Bad debt worries to ease thanks to high provision rate

| Directing cash flow to priority areas, preventing bad debts from increasing | |

| Banks boost sales of mortgaged real estate to recover bad debts | |

| Banks' bad debt continues to increase |

|

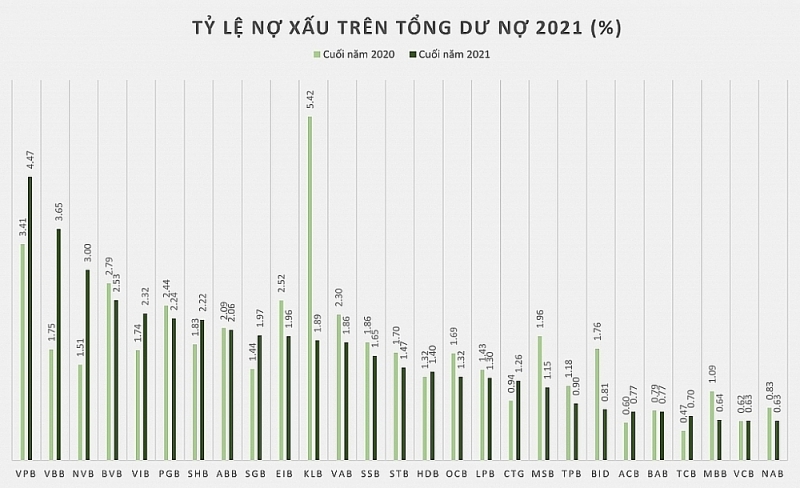

| Bad debt ratio in 2021 of 27 surveyed banks. Chart: H.Due |

Set aside risk provisions

According to the financial statements for 2021 of 28 banks listed on the stock market, VPBank currently has the highest bad debt ratio, with 4.47% of total outstanding loans, a sharp increase compared to 3.41% at the end of 2020. Next is VietBank with an increase of nearly double the previous year to 3.65%. Then, NCB, VIB and SHB maintain the ratio of 3%, 2.32% and 2.22%, respectively. The banks with the lowest bad debt ratio are MBBank with 0.64%, Vietcombank and Nam A Bank with 0.63%.

Among banks with a reduced bad debt ratio, Kien Long Bank is the most typical example when it dropped sharply from more than 5.42% to only 1.89% of total outstanding loans.

However, despite a sharp increase in their bad debt ratio, banks have also set up provisioning for risks. For example, by the end of 2021, MSB's bad debt ratio was at 1.15% of total outstanding loans. A representative of MSB said that the bank has conducted debt restructuring for customers affected by Covid-19 according to Circulars 01 and 14 of the State Bank (SBV) and has made adequate provision of up to VND1,567 billion, up 46% compared to 2020.

Similarly, in 2021, ACB set aside more than VND3,336 billion to make provision for credit risks, 3.5 times higher than the previous year, but still reported a 25% increase in pre- and after-tax profit, reaching more than VND11,998 billion and nearly VND9,603 billion. LienVietPostBank also spent more than VND1,322 billion to set up provisions for credit risks in 2021, 1.9 times higher than the previous year.

Meanwhile, TPBank's total bad debt (TPB) as of December 31, 2021 decreased by 19% compared to the beginning of the year, to only nearly VND1,157 billion, mainly thanks to the reduction of group 3 and group 5 debts. As a result, the ratio of bad debt on loan balances down to less than 1%. In 2021, TPBank still spent VND2,908 billion for credit risk provisions, an increase of 63% compared to 2020. In general, for the whole of 2021, ABBank spent nearly VND687 billion to make provisions for credit risks, up 34% from the previous year.

In the state-owned banking sector, BIDV has controlled and handled bad debts quite well over the years. Typically, BIDV has always made provisions for risks that have increased higher than profits. According to Mr. Phan Duc Tu, Chairman of BIDV's Board of Directors, by the end of 2021, this bank's bad debt had dropped sharply to 0.81%. Notably, the bad debt coverage ratio (balance of provision fund for credit risks/bad debt balance) reached 235%, the highest level in recent years and much higher than the set target.

Similarly, Mr. Nguyen Thanh Tung, Deputy General Director in charge of Vietcombank's Executive Board, said that the bad debt coverage ratio is up to 424%. In particular, all outstanding loans structured according to Circulars 03 and 14 of the State Bank have been fully set aside, two years earlier than the prescribed time limit.

VietinBank also raised the bad debt coverage ratio in 2021 to 171%, instead of 132% at the end of 2020. A representative of VietinBank said that in 2021, VietinBank controlled bad debts at a very low level. Thanks to a very careful assessment to come up with a safe scenario for 2022, VietinBank has sharply increased the bad debt coverage ratio.

Bad debt may decrease in 2022

According to leaders of many banks, compared to 2020, the banking industry has more experience in handling bad debts and controlling credit quality in 2021. This will be even better controlled in 2022, especially amid the gradual recovery of the economy.

According to a recent survey by the State Bank of Vietnam, the majority of surveyed credit institutions believe that bad debts of the whole system will drop slightly in the first quarter of 2022. As revealed by analysts of SSI Securities, in 2022, the risk for banks' bad debt is under the risk of being unable to be extended under the regulations in Circular 14. But even if this happens, the situation is not alarming thanks to the gradual recovery of the economy and higher debt repayment capacity of businesses. Besides, many banks have made 100% provision for structural debt. Credit risk is only possible with weak reserve buffer zones.

At the end of 2021, according to a representative of the State Bank of Vietnam, the bad debt ratio on the balance sheet in 2021 was 1.9%, an increase of 1.69% year on year. As a matter of fact, if other bad debts which were sold to the Asset Management Company of credit institutions (VAMC) but not yet resolved at the end of 2021 and other potential ones are included, this ratio is up to 3.79%. In addition, banks have also restructured many debts for pandemic-hit customers. Besides, other debts have been also restructured according to Circular 01, Circular 03, and Circular No. 14. In total, the overall bad debt ratio could be at 8.2%.

Therefore, despite many optimistic signals about the bad debt situation and asset quality of banks in 2022, especially with the proportion of provisions for credit risks, the banks still need full awareness.

During a meeting with the State Bank of Vietnam at the beginning of the Lunar New Year, Prime Minister Pham Minh Chinh requested the banking industry to drastically and effectively implement the restructuring of the system of credit institutions in association with bad debt settlement. This is a key task that has been a focus of the State Bank for many years.

Related News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

There is still room for credit growth at the end of the year

09:43 | 08/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Latest News

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

More News

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export

Exporters urged to actively prepare for trade defence investigation risks when exporting to the UK

14:57 | 25/12/2024 Import-Export

Electronic imports exceed $100 billion

14:55 | 25/12/2024 Import-Export

Forestry exports set a record of $17.3 billion

14:49 | 25/12/2024 Import-Export

Hanoi: Maximum support for affiliating production and sustainable consumption of agricultural products

09:43 | 25/12/2024 Import-Export

Việt Nam boosts supporting industries with development programmes

13:56 | 24/12/2024 Import-Export

VN's wood industry sees chances and challenges from US new trade policies

13:54 | 24/12/2024 Import-Export

Vietnam's fruit, vegetable exports reach new milestone, topping 7 billion USD

13:49 | 24/12/2024 Import-Export

Aquatic exports hit 10 billion USD

13:45 | 24/12/2024 Import-Export

Your care

Nghệ An Province anticipates record FDI amidst economic upswing

15:49 | 26/12/2024 Import-Export

Green farming development needs supportive policies to attract investors

15:46 | 26/12/2024 Import-Export

Vietnamese enterprises adapt to green logistics trend

15:43 | 26/12/2024 Import-Export

Paving the way for Vietnamese agricultural products in China

11:08 | 26/12/2024 Import-Export

VN seafood export surpass 2024 goal of $10 billion

14:59 | 25/12/2024 Import-Export