Banks race to raise charter capital

|

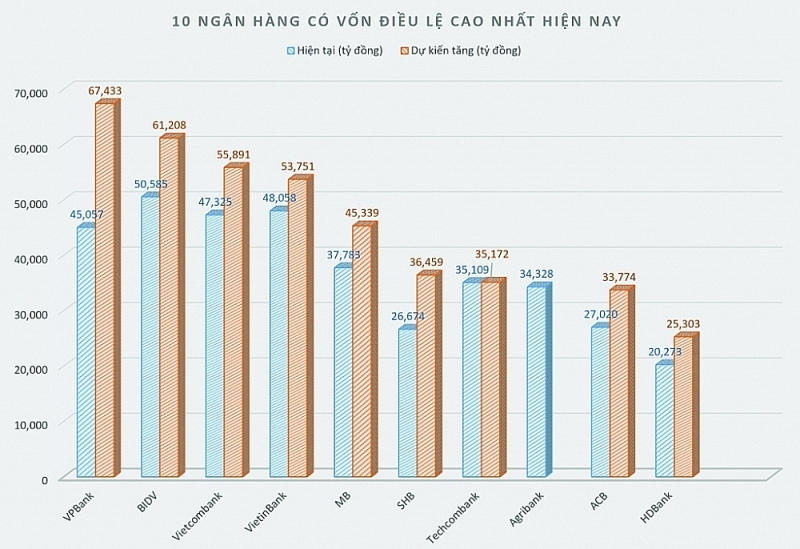

| Charter capital of the 10 highest banks in the system. Sketched by H.Dịu |

More than VND120,000 billion of charter capital was added

The State Bank has approved in writing VPBank's charter capital increase by a maximum of VND22,377 billion in the form of stock issuance to increase charter capital from equity.

VPBank's charter capital is currently VND45,056 billion, expected to reach VND67,433 billion, rising to become the bank with the largest charter capital in the system.

According to the plan, in the second phase of the capital increase, VPBank will privately issue a maximum of 15% of capital to foreign investors, bringing the total charter capital to VND79,334 billion.

Similarly, SHB was also approved to increase capital to VND26,674 billion. In 2022, implementing the resolution of the General Meeting of Shareholders, SHB will continue to increase its charter capital to VND36,459 billion - to enter the top 3 private commercial banks with the highest charter capital.

A representative of SHB said that the capital increase will help SHB continue to expand its operation scale and business development, and accelerate the bank's digitization. In addition, SHB also plans to issue up to 20% capital to foreign strategic investors. If completed this year, the bank's charter capital could reach VND43,750 billion.

Also in the first half of August, the monetary authority approved for HDBank to increase its charter capital from VND20,273 billion to VND25,503 billion. With over VND5,000 billion in additional charter capital, HDBank plans to use VND3,000 billion to supplement capital for medium and long-term loans, the rest will be supplemented with working capital for other activities.

A number of banks such as Kienlongbank, SeABank, Techcombank, ACB, VietCapital Bank, OCB, MSB were also approved by the State Bank to increase their charter capital. Popular growth options are stock dividends, equity issuance and ESOP shares for employees. It is estimated that since the beginning of the year, more than 20 banks have announced plans to increase capital with about VND120,000 billion in additional charter capital.

With the group of state-owned banks, in 2022, BIDV plans to increase its charter capital by VND10,623 billion, to VND61,208 billion, equivalent to an increase of 21%.

Vietcombank plans to increase its charter capital by nearly VND8,566 billion, from VND47,325 billion to VND55,891 billion. VietinBank also plans to increase its charter capital by VND5,694 billion, to VND53,751 billion.

In particular, in the Action Plan to implement Decision No. 689/QD-TTg dated June 8, 2022 of the Prime Minister approved the Project "Restructuring the system of credit institutions associated with bad debt settlement in the 2021-2025 period" of the Ministry of Finance, the Ministry of Finance shall assume the prime responsibility for, and coordinate with the Ministry of Planning and Investment, the Ministry of Justice, the SBV and relevant ministries and branches in, researching and reviewing control, amend and complete legal documents related to regulations on capital increase for credit institutions with state capital; coordinate with the State Bank and the Ministry of Planning and Investment in formulating and submitting a plan to the competent authorities to increase the charter capital of state-owned commercial banks; advise the Government to arrange, provide capital and supplement capital for state-owned commercial banks, especially Agribank.

Pressure in a risky business environment

The "race" to increase charter capital of the banking industry has been going on for many years. According to banking experts, capital raising plans are necessary to help the bank increase its financial potential, expand the scale of its business operations, and ensure its capital adequacy ratio (CAR) in accordance with regulations of authorities, to meet the annual growth plan. Mr. Phan Duc Tu, Chairman of BIDV's Board of Directors, said that increasing financial capacity is a prerequisite for credit institutions to meet safety indicators and develop credit to serve the economy.

Especially in the 2022-2023 period, the Government's economic recovery program will require maintaining high credit growth.

According to a survey by Vietnam Report conducted in June 2022, up to 36.4% of banks think that raising capital is the biggest challenge to growth this year, an increase of 8.6% compared to last year. At the same time, more than 54.6% of banks said that increasing charter capital is the key task of 2022, a significant increase compared to 44.4% of the previous year.

According to economic expert Dr. Can Van Luc, the equity size of 29 banks is observed to show signs of slowing down in the 2019-2021 period, from 21% in 2019 to 10% in 2021. Meanwhile, growth credit in this period still remains at 13-14%, so the problem of raising capital will continue for many credit institutions in the medium and long term.

In addition, many banks also said that the increase in charter capital will be a driving force for banks to continue to increase market share and expand business activities when the ratio of using short-term capital for medium and long-term loans is tightened. Moreover, according to securities companies, the successful implementation of the capital increase plan of some banks will be a supporting factor for the stock price increase.

Related News

U.S. Treasury continues to affirm Vietnam does not manipulate currency

13:46 | 19/11/2024 Finance

Solving necessary and urgent issues in financial and budgetary sectors

10:57 | 12/10/2024 Finance

Urgently issue Circular guiding debt restructuring affected by storm No. 3

10:25 | 29/09/2024 Headlines

Improve business environment to unlock potential for businesses

16:19 | 20/09/2024 Headlines

Latest News

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

More News

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

State-owned securities company trails competitors

14:46 | 20/11/2024 Finance

Strengthening the financial “health” of state-owned enterprises

09:23 | 20/11/2024 Finance

Exchange rate fluctuations bring huge profits to many banks

13:43 | 19/11/2024 Finance

A “picture” of bank profits in the first nine months of 2024

09:42 | 19/11/2024 Finance

Many challenges in restructuring public finance

10:02 | 18/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Disbursement of public investment must be accelerated: Deputy PM

19:32 | 16/11/2024 Finance

Your care

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Monetary policy forecast unlikely to loosen further

15:51 | 22/11/2024 Finance

World Bank outlines path for Vietnam to reach high income status

13:44 | 22/11/2024 Finance

Strictly control public debt and ensure national financial security 2025

09:26 | 22/11/2024 Finance

Revising the title of a draft of 1 Law amending seven finance-related laws

14:33 | 21/11/2024 Finance