Alcohol and beer are subject to special consumption tax

| Revising SCT on automobiles must ensure harmony of benefits | |

| Special consumption tax policy for electric cars | |

| Beverage enterprises need to renovate the process to adapt with rise of tax |

In response to the difficulties of some local customs units in determining special consumption tax on alcoholic beverages, the General Department of Customs has issued specific instructions.

Clause 1, article 2 of the 2008 Law on Special Consumption Tax stipulates that alcohol and beer are subject to special consumption tax; clause 4, article 1 of the law amending and supplementing a number of articles of the Law on Special Consumption Tax also stipulates that from January 1, 2018, alcohol under 20 degrees will have a tax rate of 35%.

|

| Nhon Trach Customs officers, Dong Nai Customs Department guide enterprises on procedures. Photo: N.H |

In addition, clause 1, article 2 of the Law on Prevention of Harmful Effects of Alcohol and Beer 2019 stipulates: Alcohol is a food-based alcoholic beverage, produced from the fermentation process from one or a mixture of raw materials mainly from starch of cereals, sugar solution of plants, flowers, tubers, fruits or beverages made from food-based alcohol.

Based on the opinions of specialized units and the direction of the Ministry of Finance, the General Department of Customs assigns units that have problems to check the records, information and actual imported goods based on current regulations to determine the nature of the goods and apply the special consumption tax policy.

In case there is sufficient basis to determine that the imported goods meet the concept of "alcohol" as prescribed in Clause 1, Article 2 of the Law on Prevention of Harmful Effects of Alcohol and Beer, this beverage product is subject to special consumption tax. At the same time, the application of special consumption tax rates is based on the alcohol content of the product.

In case of any problems, the General Department of Customs requests units to collect records and documents of specific cases and propose solutions to the General Department of Customs to report to the competent authority for settlement.

Related News

Tax increase for alcohol, beer, tobacco should go with combat against smuggling and tax evasion

09:35 | 11/09/2024 Regulations

Beverage enterprises need to renovate the process to adapt with rise of tax

13:15 | 16/08/2024 Regulations

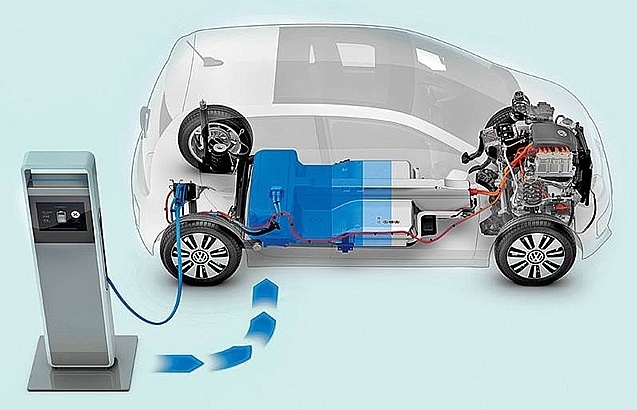

Special consumption tax policy for electric cars

14:15 | 14/08/2024 Regulations

Revising SCT on automobiles must ensure harmony of benefits

14:12 | 02/08/2024 Regulations

Latest News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

More News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Your care

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations