Vietcombank, according to SSI Securities Company, despite the reduction in payment fees, the percentage of customers using Vietcombank's digital banking has increased significantly, to about 8 million customers by the end of June 2022 up from 6.6 million customers at the beginning of 2022.

Moreover, many studies have determined that Vietnam's life insurance market still has a lot of room for growth, helping income from insurance distribution commissions to increasingly contribute to income from services. In addition, the stock market still has a lot of potential for development, helping income from brokerage, proprietary trading and securities underwriting activities to grow positively in the coming years.

With the forecast for the banking industry in the 2022-2023 period based on expectations that the economy will accelerate again on the background of strong export growth, recovery in consumption and supportive fiscal policies, experts of VNDirect Securities Company said that the banking industry will be one of the industries benefiting most from this trend.

According to a recent report, VNDirect believes that although net profit margin is unlikely to improve due to the increase in deposit rates, banks will still record high-profit growth of 29% and return on equity (ROE) will reach 22% in 2022 based on high credit growth, stable fee income and well-controlled credit costs.

Related News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

More efficient thanks to centralized payments between the State Treasury and banks

13:51 | 17/10/2024 Finance

Allocating credit room, motivation for banks to compete

19:14 | 14/09/2024 Finance

Banks minimize costs, optimize profits

19:05 | 02/09/2024 Finance

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance