Increasing bad debt, many banks cut risk provisions

| Accumulating bad debt ratio put pressure on banks |

| Ho Chi Minh City Customs: Rapidly handling more than 1,600 billion VND in bad debts |

|

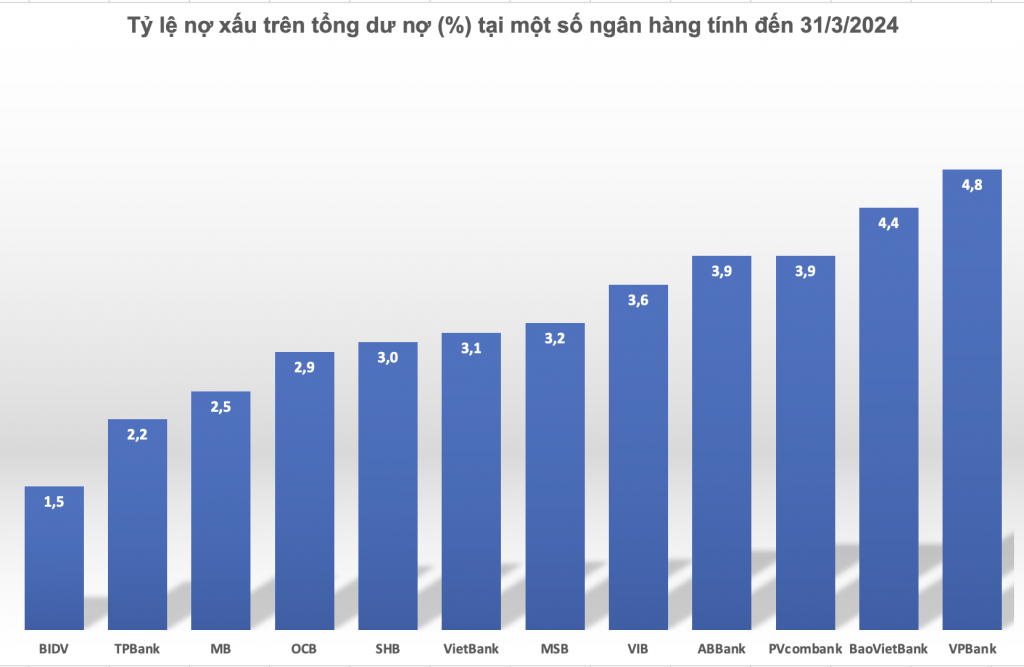

| Chart: H.Diu. Source: Quarter 1/2024 financial statements of banks |

Bad debt in many banks increased in both scale and speed

In the first quarter of 2024, the summary of financial statements of twenty eight banks listed on the market shows that the bad debt balance of twenty eight banks increased by 14.4% compared to the beginning of the year, contrary to the decreasing trend recorded in the fourth quarter of 2023. Among them, only a few banks recorded a slight improvement in bad debt ratio such as Techcombank, VPBank, SHB, NCB.

The State Bank's (SBV) investigation report on business trends of credit institutions in the first quarter of 2024 shows that credit institutions expect to reduce the bad debt ratio in the second quarter of 2024 even though the ratio of bad debt to credit balance has not achieved the desired "slight decrease" trend at the end of 2023 and in the first quarter of 2024 continues to show a "slight increase", but this trend is recognized significantly narrowed compared to the fourth quarter of 2023.

Looking at each bank, the financial report for the first quarter of 2024 also shows that the bad debt ratio of some banks increased quite rapidly, even exceeding the threshold of 3% of total outstanding debt as required by management agencies. For example, the ratio of bad debt to total outstanding debt of VPBank, although slightly reduced, is still more than 4.8% of total outstanding debt; BaoVietBank increased to nearly 4.4%; ABBank also increased by more than 3.9% while credit growth was negative by more than 19.3%; PVCombank recorded a bad debt ratio of nearly 4% along with a sharp increase in group 5 debt (debts with potential loss of capital) of 17%; Bad debt ratio at VIB is 3.6%, MSB is at nearly 3.2%, SHB is flat at 3%...

In terms of value, MB is currently the bank with the most bad debt, increasing by VND 5,500 billion in just the first three months of 2024, currently accounting for nearly 2.5% of total outstanding loans. In particular, debt with the possibility of losing capital increased sharply by 110%, from VND 2,851 billion at the end of 2023 to VND 5,996 billion as of March 31, 2024.

Although TPBank maintained the bad debt ratio on total outstanding loans at 1.45%, the scale of bad debt increased rapidly by more than 80% in the first three months of the year to nearly VND 2,500 billion. OCB also had an increase in bad debt value of more than 51%, to more than VND 4,045 billion, bringing the bad debt ratio to nearly 2.9% of total outstanding debt. In addition, some banks with bad debt increased significantly in both absolute scale and speed such as VietinBank, Vietcombank, HDBank, VietABank, NamABank...

In a recent banking analysis report, experts from SSI Securities Company commented that the bad debt ratio at the end of 2024 may only increase slightly compared to the end of 2023 (estimated from 1.63 % to 1.68%) due to the expectation that banks will promote bad debt write-off and the economy will recover stronger by the end of this year. However, problem debts including group 2 debts, restructured loans, overdue corporate bonds, old loans... need to be closely monitored.

Experts from ACBS Securities Company also believe that bad debt is increasing, while group 2 debt and restructured debt are both on the rise in the first quarter of 2024, showing that a new class of bad debt is forming. Besides, in the period of Q2/2020, Q2/2021 and Q3/2021, Q1/2023, restructured debt gradually decreases over time. However, since the second quarter of 2023, restructured debt is tending to increase gradually. The LLR ratio - bad debt coverage provision continues to decrease after a slight increase in the fourth quarter of 2023, showing that the banking system's pressure on provisioning is quite large in the coming period.

Cutting back-up costs for profit

Summary from the financial statements of twenty eight banks shows that the risk reserve balance increased by 5.7% compared to the end of last year. For example, at MB, the sharp increase in bad debt value as mentioned above caused the bank to increase risk provision costs by 46.4% in the first quarter of 2024 to VND 2,707 billion, causing pre-tax profit to decrease by 11%. compared to the same period last year. But the bank's bad debt coverage ratio (provision balance for bad debts/bad debts) decreased from 117% to 80.1%.

In addition, facing the problem of maintaining profits, many banks have sharply cut back on risk provisioning costs. For example, at TPBank, despite the sharp increase in bad debt as above, this bank cut risk provisioning costs by 58% in the first three months of the year, helping the bank maintain 9% profit growth in the context of many important business segments such as credit, stock investment... declined. OCB also cut provision costs by more than 21%, helping bank profits increase by nearly 18% in the first quarter of 2024.

Overall for banks, the bad debt coverage ratio in the first quarter of 2024 decreased by more than 7 percentage points to 87% - the lowest level since the end of the third quarter of 2023. Among them, some leading banks in terms of loan scale such as Vietcombank, BIDV, VietinBank, and MB are in the group with the deepest decline in bad debt coverage ratio. However, there are some banks increasing bad debt coverage rates such as Techcombank, Sacombank, SHB, VPBank...

According to experts, a high bad debt coverage ratio shows that the bank will be proactive in dealing with risks, but it will also have a certain impact on profits. However, in the current context, "defense" against bad debt is an issue that needs attention from banks. Because the results of the SBV's investigation of credit institutions also show that the overall risk level of customer groups is forecast by credit institutions to continue to increase in the second quarter of 2024 but with a slowing trend.

Furthermore, the fact shows that the business system continues to face many difficulties in supply chain disruptions due to many geopolitical tensions in the world that have not yet cooled down. In import and export activities, fluctuating exchange rates, rising inflation, demand and consumer spending have not yet recovered strongly... are also affecting the number and value of orders of businesses.

Related News

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

How does the Fed's interest rate cut affect Vietnam?

11:56 | 05/10/2024 Headlines

Latest News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance