Foreign providers can make tax payments from anywhere

| Payers of flat tax can make e-tax payments via e-Tax Mobile | |

| Hanoi Tax Department supports and "energises" enterprises and business households | |

| Citibank officially deploys electronic tax payments 24/7 |

|

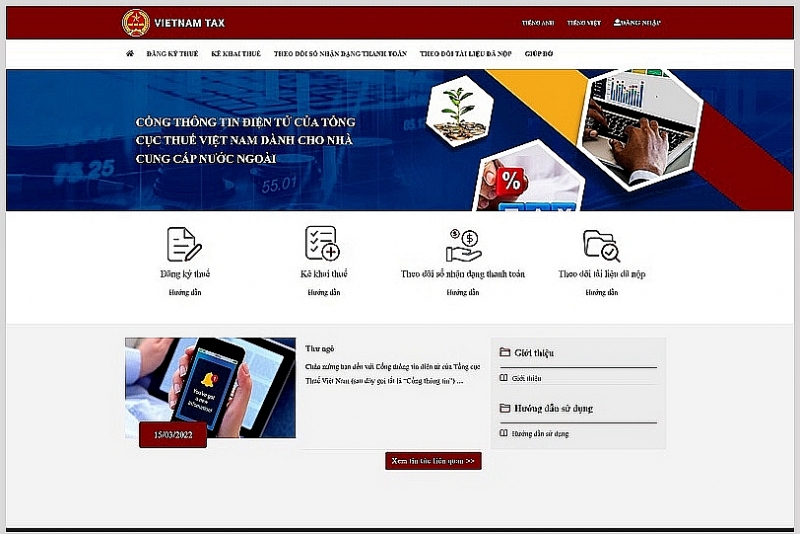

| E-portal for foreign providers |

According to the General Department of Taxation, tax revenue through cross-border business platforms by 2021 was about VND5,000 billion, such as Facebook, Google, Microsoft.

However, this number has not commensurate with the actual operation of these platforms in Vietnam – a market that is becoming increasingly attractive to foreign investors.

A number of major providers in cross-border digital content services are also present in Vietnam. According to statistics, Netflix's service is ranked 2nd in the top five online TV services after FPT Play with over 300,000 subscribers, said the General Department of Taxation.

According to statistics, by June 2021 of NapoleonCat (a tool to measure social network indicators), Vietnam has nearly 76 million people using Facebook, accounting for more than 70% of the country’s population, rising by 31 million users compared to 2019 and leading the list of popular social networks in Vietnam.

From 2019 to June 2021, under the impact of the Covid-19 pandemic, online shopping activities on this platform skyrocketed. Vietnam has also been using Facebook Messenger to advertise, sell and take care of customers online much more than other countries in the region.

Enterprises and individuals also use social networks and cross-border social networking platforms to carry out cross-border trading of goods between the two parties without signing sales contracts, making it difficult for authorities.

In addition, consumers also use foreign e-commerce platforms to purchase goods of foreign origin and individuals and organizations abroad also use the above platforms to buy products and goods from Vietnam.

The rapid and explosive development of cross-border e-commerce in recent years has been posing new and big challenges for tax authorities in tax management.

To implement tax management for foreign providers, the General Department of Taxation has actively coordinated with relevant agencies to submit to the Ministry of Finance to report to the Government and the National Assembly for approval of the Law on Tax Administration 38/2019/ QH14 dated June 13, 2019, which for the first time stipulates that a foreign supplier is obliged to directly register, declare and pay tax.

Under the Law on Tax Administration 38/2019, the Ministry of Finance issued regulations on tax registration, declaration and payment of foreign providers, and responsibilities of tax authorities, individuals and organizations in Vietnam engaging in trading of goods and use of services of foreign providers.

| Fear of using modern payment methods because it affects tax payments |

Based on the completed legal bases on tax administration for foreign providers, the General Department of Taxation built an E-portal for foreign providers to carry out the tax registration, declaration and payment from anywhere in the world.

Related News

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Violations via e-commerce in HCM City surges

13:45 | 28/12/2024 Anti-Smuggling

Sustainable Green Development: New Driving Force for the Retail Industry

07:44 | 31/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance