Banks' "step back" in the second quarter

|

| Chart: H.D |

Slow credit growth drags down profits

Up to now, 27 banks have announced business results for the second quarter and first six months of 2023. Accordingly, in the second quarter of 2023, up to 14 banks recorded negative profit growth compared to the second quarter of 2022. Two banks have a reduction of more than 90% such as ABBank, BVBank; more than 50% reduction like Eximbank, LPBank; more than 35% reduction like VietBank, VPBank, SeABank; more than 20% off such as TPBank, Bac A Bank, Techcombank...

According to the explanation of ABBank's management, the sharp decrease in profit in the second quarter of 2023 was mainly due to the increase in provision expenses for credit risks from the provisioning according to Circular 11/2021/TT-NHNN while revenue net interest income decreased by 40%. According to ABBank's financial report, the bank's risk provision expense increased more than 4 times in the second quarter compared to the same period last year, causing ABBank's pre-tax profit to drop sharply from more than VND 1,086 billion in the second quarter of this year, 2023 to more than VND 67 billion in the second quarter of this year.

According to other banks, the decline in profit from the main business lines and the increase in risk provision expenses are the main reasons for the decline in pre-tax profit. At the same time, the general difficulties of the economy along with the great impact from the international market have affected business activities of enterprises, making credit demand low. Specifically, credit in 6 months at ABBank only increased by 2.5%, credit at Eximbank also increased slightly by 1% compared to the beginning of the year… very far from the credit growth limit assigned by the State Bank (SBV). The allocation for banks is 14% for the whole year of 2023. Along with that, banks said that they have continuously reduced lending interest rates to accompany customers who are facing difficulties, causing high input capital costs, leading to net interest income fell sharply.

According to the latest update report of SSI Securities Company, the slowdown in bank profits is due to the deceleration of credit growth while the profit margin (NIM) narrows (NIM decreased by 15 percentage points compared to the previous year) and bad debt is still in an uptrend (total bad debt increased by 11 percentage points compared to the previous quarter). According to SSI experts, the credit growth rate in the second quarter was still weak compared to the first quarter in most banks. ACB, OCB, MB and VPBank are the banks with the strongest credit growth rate compared to the previous quarter, reaching about 5-6.5%.

According to the latest data of the State Bank, by the end of June 2023, credit increased by only 4.73% compared to the end of 2022 and increased by 9.08% over the same period in 2022. According to experts, credit increased the delay not only reduces interest income, but also leads to the stagnation of associated services. This is also one of the reasons for the high rate of bad debt.

The risk of bad debt increases

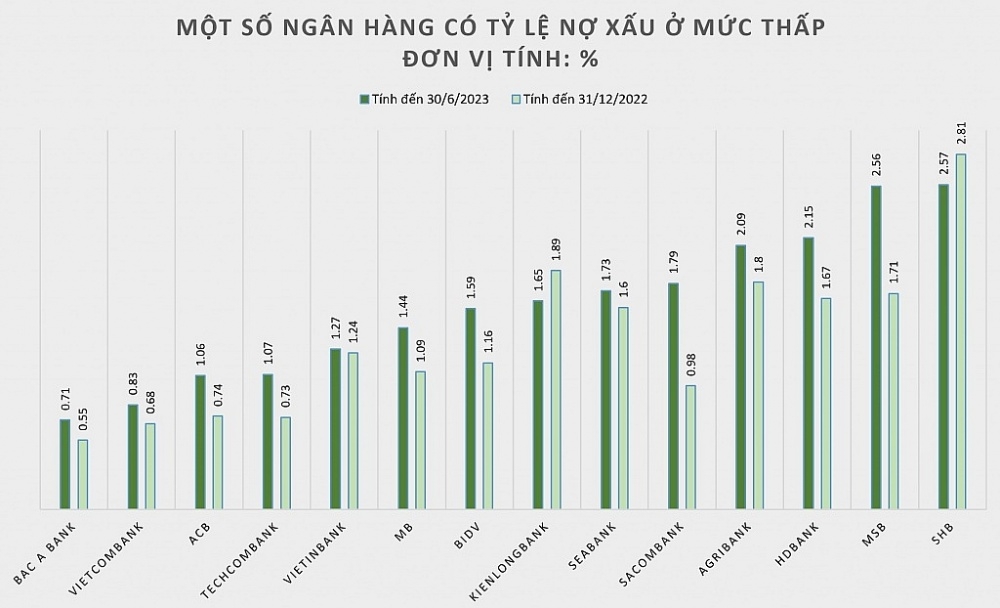

Recognition from the financial statements of banks showed that the ratio of bad debt to total outstanding loans at the end of the second quarter of 2023 increased compared to the end of 2022. On average, the bad debt ratio increased from 1.64% at the end of 2022 to 2.07% after the first 6 months of 2023.

At BIDV, by the end of June 2023, bad debt was at VND 25,970 billion, up 47% compared to the beginning of the year. The ratio of bad debt to total outstanding loans of BIDV increased from 1.16% to 1.59%. Similarly, as of June 30, 2023, MB's bad debt group 3 and group 4 increased by 1.8 and 2.2 times, respectively, and the ratio of bad debt to total outstanding loans increased to 1.44%. TPBank also had bad debt skyrocketing by 188% to VND 3,912.7 billion, 2.8 times higher than at the beginning of the period. In which, substandard debt increased by 5.6 times to VND 2,146.8 billion, potentially losing capital increased 26% to VND 636 billion. Therefore, TPBank's bad debt ratio increased sharply from 0.84% at the beginning of the year to 2.21%.

In addition, a number of banks with high bad debt ratios above 3% have also increased compared to the end of 2022 such as NCB, VPBank, BaoVietBank, ABBank, VietBank, VIB, OCB, and BVBank. The Vietnam Banks Association (VNBA) said that by the end of the second quarter, bad debts of credit institutions increased sharply compared to before, the potential bad debt ratio is 5.34% so far, many banks have bad debt ratio increased over 3%, some banks and financial companies had a sudden increase in bad debt ratio over 5% of total outstanding loans.

According to experts, the increase in bad debt comes from the freezing of the real estate and corporate bond markets, the decline in financial health of businesses and borrowers. Facing high pressure on bad debts of the system as well as to support people and businesses in difficulty, at the end of April 2023, the State Bank of Vietnam issued Circular No. 02/2023/TT-NHNN stipulating the organization credit to restructure debt repayment terms and keep the debt group unchanged. According to this circular, banks will have the option to restructure the repayment term within a maximum of 12 months and keep the same debt group while the provisions can be amortized over 2 years.

With this regulation, the pressure on both balance sheets and income statements of banks will be somewhat reduced, as the risk of increased bad debt ratio will be carried over to the second half of 2024, Profit pressure also eases at least in 2023 until the second half of 2024 when bad debt numbers will more realistically reflect the situation of borrowers. According to a recent survey by the State Bank of Vietnam, credit institutions assessed that the ratio of bad debt to total credit balance of the banking system showed a "slight increase" in the second quarter of 2023 but is expected to decrease in the second quarter of 2023.

Related News

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

More efficient thanks to centralized payments between the State Treasury and banks

13:51 | 17/10/2024 Finance

Allocating credit room, motivation for banks to compete

19:14 | 14/09/2024 Finance

Latest News

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

More News

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Your care

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance