Increasing assessment fee for issuance of domestic tour guide licenses

|

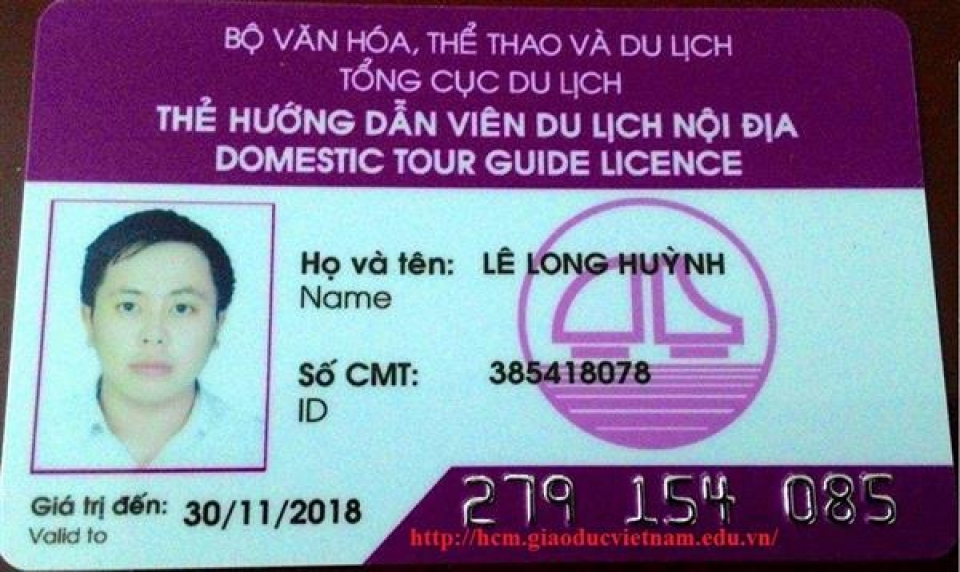

| The assessment fee for issuance of tour guide license will added VND 150.000/license |

Regarding the rates of collection, the Circular has unified the fees for assessment and issuance of international tourism business licenses for all 3 contents: new issuance, renewal, and re-issuance instead of separation, concurrently fee has increased to 3,000,000vnd/license.

The assessment fee for issuance of tour guide licenses has also approved with collection of 650,000vnd/license. Presently, this collection amount is divided into two parts, fee for issuance of international tour guide license is 650,000 vnd/license and the fee for issuance of domestic tour guide license is 400,000vnd/license

The fee for granting a new license on establishment of a branch or representative office of a foreign travel company remains at 3,000,000vnd/license. The fee for the renewal, extension and re-issuance is 1,500,000vnd/license

The fee for granting a demonstrator certificate (including: new issuance, renewal, re-issuance) is 200,000 vnd/certificate

The Ministry of Finance has also regulated: the Vietnam National Administration of Tourism and Tourism Departments of provinces and cities under charge of the Central Government are collecting organizations.

The collecting organizations must send collected fee of the previous month to the account opened at the State Treasury waiting to pay to the Budget, by the 5th of every month.

In terms of payment rate to the State budget, the Vietnam National Administration of Vietnam has saved 60% of the total collected fee of assessment and issuance of international tourism business licenses, extracted 30% of the collected fee for the Department of Culture, Sport and Tourism or the Tourism Department and 10 % for the State budget.

The Department of Culture, Sport and Tourism or the Tourism Department has saved 50% of the total collected fees of issuance of tour guide licenses, extracted 40% of the total collected fees for the Vietnam National Administration of Vietnam and 10% of the collected fees for the State budget

The fees which have been collected must pay 100% to the State Budget.

| Mong Cai Customs actively monitor self-driving tourist vehicles VCN- On the morning of October 13, 2016, speaking to a reporter of the Customs Newspaper, the ... |

This Circular takes effect from January 1st, 2017 and replaces Circular No. 48/2010/TT-BTC of the Minister of Finance guiding the regulations of collection, payment, management and use of fees for issuance of international tourism business licenses, licenses on establishing a branch or representative office of foreign travel companies in Vietnam, tour guide licenses and certificates of demonstrator.

Related News

Beware of the "invasion" of unofficial e-commerce platforms

10:12 | 12/11/2024 Import-Export

Tax, fee, and land rent exemption, reduction, and deferral policies: a driving force for business recovery and growth

11:34 | 27/10/2024 Regulations

Further improvement needed in work permit issuance

10:40 | 28/09/2024 Headlines

Corporate bond issuance doubles in seven months

16:27 | 13/08/2024 Finance

Latest News

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

More News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Your care

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations