Hanoi Tax Department ready to support 2021 tax finalization

|

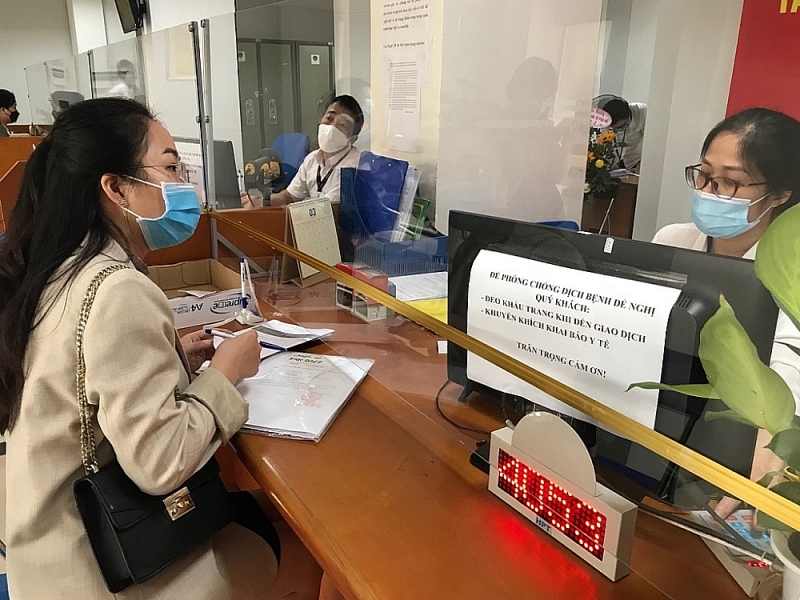

| Hanoi Tax Department is ready to help taxpayers make 2021 tax finalization. Photo: Thuy Linh. |

Multiple support channels

According to Hanoi Tax Department, from March 15, 2022 to May 4, 2022, the Tax Department will launch the program "Accompanying businesses, organizations and individuals to make 2021 tax finalization" at the department and 25 tax branches with three tasks: policy support; information technology support and tax declaration support.

This year, the tax finalization period for 2021 takes place in a very special context when new cases of Covid-19 across the country and in Hanoi have been increasing day by day.

Therefore, to ensure pandemic prevention and control and promote public communication to help taxpayers implement tax laws and policies and create favorable conditions for them in making tax finalizations, the Hanoi Tax Department plans to strengthen online support for businesses and taxpayers, targeting 90% of tax finalization dossiers sent electronically to the tax agencies.

Accordingly, the Tax Department will publicize support through the website and other channels. Specifically, the department will regularly update complete contents for tax finalization.

Besides, the contents are also posted on social networking sites of the Hanoi Tax Department (Facebook, Youtube, Zalo) to remove difficulties and deal with administrative procedures through the 479 information system to support taxpayers through the electronic tax system (eTax).

The Hanoi Tax Department said that the unit will provide information to taxpayers via phones and email addresses registered with the tax agency. All provided policies and instructions for taxpayers to make tax finalization are summarized, edited, and easily understood.

In particular, the Tax Department will also conduct online training sessions and dialogues to guide the finalization of personal and corporate income tax to guide and solve problems for taxpayers through the department’s website.

Notes about the deadline of application submission

Hanoi Tax Department also notified taxpayers of submitting PIT finalization this year.

Regarding the deadline for declaring and submitting PIT finalization applications for taxpayers, the submission deadline is the last day of the third month from the end of the calendar year or fiscal year.

The deadline for declaring and submitting PIT finalization applications for individuals who directly make tax finalization is the last day of the fourth month from the end of the calendar year. In case the deadline coincides with a prescribed holiday, the deadline will be the following working day.

The Hanoi Tax Department notes that, if an individual has a PIT refund but is late in submitting the tax finalization declaration as prescribed, the penalty will not be applied for administrative violations. Therefore, if individual taxpayers have an overpaid tax amount and have a request for a tax refund, they should actively choose the time to declare and submit the tax refund application to avoid peak periods to receive the best service from the tax authorities.

Notably, individual taxpayers should submit their PIT finalization applications online (using an electronic transaction account). This will both reduce administrative procedures and save costs for taxpayers and tax authorities.

For submitting PIT finalization applications in paper form, it is recommended that individual taxpayers should send applications by post to save time and travel costs, avoid crowded places to prevent the spread of Covid-19.

When submitting applications by post, taxpayers must fully declare their full name, contact address, email address, and phone number so that tax authorities can contact taxpayers if necessary.

Related News

Upgrading IT applications to accelerate PIT refund

09:12 | 08/08/2024 Finance

Continue to warn about forms of fraud against taxpayers

09:57 | 15/07/2024 Finance

Warning about impersonating tax authorities to commit fraud during tax finalization month

10:22 | 27/03/2024 Finance

Tax sector accompanies and supports tax finalization

09:34 | 21/03/2024 Finance

Latest News

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

More News

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Your care

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance