Bank interest rates plummet

| Interbank interest rates cool down thanks to good liquidity | |

| Central bank ceases bill issue amid increasing interbank interest rates |

|

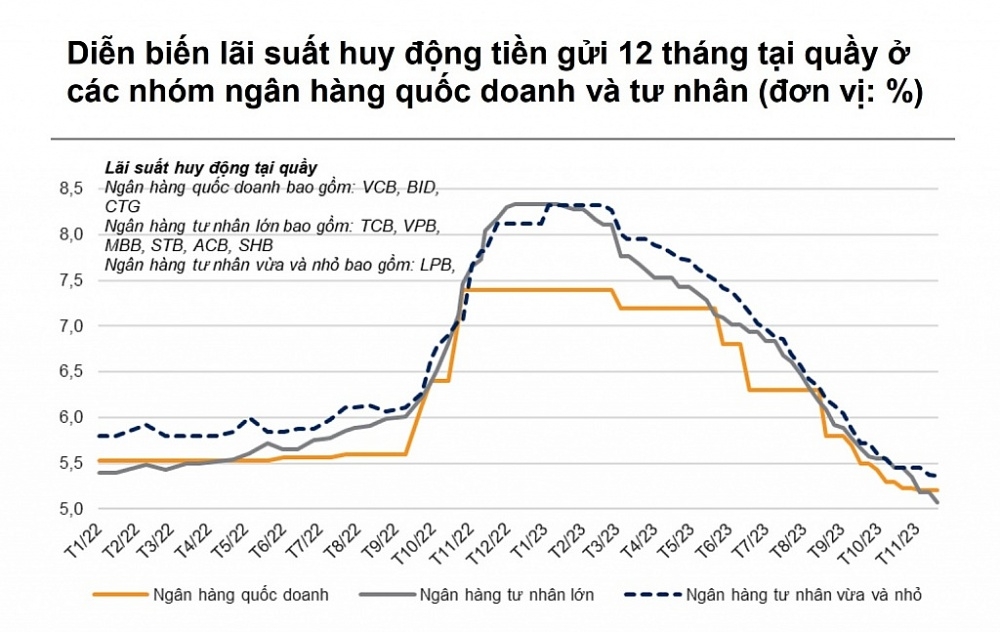

| Source: VNDirect |

Accordingly, the latest savings interest rate schedule at Vietcombank continues to decrease by 0.2%/year for deposit terms of less than 12 months. The 1-2 month deposit interest rate at this bank dropped to a record low, only 2.2%/year; the 3-month term interest rate is 2.5%/year; interest rate 3.5%/year for 6-9 month term deposits.

Vietcombank maintains the interest rate at 4.8%/year for over-the-counter deposits with terms of 12 months or more.

Over the past month, Vietcombank has reduced deposit interest rates four times with a total of nearly 1%/year, bringing interest rates at this bank to the lowest level in the market.

BIDV has also announced an official reduction of deposit interest rates by 0.1% for terms from 1 to 11 months. According to the online deposit interest rate schedule, the deposit interest rate for 1-2 month term is 3.1%/year, 3-5 month term is 3.4%/year, 6-11 month term is only 4.4%/year, and 12-36 month term remains 5.3%/year.

The highest savings interest rates at VietinBank and Agribank is only 5.3%/year.

Not only state-owned banks, a series of commercial banks also reduced savings interest rates. For example, ACB reduces the 6-month term interest rates to 3.5%/year, the 9-month term to 4.6%/year, and the 12-month term to 4.65%/year. KienlongBank applies interest rates for 6-month, 9-month and 12-month terms at 5.4%/year, 5.6%/year and 5.7%/year, respectively.

Some commercial banks still have deposit interest rates above 8%/year, but it requires high condition to enjoy the rates. For example, MSB mobilizes 12 and 13-month term deposits with the highest interest rate of up to 9%/year if the deposit amount is from VND500 billion. Below this level, the applicable interest rate is only 5.1%/year.

PVCombank offers the highest interest rate of up to 10.5%/year but the balance must be VND 2,000 billion or more and the term deposits must be over 12 months...

According to a report by VNDirect Securities Company, as of the end of November, the average 12-month deposit interest rate of commercial banks dropped to 5.14%/year, an decrease of 0.2 percentage points compared to the end of October and about 2.7 percentage points compared to the end of 2022. Thus, the deposit interest rates are lower than the Covid-19 period (from the beginning of 2021 to the first half of 2022).

VNDirect experts expect that the 12-month deposit interest rate may be 5.0-5.1% by the end of 2023 and remain at a low level in 2024.

With this move by banks, the lending interest rates tends to decrease. According to a report by the State Bank (SBV), interest rates have tended to fall, the new deposit and lending interest rates of commercial banks decline more than 2%/year compared to the end of 2022. As of December 20, the average deposit and loan interest rates of new transactions of commercial banks are 4.1%/year and 7.3%/year, respectively.

The State Bank said that after the revising down of operating interest rates and the measures by the State Bank and the commitments on reducing lending interest rates by credit institutions, the lending interest rates may be decrease in the near future.

VNDirect experts also commented that lending interest rates will continue to maintain a downward trend in the last months of this year thanks to the sharp decrease in capital costs of commercial banks in recent times.

Furthermore, many banks have announced interest rate reductions since the beginning of November. For example, SHB has announced an additional 2%/year reduction in loan interest rates for existing customers until the end of 2023; VietinBank has also announced to continue lowering lending interest rates to 5.9%/year for small and medium-sized enterprises from now until December 31.

Related News

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Banks increase non-interest revenue

10:51 | 23/11/2024 Finance

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance