Ensuring balance of capital sources and deposit interest rates amidst rising credit trend

| Taking initiative in capital sources for production and business recovery | |

| Securities firms diversify capital sources for expansion | |

| Banks race to attract low-cost capital sources |

|

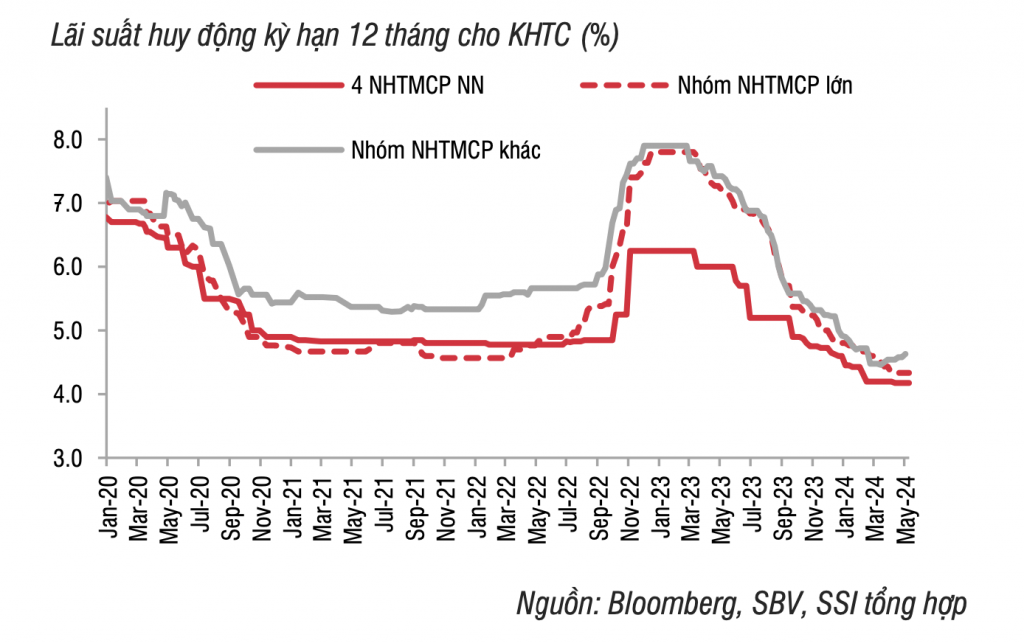

| The trend of 12-month deposit interest rates for institutional customers from 2020 to May 2024 |

More than 20 banks increase their deposit interest rates

After several months of continuous decline, the trend of increasing deposit interest rates at banks began in April 2024, with more banks making adjustments from early May.

A survey by our reporters showed that more than 20 banks had increased deposit interest rates, with many banks raising rates by 0.5-0.9% per year.

CBBank leads with a 0.9% increase for terms of six months or more.

Other banks such as Viet A Bank, Sacombank, Techcombank, TPBank, VIB, BVBank, Shinhan Bank, GPBank, and BacABank have also increased savings interest rates by 0.1% to 0.5%.

Additionally, the digital-only bank Cake by VPBank has increased deposit interest rates by 0.3-0.7 percentage points across all terms in April.

According to the monetary market and bond report by SSI Securities Corporation, deposit interest rates have started to rise across most terms, with common increases ranging from 0.1-0.5% per year. Furthermore, commercial banks are offering more favorable interest rates for online deposits (about 0.1-0.5% per year higher than over-the-counter deposits).

SSI's report indicated that, overall, the 12-month deposit interest rate for individual customers was around 4.8-5.4% per year, approximately 0.2-0.3% per year lower than at the end of 2023. Deposit interest rates for institutional customers have only slightly increased at some commercial banks, currently listed at 4.2-5.2% per year for 12-month terms.

Experts said that banks were raising deposit interest rates to balance their capital sources.

The economic and social report for the first four months of 2024 by the Ministry of Planning and Investment showed that as of April 23, 2024, capital mobilization decreased by 0.52% while credit for the economy increased by 1.6% compared to the end of 2023.

Previously, the State Bank of Vietnam (SBV) stated that credit growth was negative in the first two months of the year due to seasonal factors, only turning positive in March.

Furthermore, first-quarter 2024 financial reports showed a decrease in deposits at many banks. For instance, ABBank's deposits decreased by 16.5%, TPBank by 8.4%, MB by 1.5%, Kienlongbank by 1.2%, VIB by 1%, and SHB by 0.7%.

Regarding the reasons for the increase in deposit interest rates, Dr. Nguyen Duc Do, Deputy Director of the Institute of Economics and Finance (Academy of Finance), suggested that due to the influence of the State Bank of Vietnam selling bills to control exchange rates, leading to higher interbank interest rates. Banks that borrow a lot from each other will be affected, thereby affecting deposit interest rates.

|

| Deposit interest rates may continue to rise in the coming months. Photo: ST |

No impact on lending rates

Given the situation, experts at Rong Viet Securities (VDSC) forecasted that deposit interest rates could return to early-year levels in the coming months, with average increases of 0.5-1% per year from the bottom, depending on the term and bank group. The future trend of interest rates will depend on the ability to control the devaluation of the VND and the monetary policy developments of the US Federal Reserve (FED).

Similarly, MSB Securities' recent monetary market report predicted that credit demand would continue to rise more strongly from mid-2024 as production and investment accelerate towards the end of the year. Consequently, 12-month deposit interest rates at major commercial banks could increase by 0.5-0.7% per year, returning to 5.1-5.3% per year in the latter half of 2024.

Although deposit interest rates are rising, lending rates remain unchanged as they support businesses in accessing capital. Many banks continue to offer reduced interest rates for priority sectors and introduce numerous preferential credit policies for various customer groups.

Experts believed that lending rates would remain unchanged in the near future because the increase in deposit interest rates at banks was not significant, with short terms and delayed policy impacts. Moreover, commercial banks are likely to maintain reasonable lending rates to comply with government and SBV directives and recommendations and to achieve overall credit growth targets by year-end.

Regarding monetary policy management, the SBV will continuously maintain operational interest rates to allow credit institutions (CIs) to access capital at low costs, contributing to economic support. Concurrently, the SBV encourages CIs to cut costs to reduce lending interest rates. CIs have publicly disclosed average lending rates, the difference between deposit and lending interest rates, and loan interest information on their websites, providing reference information for customers when accessing loans.

Related News

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Latest News

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

More News

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export

Rice export prices drop, but decline expected to be short-term

08:10 | 17/02/2025 Import-Export

Key agro products expected to maintain export growth this year

08:08 | 17/02/2025 Import-Export

EU issues 12 warnings against Việt Nam’s food and agricultural exports

08:07 | 17/02/2025 Import-Export

Việt Nam to impose VAT on low-value express-imported goods

08:06 | 17/02/2025 Import-Export

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Vietnam kicked off the year with a strong start in trade, exceeding US$63 billion in the first month

16:30 | 15/02/2025 Import-Export

Import and export turnover reaches about US$29 billion in the second half of January 2025

14:52 | 14/02/2025 Import-Export

Market edges up slightly as liquidity remains low

14:48 | 14/02/2025 Import-Export

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export