E-payment helps to improve efficiency of the public service

|

| Mr. Nguyen Dai Tri, the Deputy General Director of the Taxation Department (the Ministry of Finance) spoke at the discussion session. Photo: H.Diu |

This is a review of domestic and international performance at the Vietnam Electronic Payment Forum (VEPF) 2016 which was held under the leadership of the State Bank of Vietnam (SBV) on November 24th, in Hanoi.

In the Opening speech at VEPF 2016, the Deputy Prime Minister Vu Duc Dam said that the Government has approved a master plan of e-commerce development between now and 2020, the implementation was also limited because there were not solutions to change the habits of citizens using cash.

“Currently, there are about 125,000 public services that the government and the public authorities had to provide to the citizens. But, there are less than 1,200 services provided at level 4 (be able to use), that means it is below 1%. This is a very significant contemplative figure”, the Deputy Prime Minister stressed.

Evaluating the results after one year of the inter-ministerial Agreement implementation between the Ministry of Finance and the Ministry of Industry and Trade in VEPF 2015, the Deputy Governor of the State Bank Nguyen Kim Anh affirmed that the inter-ministries had coordinated in building mechanisms, policies, and programs to promote e-payment in retail and e-commerce, implement effectively electronic tax services and offer e-payment integrated solutions in online public services, aimed at accessing banking services easily, safely and sustainably for all people and enterprises.

Accordingly, Mr. Bui Quang Tien, the Director of the Payment Department (SBV) said that in 2016 the Ministry of Industry and Trade submitted to the Prime Minister to approve the Master Plan for e-commerce development period 2016-2020.

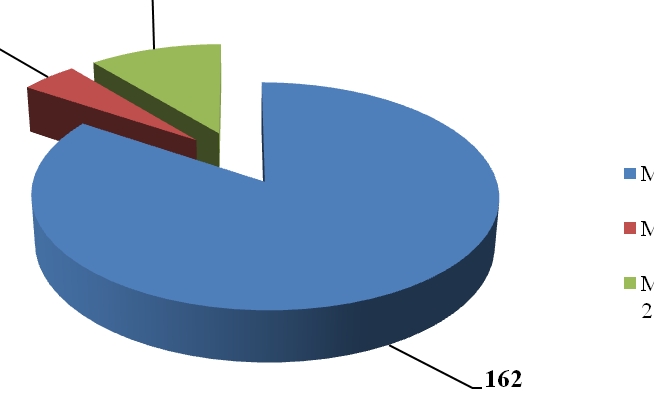

In 2016, the Ministry of Finance – the General Department of Taxation collaborated with the Ministry of Industry and Trade and the State Bank of Vietnam in promoting e-invoice application in e-commerce and e-payment. By the end of October, 2016, 96.72% of the enterprises in operation registered to use electronic tax-payment services with the tax agencies.

However, according to Mr. Tien, the process of deploying in the inter-ministerial cooperation agreement still has some problems such as: the payment system connection of the State Treasury and the IBPS system of the State Bank was not smooth. Although the commercial banks have promoted infrastructural investment, diversification of services, and expanding the customer network, in general, payment infrastructure has not been distributed evenly.

Therefore, Mr. Nguyen Dai Tri, the Deputy General Director of Taxation Department said, in 2017, the Tax industry would continue to improve the quality of electronic tax payment of enterprises through the NAPAs ports and the banks, and take steps to implement individual electronic tax at once.

In addition, in 2017, the Tax industry would also focus on implementing the electronic invoice. However, Mr. Tri desired that in order to promote the electronic tax payment and the electronic invoice, they needed the support of businesses to deploy effectively.

Within the framework of VEPF 2016, for the transportation sector, the representative of the Ministry of Transportation (MOT) reported on the deployment of automatic fee collection on national highways.

According to Mr. Nguyen Hong Truong, the Deputy Minister of Transportation, the transportation sector had a lot of payment services. With the fee collection stations in Vietnam, the people must pay by cash, when these stations guarantee to receive money, the barriers just open, it is very time-consuming. Vietnam should strive to upgrade to the new form in 2019.

“This week, the Government discussed the last time on non-stop transportation fee collection, they can issue a final decision on the non-stop fee collection in November”, Mr. Truong informed.

Related News

Responsibilities of ministries and central agencies in using public services

15:38 | 25/07/2022 Finance

Promote non-cash payment activities in the State Treasury system

10:53 | 09/05/2022 Finance

The tax management mechanism of e-commerce will be issued soon

10:28 | 23/10/2020 Anti-Smuggling

Customs public services integrated into the National Public Service Portal

15:55 | 11/03/2020 Customs

Latest News

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

More News

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Your care

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance