Insurance firms plan to go digital

|

Just over 82% of firms said they aimed to use digital technologies as momentum for growth in the Fourth Industrial Revolution, while 64.7% planned to build on two key factors of the Fourth Industrial Revolution, including Internet of Things (IoT) and Big Data.

The survey showed that the total insurance premium in the first quarter of the year of all surveyed companies was higher than the same period last year. Life insurance businesses said their premium in the January-March period rose on average of 159% from last year and that of non-life insurance rose 24%.

The positive factors in the economy, favourable conditions of the population and insurance firms’ efforts to expand operation scale and improve financial ability contributed to the high growth, Vietnam Report said.

In addition, the foreign ownership at insurance companies which has been rapidly increasing also brought favourable conditions to the market.

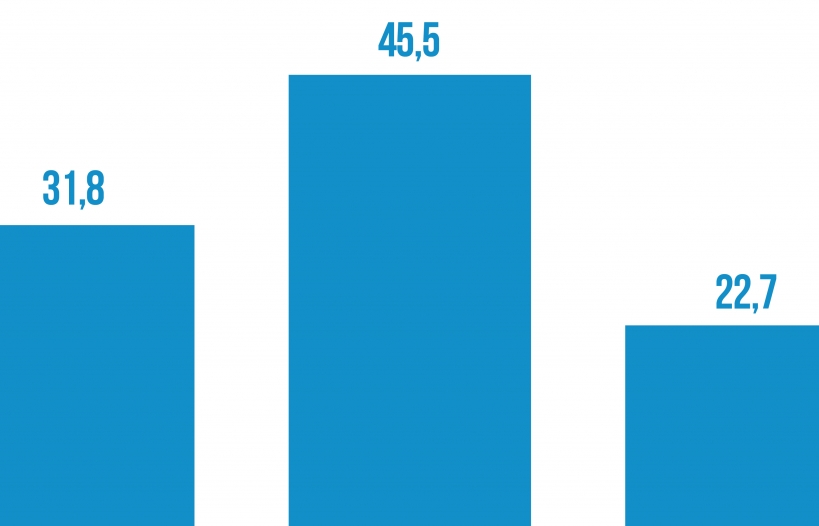

The insurance sector is highly concentrated, as the top five leading life insurance businesses accounted for 80% of the total market share and top five non-life insurance firms made up 60% of the total.

For this reason, insurance enterprises have been facing increasing competitive pressure to occupy market shares, Vietnam Report said.

Many non-life insurance companies such as Bao Viet, PTI, MIC and BIC have applied digital technologies to their insurance payment management. Non-life insurance firms such as Prudential and Aviva, with support from their parent groups, have invested in artificial intelligence with chatbots to support their businesses.

Developing new products has also been a priority as people have paid much attention to their health.

The survey also revealed that 64% of surveyed companies would continue to research new products for different customers.

In addition, insurance businesses have been promoting their coverage in the market and expanding their networks by establishing branches and offices, online sales and cooperation with banks through arrangements known as bancassurance.

They have also cooperated with fintech and healthcare service companies to sell their products.

The growing cooperation between banks and insurance through bancassurance has been a major story in the 2017-18 period, with big deals such as Manulife and Techcombank, Aviva Vietnam and Vietinbank and AIA and VPBank.

Bancassurance has seen strong growth in the past two years, becoming an important distribution channel in the insurance market.

In addition, cooperation between insurance companies and fintech has been a new factor in the market. Around 79% of insurance companies said they planned to expand cooperation with fintech to develop distribution channels and insurance services on the internet and payment sector.

In the 2011-17 period, the total investment of insurance firms into the economy rose 17.7% a year on average. This showed that Vietnam’s insurance market not only is a useful tool to protect investors in most economic sectors such as assets, aviation, credit and healthcare but also a mid-and-long-term capital channel for the economy.

Experts and insurance companies said the Government should continue to enhance support policies to gradually improve transparency in the market. The solutions to improve the business environment and competitiveness of the Finance Ministry have brought positive results in the market.

Insurance firms said they would continue promoting growth, expanding scale while improving product and service quality.

Most negative information about insurance companies in media came from complaints relating to insurance contracts and payment.

Insurance businesses should enhance training on human resources and build dispute-resolving processes to ensure the customers’ rights.

Related News

Insurance creates trust and peace of mind for customers affected by typhoon No. 3

10:05 | 23/09/2024 Finance

Insurance brings peace of mind to customers during Yagi typhoon

20:34 | 17/09/2024 Finance

Note for businesses when converting green and digital

10:00 | 05/09/2024 Import-Export

The insurance industry is expected to grow by 10 percent in 2024

08:27 | 04/08/2024 Finance

Latest News

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

More News

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Your care

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance