Covid-19 "exposes" weaknesses of Food and Beverage industry

|

| The Food and Beverage industry in 2020 has been one of the important economic sectors. |

Shooting stars

As in 2019, the ranking of the Top 10 prestigious companies in the Food and Beverage industry in 2020 is built on scientific and objective principles.

Companies are assessed and ranked based on three main criteria: financial capacity shown on the latest financial report; media credibility is assessed by Media Coding method - encoding the articles about companies on influential media channels; the survey of research subjects and stakeholders: consumers, experts was conducted in August 2020 and divided into seven categories: milk and dairy products; sugar, confectionery and other nutritional foods; packaged foods, spices, cooking oils; fresh, frozen foods; alcoholic beverages; non-alcoholic beverages.

Regarding the dairy and dairy products, the top three in the top 10 have not changed with familiar names: Vietnam Dairy Products Joint Stock Company (Vinamilk), TH Dairy Products Joint Stock Company, and FrieslandCampina Company Limited.

Notably, NutiFood - Nutrition Food Joint Stock Company ranked 4th in the top 10 ranking in 2019 and Ba Vi Dairy JSC (ranking 8th) is removed from the list.

Two new names are added –Vietnam Vitality Milk Company-Vitadairy and Lothamilk Joint Stock Company.

Regarding the sugar, confectionery and other nutritional food industries, the list remained unchanged, the top three still belonged to Nestle’ Vietnam Co., Ltd., Orion Vina Food Co., Ltd., and Mondelez Joint Stock Company Kinh Do Vietnam.

|

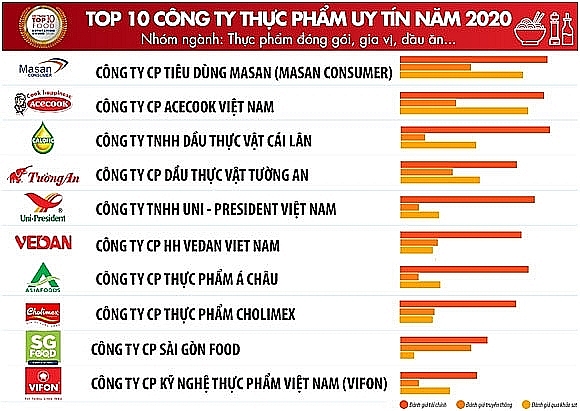

| Top 10 prestigious food companies in 2020 - industry: Packaged food, spices, cooking oil |

Regarding packaged foods, spices and cooking oils, the first and second positions were still held by Masan Consumption JSC and Acecook Vietnam JSC.

The third position has had a change. Ajinomoto Vietnam Company not only gives this position to Cai Lan Vegetable Oil Co., Ltd. but was also removed from the top 10. The name added to the list was Cholimex Food Joint Stock Company.

Regarding the fresh and frozen food industry, the top three also had a change. The first and second positions still belonged to C.P Vietnam Livestock Joint Stock Company and Vietnam Animal Industry Joint Stock Company (Vissan). Vinh Hoan Joint Stock Company had to cede third position to Dabaco Vietnam Joint Stock Company to drop to the 7thposition.

Regarding the group of alcoholic beverages, the top three did not change with the names: HeinekenVietnam Brewery Company Limited, Saigon Beer Alcohol Corporation, Hanoi Beer-Alcohol-Beverage Corporation.

Viet Ha Beer and Beverage Joint Stock Company was removed from the top 10 list, added to the list was Anheuser -Busch Inbev Vietnam Company Limited.

Regarding the group of non-alcoholic beverages, the unchanged top three belonged to Suntory Pepsico Vietnam Beverage Company Limited, Tan Hiep Phat Trading and Service Company Limited and Coca-Cola Vietnam Beverage Company Limited. Chuong Duong Beverage Joint Stock Company and Tan Quang Minh Production - Trading Company Limited were removed from the top 10 list.

URC Viet Nam Company Limited and TNI Company Limited were added the list.

Exposing weakness

For many years, the food and beverage (F&B) is in the fast-moving consumer goodsgroup (FMCG), is alwaysone of the important economic sectors with great potential fordeveloping in Vietnam. According to forecasts, FMCG industry in Vietnam will have a growth rate of 5-6% in the 2020-2025period.

However, the F&B industry in Vietnam is now compared to a "village" due to the lack of comprehensive planning, the lack of a management agency,they do at their own discretion and preference.

Many in the F&B industry have been exposed when Covid-19 arrived, typically issues related to logistics, distribution, and human resource management.

|

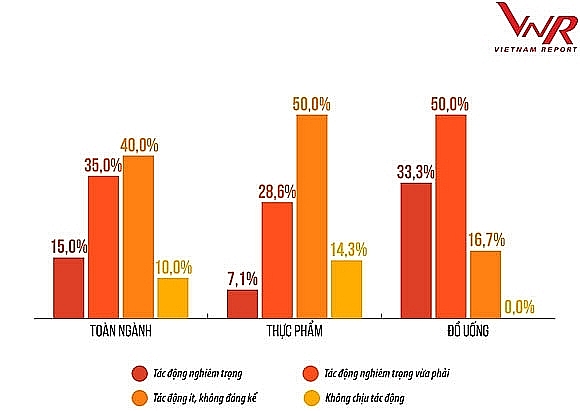

| The impact of COVID-19 epidemic on general production of enterprises |

The leaders of some large F&B enterprises said that the size of the enterprises in the industry was still fragmented andthe financial potential was weak,so when they faced a big shock like COVID-19,they often fell into a vicious cycle due to cash flow management, staff reduction, cost cutting.

But basically, the demand of people for food and drinkare difficult to change,when we accept "living with storms", enterprises will facethe shortage of personnel,production is not enough to meet the market demand,broken supply of raw materials due to lack of initiative in supply.

It is important that enterprises learn the lesson from shocks.

Up to 68.4% of enterprises in the industry realized that COVID-19 had created a boost to digital transformation. The evidence is that the enterprises which have built and applied modern technology processes in production and management have proved very stable during the crisis.

Except forworkers at factories who are forced to workin shifts,all other activities of the enterprise can be controlled and monitored remotely through software, applications and camera systems from the warehouse, forwarding, sales, distribution or online meetings connecting branches across the country

In addition, 63.2% of enterprises said that it was an opportunity to accelerate innovation. Innovation from the distribution system and adjusting the ratio between traditional and modern channels,developing applications to enhance customer experience when shopping, innovating from friendlypackaging design, and product brands for the environment,innovating from developing products to enhance the resistance and immune system.

More importantly, COVID-19 is the condition that makes profound changes in the leadership strategy, helping the F&B business community be strongerin the future.

Related News

Sustainable development trends in the food and beverage industry

14:44 | 22/08/2023 Import-Export

COVID-19 drug-related trafficking prosecuted

09:23 | 30/03/2023 Anti-Smuggling

Top 10 Vietnamese construction material companies announced

20:51 | 25/03/2023 Import-Export

China recovers border clearance as before the outbreak of Covid-19

17:39 | 01/03/2023 Customs

Latest News

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

More News

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export

Exporters urged to actively prepare for trade defence investigation risks when exporting to the UK

14:57 | 25/12/2024 Import-Export

Electronic imports exceed $100 billion

14:55 | 25/12/2024 Import-Export

Forestry exports set a record of $17.3 billion

14:49 | 25/12/2024 Import-Export

Hanoi: Maximum support for affiliating production and sustainable consumption of agricultural products

09:43 | 25/12/2024 Import-Export

Việt Nam boosts supporting industries with development programmes

13:56 | 24/12/2024 Import-Export

VN's wood industry sees chances and challenges from US new trade policies

13:54 | 24/12/2024 Import-Export

Vietnam's fruit, vegetable exports reach new milestone, topping 7 billion USD

13:49 | 24/12/2024 Import-Export

Aquatic exports hit 10 billion USD

13:45 | 24/12/2024 Import-Export

Your care

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export