Banks bad debt tends to increase

|

| Bad debts also increased when many debts that were restructured were changed into debt groups. Source: Internet. |

Debt quality goes down

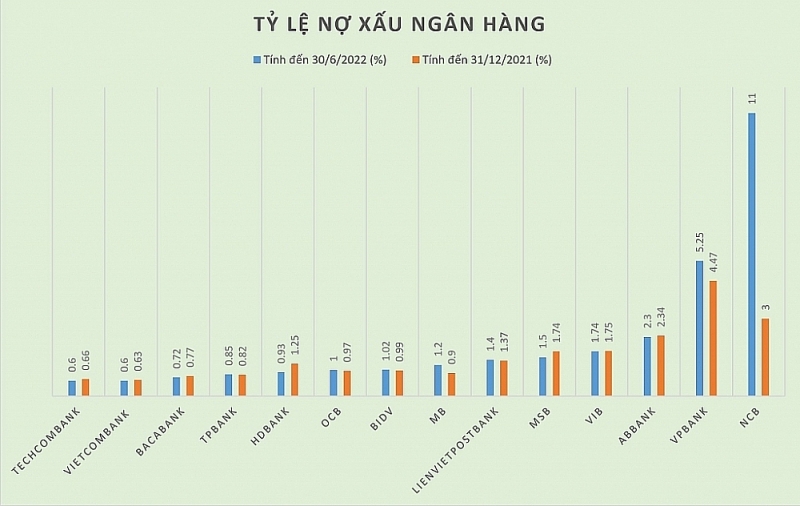

The strongest increase in the system so far is NCB. NCB's consolidated financial statements recorded that the ratio of bad debt to total outstanding loans jumped from 3% at the beginning of the year to 11% at the end of June 2022.

In which, debt groups all increased sharply, sub-standard debt increased by 90% from more than VND600 billion to nearly VND1,144 billion, and debt group 3 increased 15 times compared to the beginning of the year, from VND181 billion to VND2,626 billion. The worst debt group is debt group 5 - debt that is likely to lose capital also increased by more than 140% to VND1,130 billion.

Next is VPBank when the total bad debt by the end of June increased by 27% compared to the beginning of the year, to more than VND20,600 billion, making the ratio of bad debt to total outstanding loans increase to 5.25% compared to 4.47%.

In which, VPBank's debt with the possibility of losing capital increased by more than 240%, and doubtful debt also increased by 20%.

LienVietPostBank's financial report also shows that, compared to the end of 2021, the bank's total bad debt increased by 11.2% to nearly VND3,183 billion, of which group 3 debt increased by 67.5%, group 5 debt also increased by 37.8%. The ratio of bad debt to total outstanding loans of the bank increased from 1.37% to 1.4%.

At MB, customer loans increased sharply by 14.1%, among the highest in the whole system, helping pre-tax profit to reach more than VND11,896 billion, up 49% over the same period last year. However, credit quality tended to worsen as the ratio of bad debt to total outstanding loans increased to 1.2% compared to 0.9% at the beginning of the year. Notably, debt with the potential to lose capital increased the most by 123% from nearly VND820 billion to VND1,826 billion, debt in groups 3 and 4 also increased slightly compared to the figure by the end of 2021.

For TPBank, TPBank's total bad debt at the end of the second quarter of 2022 was VND1,285 billion, up 11% compared to the beginning of the year. In which, debt with the possibility of losing capital increased to 51%. As a result, TPBank's bad debt-to-loan ratio increased slightly from 0.82% to 0.85%.

According to BIDV's Q2 financial report, the bank's asset growth and profit growth were positive, but debt quality tended to be worse. The ratio of bad debt to total outstanding loans after 6 months of 2022 has increased to 1.02%, compared to 0.99% at the end of 2021. In which, the number of group 5 debts (debts likely to lose capital) increased. 18%, group 3 debt (substandard debt) increased sharply by nearly 47%, and only group 4 debt (doubtful debt) decreased by nearly 30%.

|

| Bad debt ratio at some banks. Sketched by: H.Due |

According to the financial statements, some banks still recorded the ratio of bad debt to total outstanding loans flat, even down compared to the first quarter of 2022, but in terms of the number of bad debt groups, especially those that can capital loss is recorded as an increase.

For example, so far, Techcombank is a bank that has controlled the quality of bad debts, almost standing still or decreasing slightly in the previous quarters, so in the first half of this year, this bank also recorded a flat bad debt ratio at 0.6% of total outstanding loans. However, Techcombank's total debt in group 3,4,5 in the first 6 months of the year increased by 2.85% compared to the end of 2021, with group 5 debt increasing by 27%.

With this development, at VIB, by the end of the second quarter, the bad debt ratio accounted for 1.74% of total outstanding loans, lower than 1.75% at the beginning of the year. But VIB's doubtful debt and potentially loss-making debt increased by 32% and 67%, respectively. The ratio of bad debt to total outstanding loans of ABBank also decreased slightly from 2.34% at the beginning of the year to 2.3%, but group 5 debt increased by 20% compared to the beginning of the year and accounted for 58% of total bad debts, total absolute loan balance increased by 10.7%. BacABank also had a bad debt ratio decrease from 0.77% to 0.72% after 6 months of 2022, although group 3 debt decreased, group 5 debt was flat, but group 4 debt was more than 35%.

Bad debt continues to increase

In fact, from the beginning of the year, experts have given many warnings that the bad debt ratio at banks may increase sharply because banks have had to stop debt restructuring for businesses affected by Covid-19 since June 30.

In a report on banking conducted by Vietnam Report Joint Stock Company (Vietnam Report), many experts participating in the survey said that bad debt tends to increase quite strongly when the influence of the pandemic on the bank's balance sheet is forecast to continue for a long time because businesses have not been able to recover and the debts after being facilitated for restructuring are ranked in groups 1 and 2, but still unable to improve will force the system to officially record as bad debt, especially after Circular 14 expires on June 30, 2022.

In this regard, Nguyen Quoc Hung, General Secretary of the Banking Association emphasized that millions of billions of VND of credit were affected by the pandemic, but the structural debt was only about VND300,000 billion. In fact, the risk of bad debt of banks is much higher than the data in the accounting books, so banks are facing more clearly bad debts.

With these statements, the survey results of the Vietnam Report show that 45.5% of banks expect to continue to increase provision for risk, 36.4% of banks maintain provision levels as in the previous year and only 18.2% reduced provision for risk.

Therefore, many banks have sharply increased the ratio of bad debt coverage, such as Vietcombank with the highest ratio up to 506%, BIDV with 279%, Techcombank with 171.6%, ACB with 185%. But there are also banks that have sharply reduced provisioning, such as ABBank down 32% over the same period, BacABank down 2%, and MB down 17%.

Related News

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

More efficient thanks to centralized payments between the State Treasury and banks

13:51 | 17/10/2024 Finance

Allocating credit room, motivation for banks to compete

19:14 | 14/09/2024 Finance

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance