Deny receiving declaration if declarants do not send vouchers via electronic system

|

| Professional activities at Noi Bai International Airport Customs Branch. Photo: N.Linh |

Dealing with this situation, the Director General of Vietnam Customs has directed the provincial Customs Departments to strictly comply with regulations in the course of carrying out customs procedures for export and import goods. Customs authorities would deny receiving customs declarations when enterprises fail to send electronic vouchers to electronic data systems in accordance with regulations.

The General Department of Vietnam Customs shall also send a document to request Customs IT and Statistics Department to add the function of requesting customs declarants to send in advance the customs dossiers as specified in Article 16 of Circular No. 38/ 2015/TT-BTC (amended and supplemented in the Circular No. 39/2018/TT-BTC). If the customs declarer does not submit, the system will not receive the customs declaration.

At the same time, requesting the Customs Department to direct the customs branches to strictly comply with Point a, Clause 1, Article 18 of Circular No. 38/2018/TT-BTC, when inspecting customs dossiers, customs authorities should check and compare the information declared in the customs declaration with the documents of the customs dossiers sent by the customs declarants through the system. The customs declarers will not be required to submit the paper copies, but if not previously submitted via the request system, the declarant should re-submit through IDA01.

During the waiting time for Customs IT and Statistic Department to develop the function on the systems, for the declarations in the green channel, at the beginning of working hours the next day after clearance the customs branches should assign customs officials to check the system, and if detecting that the customs declarants have not attached vouchers in the customs dossiers yet or submitted inadequately according to regulations, they would request the customs declarants to supplement vouchers via the system.

The General Department of Vietnam Customs also instructed local customs units to review customs declarations which have already been cleared, released or put on preservation. The customs branch where the registration of declaration form is made should inform the customs declarant about the supplement and request the customs declarants to supplement the vouchers of the customs dossier through the system.

Related News

Reforming customs valuation to facilitate law-abiding enterprises

17:40 | 27/04/2022 Customs

Many regulations on customs dossiers continued to research for amending

12:27 | 17/07/2020 Regulations

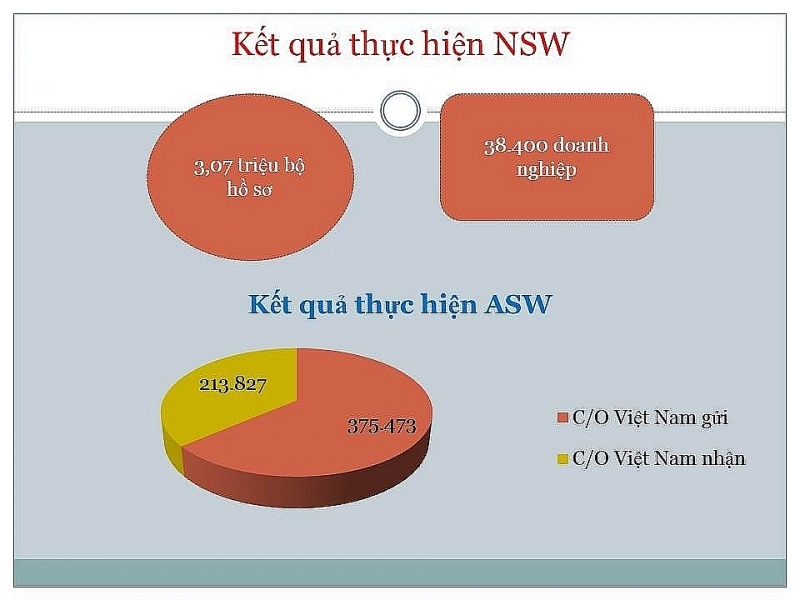

More than 3 million dossiers implemented via National Single Window Mechanism

15:27 | 15/06/2020 Customs

Latest News

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

More News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Your care

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations