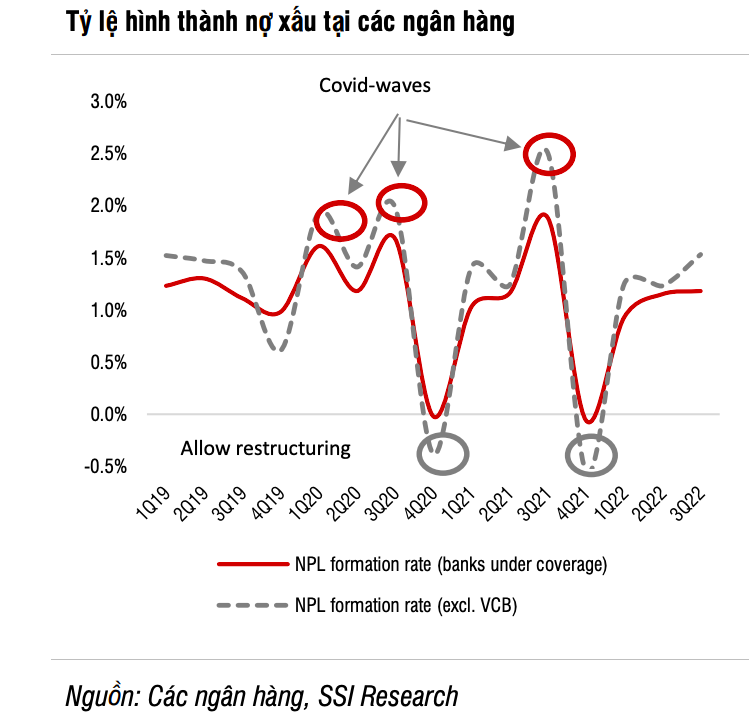

Asset quality at banks is deteriorating

|

| Rate of bad debt formation at banks |

It is difficult to sell real estate which affects the ability to repay bank loans

In the analysis report of the banking industry just released, SSI Research said that the market was starting to see difficulties among companies in raising capital (and restructuring debt) for their business.

This might increase the risk associated with the debt repayment ability of these companies. Some enterprises had requested a deferral of principal (and interest) payments.

According to data from SSI Research, the total number of bonds currently in circulation excluding the group of bonds issued by banks was about VND 945 trillion, of which, 27% would mature in 2023 and 2024, and 12% would mature in 2025. Nearly a third of these bonds were on the bank's balance sheet. However, this figure still did not include bonds that had been distributed to individual investors with payment guarantees, as well as those that were not currently on a bank's balance sheet. However, the bank would still bear the credit risk relevant to the bonds under the repo contract (repurchase agreement).

Many real estate investors are facing difficulties such as increased inventory, reduced sales and significant pressure on short-term cash flow when some bonds are approaching maturity, especially in the period from December 2022 to March 2023. Rising loan interest rates for purchasing houses have also caused hesitation among potential homebuyers even though some property developers have offered 30-40% discounts to homebuyers with cash on hand (with a prepayment rate of 90%).

For example, in Ho Chi Minh City, the number of apartments traded in the third quarter of 2022 was only 900 units, down 89% compared to the second quarter of 2022. The absorption rate reached 15-35% for new projects, the lowest level since 2019. The situation is better in the Hanoi market, where the absorption rate reached 50% but the inventory of apartments with over VND4 billion have not shown any signs of decreasing.

On the buyer side, from the transaction data of the past two years, SSI Research observed that a part of house purchases was for speculative purposes rather than for owning. Most of these investors took loans from banks because of their attractive repayment schedules. Many incentives were offered including interest rate support, interest and principal exemption for the first 1-2 years, investment income guarantee for some products, loan rate of about 80-90%, and loan term of up to 35 years.

For loans with a debt-to-income (DTI) ratio of 70% at disbursement, when the grace period expires and the loan rate returns to normal, the ratio will increase to 81% and 96% if lending rates increase by 2% and 4% respectively. In that case, it is highly probable that the property owner will resell the property to repay the loan.

Therefore, SSI Research forecasted that the wave of real estate price decline would likely continue until the end of the year, with a drop of 10-20% or even higher. For speculative buyers who have not yet been able to resell real estate to pay off their loans, the delinquency rate for home loans might increase. The total outstanding balance of all home loans at banks analysed by SSI Research was about VND 1.3 quadrillion.

Great pressure on bad debt and provisioning

SSI Research assessed that banks would face asset quality problems in the future. Unless special regulations on debt classification/provisioning for loans/bonds maturing in 2023 were implemented, bad debt and provisioning would be relatively large pressures.

For bonds whose bondholders are not banks, the impact on the classification of bank loans depends on the terms and conditions (T&C) of each bond issue and the prudent level of each bank.

While there are variations in the T&Cs of bond issues, it is common practice to have a list of violations, whereby the bond is deemed mature and the collateral is sold to cover the issuer's obligations. Such violations include, but are not limited to, failure to replenish collateral within five days and overdue payment of lots of bonds/other loans by that issuer to other creditors (banks, enterprises, retail investors).

However, the determination of a bond as default is at the discretion of the bondholder. So far, SSI Research said that it had seen a few cases with small bond issuance balances where bondholders only needed to recover their capital and they did not declare the defaulting issuers. The recent cases of small-scale bond issuance have mostly been resolved in the direction of extending the payment date.

Most banks in Vietnam apply debt classification according to the quantitative method, meaning that a loan will be considered bad debt if it is overdue for more than 90 days. The exceptions are VCB, BID, CTG, ACB and MBB which apply both qualitative and quantitative methods to classify debts. When one bank changes the debt group of its customers, the other banks must also change because the CIC credit ratings for those customers will change.

Related News

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Seafood exports increase competitiveness through quality

10:24 | 09/12/2024 Import-Export

Customs sector aims for quality standards aligned with ISO 9001:2015

14:25 | 09/11/2024 Customs

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

Latest News

SBV makes significant net withdrawal to stabilise exchange rate

07:59 | 15/01/2025 Finance

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

More News

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Your care

SBV makes significant net withdrawal to stabilise exchange rate

07:59 | 15/01/2025 Finance

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance