Banking “rush” to finish the plan soon but burden on bad debts

|

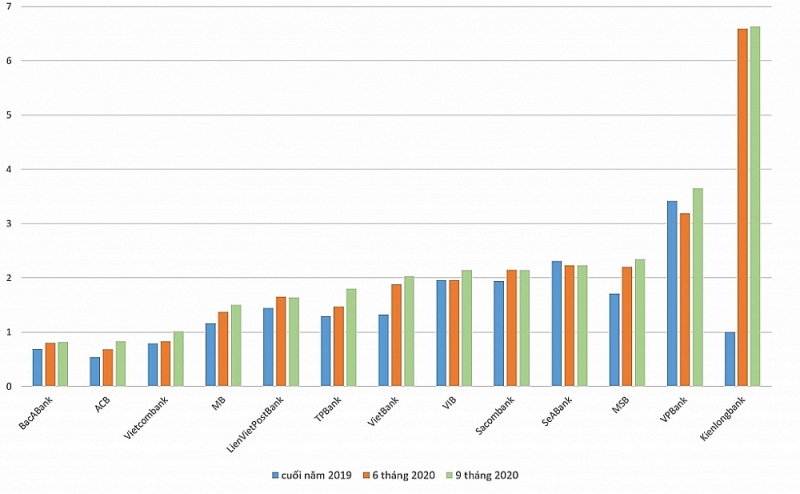

| Comparing the rate of bad debts of some banks at the end of 2019, 6 months and 9 months in 2020. Sketched by H.Dịu |

Speeding to finish

At LienVietPostBank, thanks to the sudden growth of profit in the third quarter, the bank's profit in the first nine months reached VND1,741 billion, up 6.4% over the same period last year, exceeding 2.4% compared to the target for the whole year. The leadership of LienVietPostBank forecasted that, in the remaining months of the year, the economy would continue to recover, the demand for business and consumer loans would increase again, and the profit before tax of the bank in 2020 would exceed the results in 2019 and hit the highest level in 12 years of banking operations.

Similarly, in the first nine months of 2020, profit before tax of MSB was over VND1,666 billion, up 56% over the same period last year, exceeding 16% of the yearly plan (VND1,439 billion). Profit after tax reached nearly VND1,328, an increase of 53% and equal to 127% of the total profit after tax of the whole year in 2019.

Besides that, some banks had lower profits compared to the same period last year, but they still exceeded the target for the whole year 2020.

At Saigonbank, the profit before tax of bank in the first nine months of 2020 reached VND177 billion, a decrease of 19.7% over the same period in 2019 but still exceeding 36% compared to the whole year’s target. VietBank also had profit before tax of VND374 billion, down 13% over the same period last year but exceeding 25% of the year’s target.

Along with a number of banks that have already finished, many commercial banks have also reached around 90% of the year's plan. VPBank's financial statements showed that profit before tax in the nine months reached 92% of the plan, equivalent to nearly VND9,400 billion, up nearly 30% over the same period last year.

In the first nine months, profit before tax of VIB also reached VND4,025 billion, up 38.1% over the same period last year and nearly 90% of the year’s target. Similarly, banks such as Sacombank, MB, Techcombank have also completed about 90% of the year plan after nine months.

However, there are still a few banks that are having difficulties in completing the annual plan. For example, Kienlongbank with a new profit in nine months is VND144 billion, reaching less than 20% of the year plan, a decrease of 38.7% over the same period in 2019, while this bank set a target of profit before tax in 2020 at VND750 billion.

According to the explanation of the management board of Kienlongbank, the reason for the decline in profits was mainly because the bank reduced its income when implementing the support policy for customers affected by the Covid-19 pandemic as prescribed.

Moreover, the bank also had to increase the cost of risk provision for loans for a group of customers having collateral assets of another bank. Therefore, this effect was only temporary, after handling the collateral (expected in the fourth quarter of 2020), based on the proceeds, Kienlongbank would record provision reversal, contributing to increased revenue of the whole year.

Bad debts are still difficult

Since the outbreak of the pandemic, the financial statements of 2020 of banks have clearly demonstrated an increase in bad debt. Therefore, over the past nine months, this issue has been shown more clearly.

As at Military Bank (MB), the consolidated financial statements of the third quarter showed that the profit before tax in nine months only increased slightly, but bad debt increased three times over the beginning of the year.

Specifically, debt of group 4 (doubtful debt) increased by about 13%, up to more than VND1,016 billion, but debts of group 5 (bad debts) increased "suddenly" from VND617 billion at the end of 2019 to over VND1,980 billion in the first nine months of 2020, that is more than a three times increase, up to 221%. However, thanks to high credit growth, the ratio of non-performing loans of MB is only 1.5%.

The biggest increase is Kienlongbank, by the end of September 2020, this bank has a total of VND2,239 billion of bad debt, up nearly 6.6 times compared to the beginning of the year. In particular, bad debt mainly increased in group 5, with an increase of nearly 9 times, up to VND2,133 billion. As a result, the ratio of non-performing loan over the total of debts is pulled up to 6.63%, a very high increase compared to 1% at the beginning of the year.

Along with that, many other banks also had a high increase in bad debt such as TPBank, with total bad debt increasing by 60% compared to the beginning of the year, pulling the ratio of bad debts over the debt of TPBank from 1.29% at the beginning of the year to 1.78%. Vietcombank also increased from 0.79% to 1.01%; Sacombank increased from 1.9% to 2.13%; VPBank increased from 3.42% to 3.65%; ACB from 0.54% to 0.83%.

BIDV Research Institute estimated that the on-balance-sheet bad debt by the end of 2020 might be at 3% and by the end of 2021 would be 4%. The experts also said that the third and fourth quarter would be the time when the banking industry suffers from the impact of the Covid-19 pandemic, the biggest challenge and difficulty would be the problem of bad debt, but the handling of bad debts was forecast to be more difficult due to the impact of the Covid-19 pandemic.

Moreover, the increase in bad debt would cause banks to increase provisioning, from that affecting profits. Besides that, the measures of deferred debts, or reduce interest rates, would also affect the "real" non-performing loan ratio and bank profits in the future.

Related News

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Green credit proportion remains low due to lack of specific evaluation criteria

09:02 | 24/11/2024 Finance

Control of major shareholders in banks

09:25 | 16/09/2024 Finance

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance