Be careful with bad debt risks and ensure capital adequacy

|

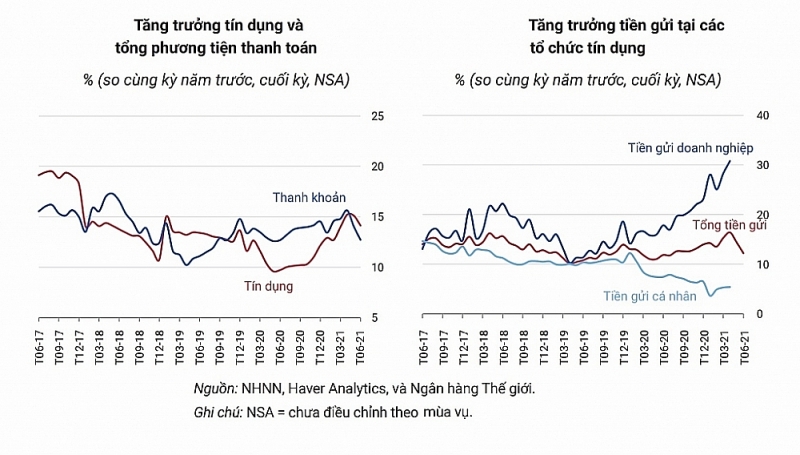

| Growth of credit and deposits at banks. Source: WB |

The impact has not been fully reflected in the books

In a report recently published by the World Bank in Vietnam, this agency assessed that the State Bank of Vietnam (SBV) would still maintain a loose monetary policy in the first half of 2021. The State Bank of Vietnam kept the refinancing interest rate at 4% and encouraged commercial banks to lend new loans at lower interest rates or restructure loans, waive and reduce interest and fees, and maintain the same debt group to support customers affected by the Covid-19 pandemic.

However, according to experts, the banking industry needs to be cautious because the impact of Covid-19 has not been fully reflected on the books due to the policy of restructuring the repayment term. Besides, the average number can mask the problems that each bank is facing.

The World Bank's report also said that the ratio of outstanding loans to GDP reached 136% in 2019, increased sharply to 146% by the end of 2020, increasing risks for banks, due to their relationship with other industries such as tourism, aviation, and possibly real estate.

This is evidenced by the deterioration of loan quality in some banks. In the report to the Government, the State Bank forecasts that by the end of December 2021, the bad debt ratio of the whole system will be at 2-3%; the ratio of bad debt on the balance sheet, unresolved debt sold to VAMC and potential debt becoming bad debt of the whole system is at 4-4.5%.

If the debts that are not transferred to bad debts due to the repayment term structure according to Circular 01/2020/TT-NHNN by the end of December 2021 have not yet been calculated, the ratio of bad debts on the balance sheet and debts sold to VAMC has not been resolved and the potential debt to become bad debt of the credit institution system will be at nearly 5%.

According to many experts, this bad debt ratio is still much lower than reality because the State Bank has issued temporary measures to allow the rescheduling of debt repayment terms for customers in difficulty in accordance with Circular 03 amending Circular No. April 1, 2020/TT-NHNN.

According to the Vietnam Banks Association (VNBA), from June 10, 2021 to the beginning of August 2021, more than VND600 trillion of outstanding loans were affected out of the total actual outstanding loans of more than VND1.19 quadrillion.

However, Circular 03 only allows debt restructuring with outstanding loans arising before June 30, 2020 and can only extend the debt restructuring period to December 31, 2021. But in the context of the current pandemic, in more than three months, banks are worried that businesses still cannot repay their debts, so the risk of bad debt transfer is very high

Recognizing these difficulties, the State Bank is seeking opinions on amending Circular 03, in which the remarkable point is to extend the time for debt restructuring, interest and fee exemption and reduction by six months compared to the current one.

|

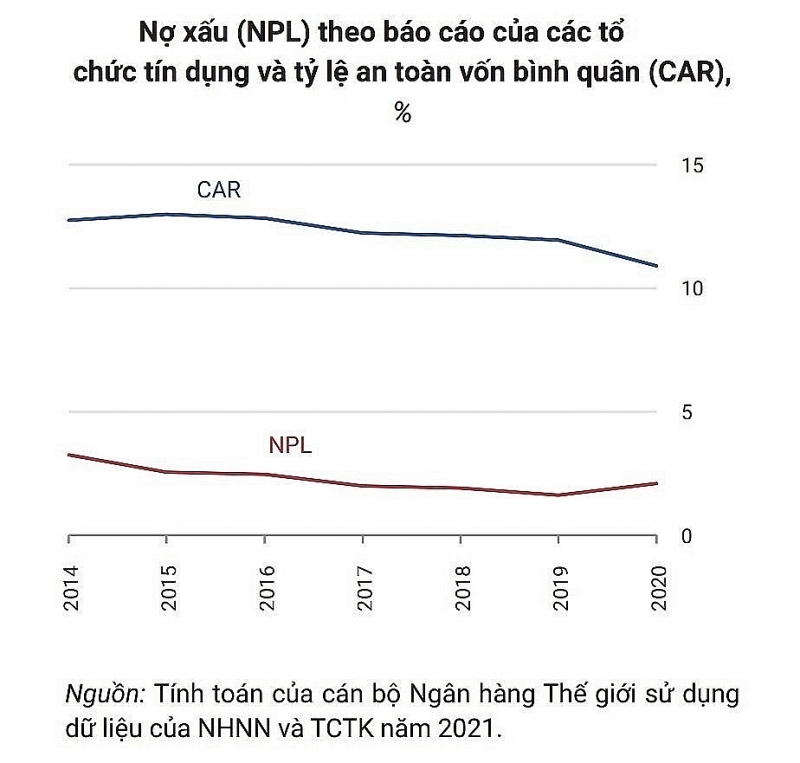

| Bad debt ratio and capital adequacy ratio of credit institutions. Source: WB |

Be careful when the capital adequacy ratio is not guaranteed

In addition to the concerns of bad debt, the WB's report said that the overall capital adequacy ratio (CAR) of banks decreased from 11.95% at the end of 2019 to 11.13% in December 2020 and 11.1% at the end of June 2021. These general figures may mask the vulnerability of some commercial banks, including those with low CAR, as demonstrated by their inability to meet the requirements of the banking sector of Basel II standards.

According to WB experts, the increased risk of default could increase stress in the financial sector over time.

According to Ms. Dorsati Madani, senior economist at WB in Vietnam, the SBV has issued many guidelines for banks to be able to delay debt for businesses and people affected by the pandemic. The abundant liquidity in the market is a positive sign. However, the agency in charge of monetary policy should be careful with the growing risks of bad debt, especially in banks that have not yet ensured capital adequacy.

In addition, WB experts said that the competent authorities need to develop a strategy to end the measures that allow the restructuring of the repayment terms clearly, as well as issuing a plan to deal with bad debts. In addition, there should also be a clear mechanism to handle weak and struggling banks and continue to recapitalize banks to meet the requirements of Basel II.

Related News

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Urgently issue Circular guiding debt restructuring affected by storm No. 3

10:25 | 29/09/2024 Headlines

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance