Banks continue savings interest rates “race”

|

| Many banks have announced new deposit interest rates since the beginning of June. Photo: Internet |

On the first day of June, BIDV announced a new deposit interest rate schedule. This was the first adjustment of BIDV's deposit interest rate since August 2021.

Accordingly, BIDV increased interest rates for long terms (from 12 months or more) by 0.1 percentage point to 5.6%/year, but the bank kept the interest rates for short terms, currently 6-9 months, at 4%/year, while 3-5 month terms are 3.4%/year, and 1-2 months at 3.1%/year.

Vietcombank also announced the deposit interest rate schedule for online deposit on its website, plus 0.1%/year compared to over-the-counter deposit method.

Despite the upward adjustment, the deposit interest rates of the group of four state-owned banks are still the lowest in the market. Vietcombank and VietinBank have the highest interest rates of only 5.6%/year, with Agribank at 5.5 %/five.

With other joint stock commercial banks, in the first days of June, deposit interest rates for term (3, 6, 12, 24 months) continued to be adjusted up, with a common increase margin from 0.1-0.5% a year, with some banks even increasing to 0.8%.

For example, VIB had the strongest correction when it increased by 0.8% for 6-month and 9-month tenors. In addition, the 3-month term was also adjusted by the bank by 0.5%, the 24-month term was adjusted by 0.4%. With an increased interest rate margin, VIB's 3-month term has an interest rate of 4.0%/year; 6 months is 5.8%/year; 12 months is 6.2%/year; 24 months is 6.2%/year.

Techcombank also announced to adjust the deposit interest rate to increase by 0.3-0.7 percentage points in many terms. NCB has also increased by 0.3-0.5% for some terms, specifically 6 month term is 6.3%/year, 12-month term is 6.6%/year for 24 months is 6.9%/year (increasing by 0.5%).

SCB also adjusted to increase deposit interest rates in some terms with an increase of 0.1-0.3%. Some banks such as OceanBank, BaoVietBank, PGBank, ACB, and SHB also increased interest rates within the range of 0.1-0.4% depending on the term.

|

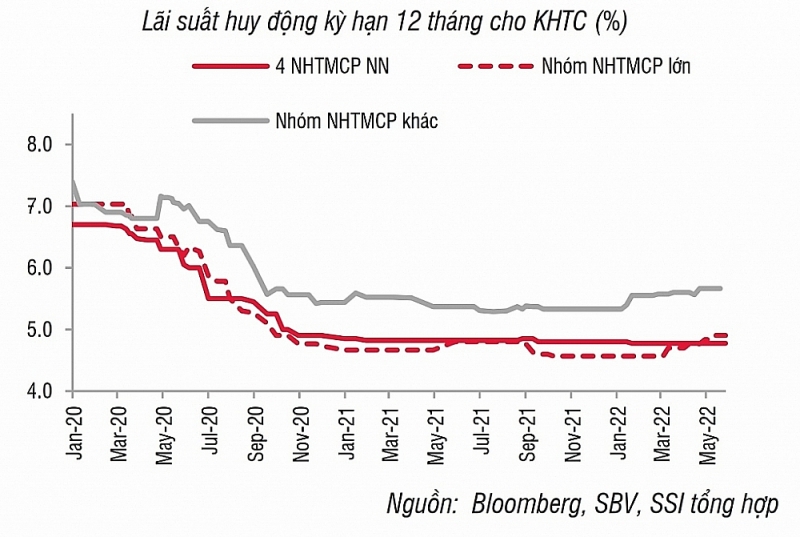

| Movement of 12-month term deposit interest rates for institutional customers. |

Not only increasing deposit interest rates, many banks also launched promotions, gifts, and lucky draws to attract customers to deposit.

Thus, it can be seen that banks are still continuing to "race" to increase deposit interest rates. The main reason is that credit has increased rapidly after the epidemic is under control, and banks have started to deploy a 2% interest rate support package, leading to pressure to increase deposit interest rates to mobilize capital. According to the State Bank, it is estimated that by May 27, credit will increase by 7.75%, more than double the same period in 2021.

Experts at VNDirect Securities said that deposit interest rates will remain under pressure from now until the end of the year because of inflationary pressure. However, the increase will not be too large, only about 30-50 basis points for the whole year of 2022. In which, the 12-month deposit interest rate of commercial banks may increase to 5.9-6, 1% a year at the end of 2022 (currently 5.5-5.7% a year), still well below pre-pandemic levels of 7% a year.

Meanwhile, the report of VBCS Securities Company said that the volatility of deposit interest rates will continue to depend heavily on the abundance of capital flows in the interbank market. With inflation pressure forecasted to continue in the coming months along with the demand for higher credit growth during the economic recovery period, deposit interest rates are forecasted to be under upward pressure of 100- 150 basis points for the whole of 2022.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

More efficient thanks to centralized payments between the State Treasury and banks

13:51 | 17/10/2024 Finance

Latest News

SBV makes significant net withdrawal to stabilise exchange rate

07:59 | 15/01/2025 Finance

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

More News

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Your care

SBV makes significant net withdrawal to stabilise exchange rate

07:59 | 15/01/2025 Finance

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance