Implementing CPTTP: How does Vietnam cut tariff?

| CPTTP – challenges for Vietnamese businesses | |

| CPTTP to open doors for apparel exports to Australia | |

| Why does Vietnam have to sign many FTAs? |

|

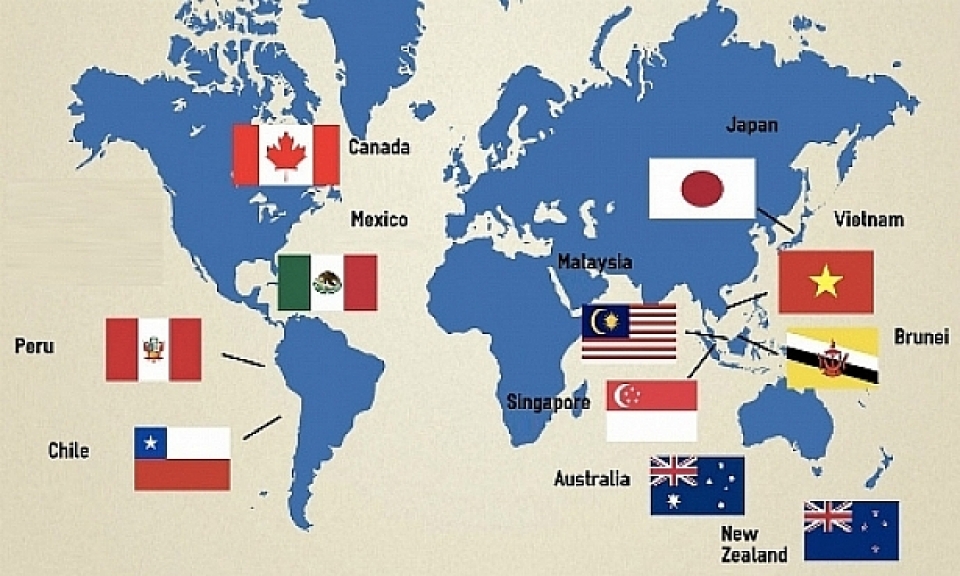

| Illustrative photo |

According to this draft, the tax on cars with a cylinder capacity of 3000cc or more, in the 10th year of implementing CPTTP and in the 13th for new cars shall be cut. The first tariff quota for used cars is 66 cars and this quota will gradually increase and reach 150 cars from the 16th year. The tax rate in the quota reduces to 0% in the 16th year; the out-of quota tax shall comply with the preferential import tax rate under Most Favoured Nation (MFN) status.

According to the roadmap, the import tax on Iron, Steel, and petroleum products shall be abolished in the 11th year.

The import tax on milk and dairy products shall be abolished immediately, and on some other products shall be cut in the third year.

The import tax on corn shall be abolished in the 5th year and the 6th year.

The import tax on alcohol shall be abolished in the 3rd year for Sake alcohol, and the tax for the remaining terms shall be abolished in the 11th year and some items in the 12th year.

The import tax for chicken meat shall be abolished in the 11th and 12th year.

The import tax on fresh pork shall be abolished in the 10th year and in the 8th year for frozen pork.

The import tax on food processed from meat shall be abolished in the 8th and the 11th year, and fishery products shall be abolished in the 5th year.

The import tax in the WTO’s quota on sugar, eggs and salt shall be abolished in the 6th year and in the 11th year for sugar and salt. The out-of quota tax shall comply with the preferential import tax rate under the MFN clause.

The import tax in quota for Tobacco leaves shall be abolished in the 11th year of implementing CPTPP for the quota of 500 tons, increasing by 5% each year within 20 years. The out-of-quota tax rate shall be comply with the preferential import tax rate under MFN status until the 20th year, and by the 21st year the import tax rate shall be 0%.

The import tax on Textiles, footwear, rice and fertilizers shall be abolished as soon as the agreement comes into effect. Similarly, the tax on plastic and plastic products; chemicals and chemical products; paper and wood furniture; machinery and equipment, shall be mostly abolished when the agreement takes effect, and be abolished for some items in the 4th year.

The import tax on cigarettes shall be abolished in the 16th year.

| Japan is the largest trading partner of Vietnam in CPTTP VCN- Among 10 trading partners under the Comprehensive and Progress Agreement for Tranc-Pacific Partnership (CPTTP), Japan is ... |

It is known that in CPTPP, Vietnam commits to abolishing currently applied export tax for most items, basically according to the roadmap from 5-15 years after the agreement comes into effect. Some key commodity groups such as coal, oil and some types of ore and minerals (70 commodities ) are still applied export tax.

Besides, 65.8% of the import tariff lines will be abolished as soon as the agreement takes effect; 86.5% of tariff lines with 0% tax rate shall be abolished in the 4th year; 97.8% of tariff lines shall be cut in the 11th year; the remaining tariff lines will be abolished in the 16th year or under the tariff quota.

Related News

Regulating goods across Huu Nghi International Border Gate during peak times

19:37 | 02/11/2024 Customs

Strictly control imports and trade of toxic chemicals

17:34 | 03/11/2024 Anti-Smuggling

Ensure harmony of interests of “3 parties” when applying 5% VAT on fertilizers

08:54 | 30/10/2024 Regulations

Latest News

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

More News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Striving for average CPI not to exceed 4%

16:41 | 01/11/2024 Finance

Delegating the power to the government to waive, lower, or manage late tax penalties is suitable

16:39 | 01/11/2024 Finance

Removing difficulties in public investment disbursement

09:30 | 31/10/2024 Finance

State-owned commercial banking sector performs optimistic growth, but more capital in need

09:28 | 31/10/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

Rush to finalize draft decree on public asset restructuring

09:28 | 29/10/2024 Finance

Inspection report on gold trading activities being complied: SBV

14:37 | 28/10/2024 Finance

Budget revenue in 2024 is estimated to exceed the estimate by 10.1%

10:45 | 28/10/2024 Finance

Your care

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance