Five groups of analysis and classification issues should be noted in Circular 17/2021/TT-BTC

| Data analysis and risk identification as key tasks in anti-origin fraud work in 2021 | |

| New regulation on classification, analysis, inspection on quality and food safety for import and export goods |

|

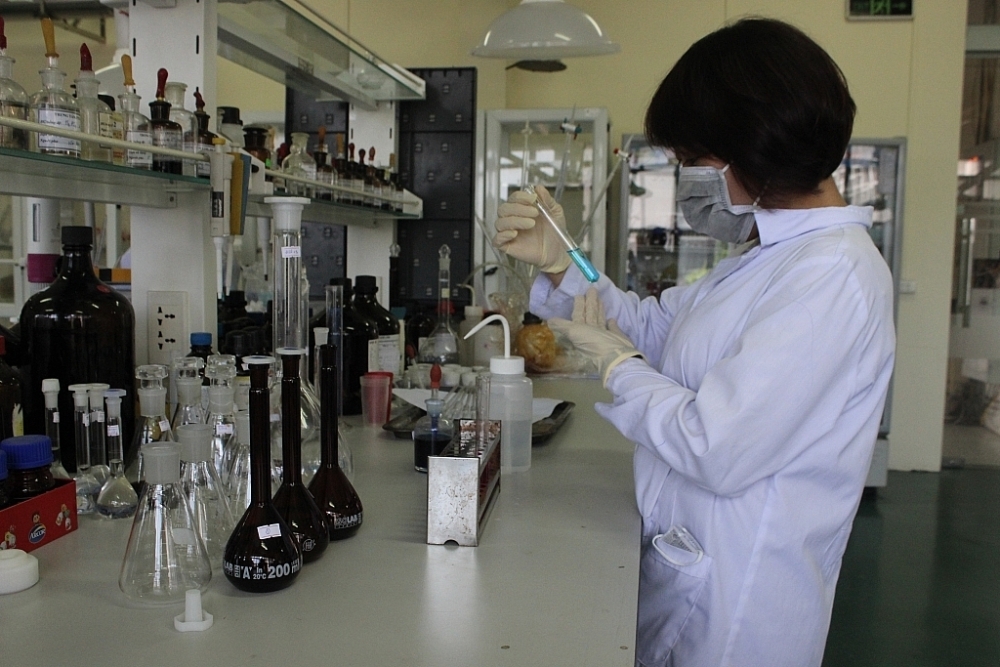

| Sample analysis at the Center for Analysis and Classification under the Customs Verification Bureau. Photo: H.Nu |

Circular 17 has five main groups of issues that customs officers performing the classification and enterprises should note.

Five groups of issues are specified in Circular 17 related to dossiers of requirements, samples of goods, competence to issue results, date of issuance and dossier forms.

Regarding dossiers of analysis requirements for classification, according to the provisions in Points 1 and 4, Clause 2, Article 1 of Circular 17, each item must make a request for analysis of import and export goods and a sampling record. For technical documents, if there is no technical document, the Customs authority must clearly state the reason.

Regarding the problem of samples of goods sent for analysis and classification, Item b, Item c, Point 1, Clause 3, Article 1 of Circular 17 stipulate that the number of samples for analysis and classification must be two samples and not one sample in case the customs import declarant has only one sample. The customs office where the analysis is requested will send the sample directly or by post, and will not give it to the declarant to transfer the sample.

Meanwhile, the director of the Customs Verification Sub-Department shall issue a notice of the analysis result together with the commodity code, and notify the analysis result with the proposed code.Regarding the competence to issue the notification of results, according to the provisions of Clauses 4 and 5, Article 1 of Circular 17, from April 12, the Director of the Customs Verification Bureau is allowed to issue a notice of results of classification and notice of quality inspection and food safety inspection.

Regarding the time limit for issuing notices, Clause 4, Article 1 of Circular 17 clearly states that the time limit for issuing notification of classification results does not exceed five working days, in case the time for analysis depends on complicated technical analysis process or samples, it must not be more than 20 working days from the date of receipt of complete dossiers and analytical samples.

Regarding the time limit for issuing notification of analysis result together with commodity code, Circular 17 stipulates not exceeding five working days, in case the time for analysis depends on technical process or complicated goods samples, it must not exceed 10 working days from the date of receipt of complete dossiers and analytical samples.

Finally, a matter related to the form, in Clause 7, Article 1 of Circular 17, there are four relevant forms, including: Request for analysis of import and export goods and goods sampling record (Sample 05/PYCPT/2021); Notify classification results for import and export goods (form No. 08/TBKQPL/2021); Notify results of quality inspection, food safety inspection for import and export goods (form No. 09/TBKQKT-CL-ATTP/2021) and notify analysis results with codes for import and export goods (sample No. 10/TBKQPTPL/2021).

According to the representative of the Import-Export Tax Bureau, Circular 17 specifies the responsibilities of the Customs authorities in the classification of goods, analysis for goods classification; analysis for quality inspection, food safety inspection for import and export goods.

Circular 17, moving the customs management in a more professional and efficient direction, shortens the processing time, it also helps to facilitate trade for enterprises in customs clearance for import and export of goods by significantly reducing time in specialized inspection activities.

In order to effectively implement the provisions of Circular 17, the General Department of Customs has directed its affiliated departments, provincial and municipal Customs Departments to actively organize training and effectively implement regulations for officers, especially public servants working in classifying and analyzing goods. At the same time, the Customs units propagate, disseminate and guide the business community to understand and comply with the provisions of Circular 17.

Accordingly, the General Department of Customs noted that when implementing the provisions of Circular 17, they need to pay attention to the issues of documents required for analysis, samples of goods for analysis and classification and forms.

The provisions of Circular 17 apply to import and export consignments registered for declarations from April 12, 2021 as well as the deadline for issuing notice of analysis results with codes.

The General Department of Customs also requested the Customs Verification Bureau to urgently submit to the General Department of Customs to sign for promulgation an analytical process to classify, analyze and verify import and export goods to effectively implement this regulation.

Related News

Quang Ninh Customs strives to collect over VND17,800 billion in revenue in 2025

16:45 | 19/01/2025 Customs

6 outstanding events of Vietnam Customs in 2024

07:55 | 15/01/2025 Customs

Da Nang Customs Department supports enterprises in developing Customs-Business partnership

13:07 | 09/01/2025 Customs

Lang Son Customs finds it difficult to collect and handle tax arrears

15:13 | 07/01/2025 Customs

Latest News

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

More News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations