Optimizing opportunities from EVFTA in the new context

|

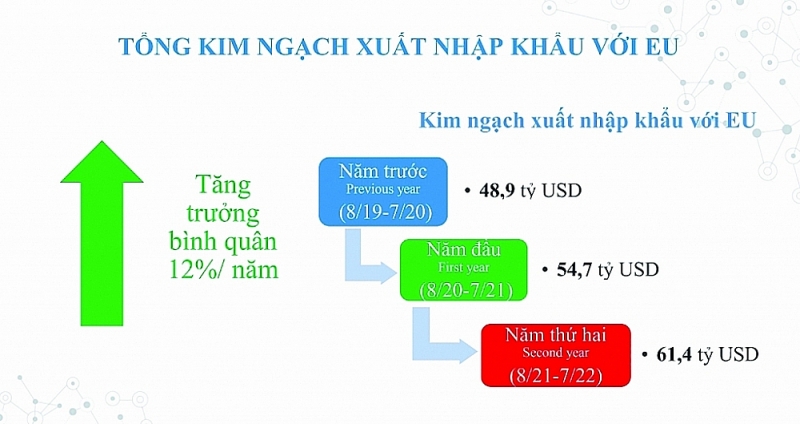

| Source: Ministry of Industry and Trade |

The context has changed

Although now, the Covid-19 pandemic has been basically controlled in Vietnam and many countries around the world, including the European Union (EU), the consequences are still very heavy.

The world economy was dealt another blow from the war between Russia and Ukraine, disrupting supply chains, increasing inflation, and increasing consumer demand in European countries. Europe changed dramatically. To curb inflation, many countries raised interest rates, causing many currencies to depreciate sharply, in which, the Euro has strongly depreciated against the USD.

According to Dr. Le Xuan Sang, Deputy Director of the Vietnam Institute of Economics, recently, Europeans have two consumption trends, one is to make up for the distance due to the pandemic, so they should shop more, the other is to spend more money. Use it with caution and pay more attention to environmental factors and social responsibility. However, the second consumption trend is more likely to occur because EU people's jobs are affected and income is lower.

Separately analyzing the products of the textile industry, Dr. Sang said that the textile and garment industry is still assessed as having a negative impact on the environment. One study found that 77% of EU consumers care about environmental conditions, 72% focus on product-related services and 51% pay attention to quality. In addition, the demand for high fashion products and the increasing trend of product personalization makes it necessary to constantly change product designs and models. The mass production method gradually reduces the size of each shipment to avoid high inventories.

This expert recommends that textile enterprises need to quickly change production methods to catch up with new consumption trends. Instead of waiting for large orders, businesses need to focus on producing small orders with different characteristics and fast delivery times. At the same time, flexible in production and management to meet the diverse needs of customers.

Opportunities will open up if you know how to take advantage

However, according to businesses, changes in demand and market context also create many opportunities for businesses if they know how to take advantage. For example, with the ongoing energy crisis in the EU, while the EU is the largest market for wood pellets in the world, accounting for 75% of global demand, Vietnam's wood pellet exporters there will have great opportunities. The export value of wood pellets continuously increased from USD 165 million in 2017 to USD 413 million in 2021 and has reached about USD 568 million in the first 6 months of 2022 (up 82.8% over the same period in 2021).

Or with fertilizer businesses, currently, Russia bans exports, China restricts fertilizer exports, and many large fertilizer manufacturing companies in the EU have simultaneously announced to cut output or close factories, so fertilizer prices have been increasing quite strongly.

|

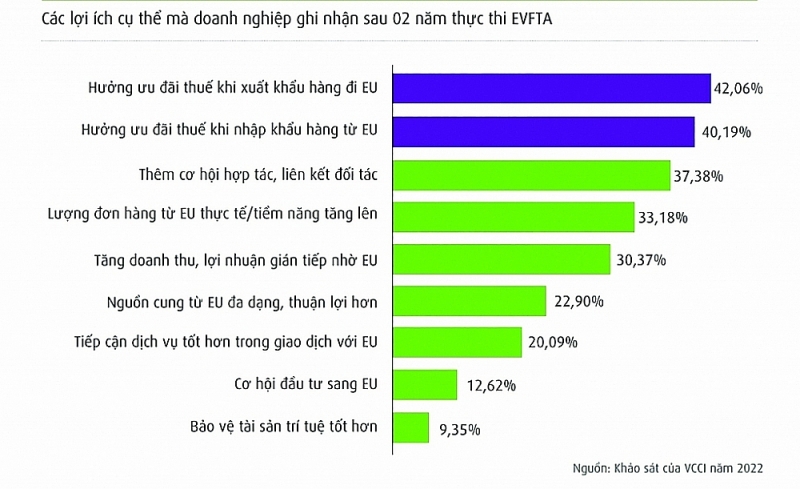

| Source: VCCI survey in 2022 |

For businesses in the food and beverage industry, opportunities are also open thanks to the roadmap to reduce or eliminate tariffs to boost the export volume of Vietnamese food and beverage products to Europe. In addition, Vietnamese enterprises are also exempt from inspection of production facilities, facilitating small and medium enterprises in the process of being recognized for food and beverage products meeting the sanitary and phytosanitary standards (SPS) of the EU.

Moreover, the EVFTA also includes EU commitments to providing technical assistance to Vietnam to comply with SPS measures. According to businesses, this commitment will create opportunities for Vietnamese exporters to be supported to perfect their products, especially small and medium-sized enterprises that are limited in production and preservation technology and have difficulty in meeting the requirements of EU SPS standards.

Therefore, businesses believe that, in the next 2-3 years, at least from the perspective of goods trade, FTAs in general and EVFTA, in particular, can be meaningful support for businesses, especially for export manufacturing enterprises to overcome difficulties to stabilize production and continue to develop.

For the rice industry, the EU gives Vietnam a quota of 80,000 tons per year. The EU will also fully liberalize broken rice. These commitments help Vietnam to export an estimated 100,000 tons to the EU annually.

Pham Thai Binh, General Director of Trung An Hi-tech Agriculture Joint Stock Company, said the company has exported to the EU market shipments of fragrant rice with export prices of more than $1,000/ton, but on a large scale. In the industry, exports to the EU are still very modest because Vietnam exports over 6.4 million tons of rice/year.

Therefore, he said, businesses need to invest in a methodical and focused way to exploit the EVFTA more substantively.

Barriers still exist

According to a survey by VCCI, FTAs, including new generation FTAs with a wide scope like the EVFTA, only directly "touch" aspects of production, import and export, services, investment and some other rule areas (competition, intellectual property, e-commerce, etc.) but not all economic or business environment issues. Therefore, businesses have quite clearly identified the obstacles in realizing the opportunities and benefits that EVFTA and FTAs can bring.

Survey results in the report "Vietnam after 2 years of implementing EVFTA from a business perspective" of VCCI showed that approximately 3 out of 10 businesses complained about slowness, obstacles, and lack of flexibility of FTA enforcement agencies; 1 out of 4 enterprises rated the business environment as not favorable and there were unreasonable obstacles.

In addition, in the context that most businesses have just come out of an unprecedentedly difficult period due to the Covid-19 pandemic, businesses are aware that the biggest obstacle is limitations in competitiveness.

In addition, regarding the use of tariff preferences, the common reason why enterprises have not yet enjoyed them is that they do not meet the required rules of origin or because they have enjoyed other tax incentives such as GSP or low MFN preferential import tax.

However, there are also a few who do not enjoy incentives because they do not ensure the requirements for documents, other related procedures or even do not know anything about these incentives.

With the above issues, according to Nguyen Tuong, a representative of the Vietnam Association of Logistics Service Enterprises, businesses need to actively improve the level of service provision and the level of cooperation to attract investment, technology transfer, and support for digital transformation to improve production capacity to meet the requirements of the FTA.

According to Lawyer Dinh Anh Tuyet, Head of the IDVN Law Office, and an arbitrator of the International Arbitration Center (VIAC), businesses need to make long-term plans to be ready to meet the increasingly strict demands of the law, labor standards, environmental protection, especially enterprises in the fields of development, exploitation of agriculture, fisheries, processing and production of food and beverages. Businesses need to learn competition law in the EU to avoid the risk of being investigated and applying trade remedies.

On the management side, Dr. Le Xuan Sang suggested that the State should support and accompany businesses to boost exports and take advantage of opportunities when EU countries cut production or many countries restrict the export of some products.

Along with that, the authorities need to strongly implement activities to support trade promotion, connect supply and demand through the transnational trade and e-commerce system, and support market information to remove barriers, and diversify markets to promote exports.

Related News

The wood industry seizes opportunities amid changes in the export market

11:22 | 16/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export

Vietnamese businesses struggle to access green finance

09:58 | 18/12/2024 Import-Export

US trade policy is expected to be "stricter", what should businesses do?

15:50 | 02/12/2024 Import-Export

Latest News

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

More News

Binh Dinh province works to attract investment from Japan

15:44 | 19/12/2024 Import-Export

Agricultural, forestry and fishery exports “reach the target” early

15:20 | 19/12/2024 Import-Export

Thailand remains Vietnam’s biggest trading partner in ASEAN

15:35 | 18/12/2024 Import-Export

Rubber value soars in 2024: VRA

15:33 | 18/12/2024 Import-Export

E-commerce: a gateway to boost Vietnamese commodities in the UK market

16:55 | 17/12/2024 Import-Export

Agro-forestry-fisheries exports top 62 billion USD in 2024

16:51 | 17/12/2024 Import-Export

Removing “bottlenecks” for digital transformation in industrial production

10:00 | 17/12/2024 Import-Export

UKVFTA facilitates Việt Nam's tuna exports to UK market

13:56 | 16/12/2024 Import-Export

Vietnam’s garment-textile exports expected to reach 44 billion USD this year

13:53 | 16/12/2024 Import-Export

Your care

Seafood exports expected to exceed $10 billion in 2025: expert

20:28 | 21/12/2024 Import-Export

Top 10 Reputable Animal Feed Companies in 2024: Efforts to survive the challenges of nature

18:30 | 21/12/2024 Import-Export

Vietnam's import-export surges 15.3%

09:44 | 20/12/2024 Import-Export

More Vietnamese firms interested in Saudi Arabia: Ambassador

09:43 | 20/12/2024 Import-Export

“Give and Take” in the Value Chain of the CPTPP Market

09:30 | 20/12/2024 Import-Export