Apply Electronic C/O form D in ATIGA

|

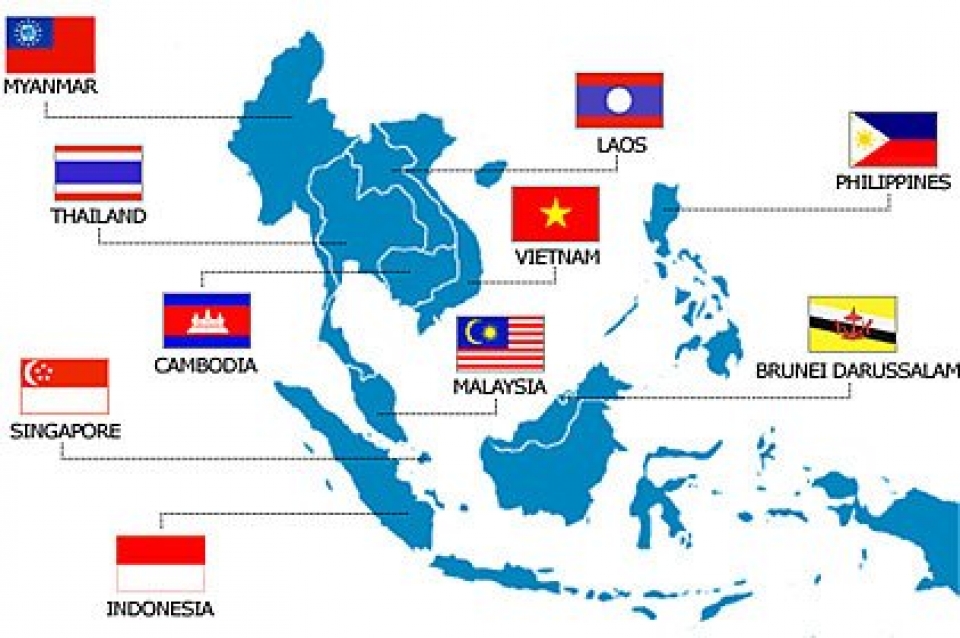

| ASEAN countries have agreed the contents to modify Rules of Origin forATGA. Picture: Internet. |

In January 2016, ASEAN countries agreed the contents to modify Rules of Origin of ATIGA and the ASEAN Secretariat submitted to the AFTA Council to approve, including 2 items: the list of information technology products under code HS 2012, and C/O procedure issuing and testing modified to apply electronic C/O form D.

At the end of February 2016 and in early March 2016, the AFTA Council ratifiedthe list of information technology products (ITA) under code HS 2012 and approved the modifying ofprocedures forissuingand testing to apply electronic C/O form D in ATIGA.

In order to legalizethese international agreements, the Ministry of Industry and Trade issued Circular 22, which modified and implementedthe following: Annex IV in the list of information technology products (ITA) under code HS 2012. Annex VII in C/O procedure issuing and testing (adding articles to apply elcectronic C/O form D).

Besides, the filling deadline (applied for written and electronic documents) is prescribedas5 years (instead of 3 years as in Circular 21/2010/TT-BTC). The other appendices basically remain unchanged and consolidated from Circular 21/2010/TT-BTC and Circular 42/2014/TT-BTC.

The Circular comes in to force on December 15, 2016.

Related News

Why seafood exports to some Middle Eastern Countries are stalled

14:47 | 20/11/2024 Import-Export

Binh Phuoc Customs answered questions about duties and C/O

10:03 | 04/07/2024 Customs

New points about rules of origin in AKFTA

08:05 | 03/04/2024 Regulations

Customs processes more than 14 million declarations in a year

10:20 | 18/03/2024 Customs

Latest News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

More News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations