Facilitate development of corporate bond market – Part 3: Investors should understand their positions

|

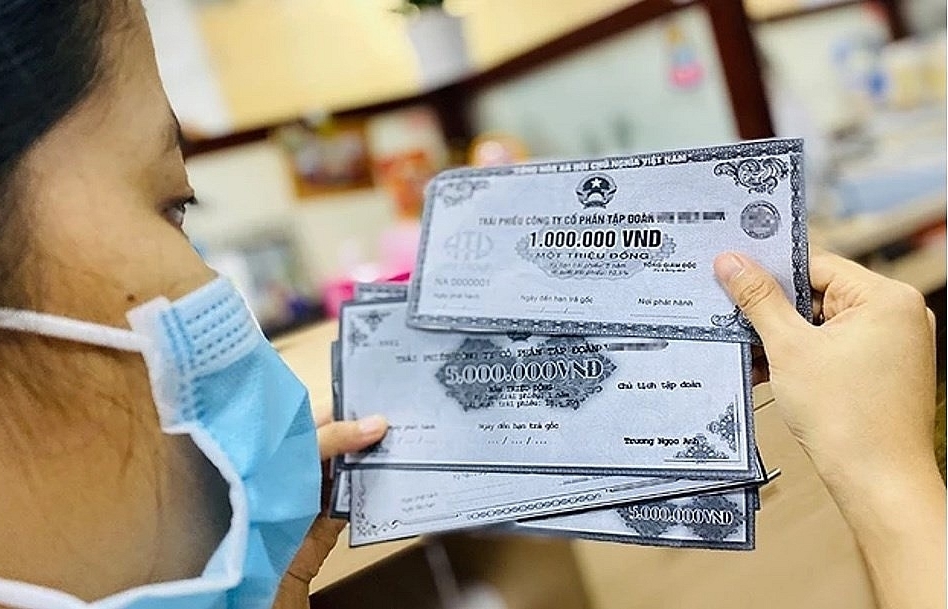

| The restrictions of investment of individual investors will help the corporate bond market to be more transparent and professional. Photo: Internet. |

Completing legal framework

At the end of 2020, the size of the corporate bond market accounted for 15.1% of GDP and 10.3% of the outstanding credit of the whole system. However, the market had many potential risks. There was ease in corporate bond issuance and there were no binding conditions. Investors bought the bonds with confidence as interest rates offered by issuers were more attractive than banks’ rates. Therefore, cash flow poured into the corporate bond market despite the risks. Some issuers have only a few billion VND of charter capital but they sold bonds worth trillions of VND.

Experts and representatives of the Ministry of Finance have noted the risks of illiquidity in both principal and interest, but investors have not paid attention to the recommendation.

There is an urgent need to amend and supplement regulations to strictly control this operation.

The Ministry of Finance has submitted to the Government for promulgation three decrees, including Decree 153/2020, Decree 155/2020 and Decree 156/2020. These decrees have created a legal framework to promote the market’s operation in a professional and transparent manner.

These decrees specify between the private placement and public offering of corporate bonds. Decree 155/2020 and the Law on Securities stipulate that the corporate bond issuer must be approved and given a credit rating by the State Securities Commission; the issuer must make a profit in the year preceding the offering year and not have accumulated loss in the offering year; does not have any debt that is overdue for over a year. These strict conditions aim to limit the risk to the lowest level for all investors.

For private placement bonds, Decree 153/2020 provides conditions for professional securities investors, so the criteria given are also more simple.

The issuer must meet adequacy ratios and prudential ratios in operations in accordance with regulations of specialized laws; they must have a bond issuance plan approved and accepted as per regulations; their financial statements of the year preceding the year of issuance have been duly audited by an accredited audit organization; they must have a commitment to fulfill the obligations of the issuer to investors in terms of conditions for issuance and payment, and ensuring the legitimate rights and interests of investors.

Based on the parameters provided by the issuer, professional investors will self-assess, take responsibility for their own investment decisions and bear all risks arising in bond investment and trading.

The legal system has provided the two different methods of management and supervision. The public offering must be approved and controlled by the State Securities Commission, while the private placement does not need a license by the State authority.

The issuer only meets the issuance conditions, comply with the regulations on bond issuance, and provide transparent and complete information to investors. The private placement of bonds will be managed by intermediary service providers in the market, including issuance consulting organizations, underwriters, bond auctions and depository organizations. Thereby, the State management agency will have information about this bond.

To increase the liquidity of private placement bonds, and provide information on bond transactions after issuance, Decree 153 stipulates the organization of a secondary trading market for this bond.

Currently, the Ministry of Finance assigns the Hanoi Stock Exchange to build a model meeting Vietnam's market conditions to report to the State Securities Commission.

The Ministry also considers issuing legal documents for transactions in the secondary market.

Protecting the interests of participants in the market

Ketut Ariadi Kusuma, World Bank Senior Financial Sector Specialist, highly appreciated the new legal framework of Vietnam’s corporate bond market and said that this is the significant improvement compared to the former legal framework.

These new decrees help Vietnam to follow best practices of the international market, making the market more transparent, reducing systemic risks and contributing to sustainable development.

The corporate bond market still shows great potential, but there needs to be a balance between supply and demand. Currently, the supply has developed rapidly. However, the number of investors is still limited. There is only one group of investors, mainly banks. Therefore, professional investors should be expanded such as insurance companies, mutual funds, investment funds, pension funds, etc.

"The diversification of investors will bring different strategies and views on the market, thereby boosting trade and creating a competitive secondary market," Mr. Ketut Ariadi Kusuma said.

Nguyen Hoai Thu, Head of Investment, Public Equities and Fixed Income, at VinaCapital, said that new regulations will limit the individual investors' participation in the corporate bond market. However, this will help the market to become more transparent and professional. This not only helps protect retail investors, but also opens up opportunities for fund management companies because investors, who cannot directly access the market, can buy fund certificates of these companies.

Do Ngoc Quynh, General Secretary of the Vietnam Bond Market Association, also said that the distinguishing of the two forms of private placement and public offering in accordance with the risk nature of each method will help more strictly control the market.

Thereby, creating a foundation for the corporate bond market to operate more effectively while attracting capital for the economy in accordance with the Government's policy and protecting the interests of participants.

In the near future, the Ministry of Finance will develop a legal framework on corporate bonds of project enterprises and issue green bonds.

The PPP Law provides regulations on the issuance of bonds by PPP enterprises. The Environmental Law also provides provisions for the issuance of green bonds.

Currently, the Ministry of Finance is working with the Ministry of Natural Resources and Environment and the Ministry of Planning and Investment to develop a draft guiding these laws. It will also complete regulations on investment mechanisms of financial intermediaries such as Vietnam Social Security; complete regulations on voluntary pension funds; and build a legal basis for securitization product.

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Crypto Assets should be managed rather than prohibited

19:29 | 30/08/2024 Finance

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Latest News

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

More News

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

HCMC: Domestic revenue rises, revenue from import-export activities begins to increase

09:36 | 16/11/2024 Finance

Your care

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance