Special consumption tax policy for electric cars

|

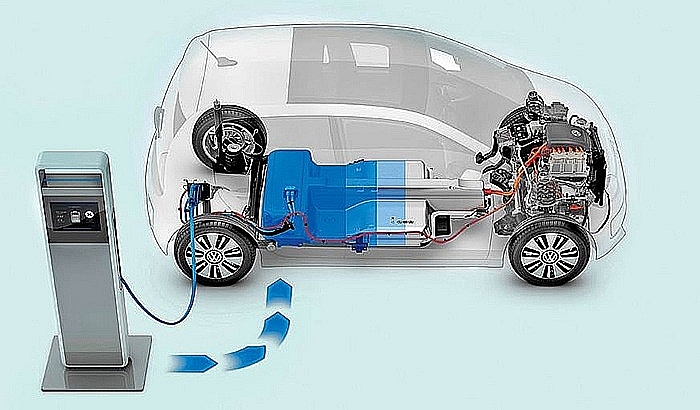

| Special consumption tax policy encourages consumers to use environmentally friendly vehicles. Photo: ST |

Apply preferential tax rates for electric vehicles, gasoline-electric vehicles with separate chargers

According to the current Law on Special Consumption Tax, cars operating on gasoline combined with electricity and bio-energy, in which the proportion of gasoline used does not exceed 70% of the energy used, are subject to a special consumption tax rate of 70% of the tax rate applied to the same type of vehicle using an internal combustion engine. According to the Ministry of Finance, the above regulation aims to encourage consumers to use environmentally friendly vehicles with two engines (gasoline engine and electric engine). Under normal conditions, the vehicle mainly runs on an electric motor, the gasoline engine is a backup (when the battery used to operate the electric motor runs out of power), and the amount of emissions into the environment is much lower than that of other conventional vehicles.

Ms. Nguyen Thi Cuc, President of the Vietnam Tax Consulting Association, said that the special consumption tax policy for automobiles needs to ensure harmony between factors such as budget revenue, environment, stable production and business of enterprises, jobs for workers, consumption orientation, etc. In addition to tax policies, there should be a synchronous policy to encourage consumers to switch to electric vehicles, which are environmentally friendly.

However, to avoid confusion with hybrid vehicles (vehicles with 2 engines and under normal conditions mainly run on gasoline engines), the Ministry of Finance believes that it is necessary to supplement regulations clearly stating that environmentally friendly vehicles subject to preferential special consumption tax rates are vehicles charged with a separate electric charging system. In addition, for environmentally friendly vehicles, in addition to gasoline vehicles combined with electric energy, bio-energy, electric vehicles, there are also vehicles using natural gas that also need tax incentives to encourage production, assembly and consumption. This is to encourage the production and use of environmentally friendly vehicles; ensure the clarity, ease of understanding and implementation of the policy.

Assessing the impact, the Ministry of Finance said that these solutions are consistent with the 2013 Constitution (Clause 4, Article 70) stipulating the duties and powers of the National Assembly in regulating, amending or abolishing taxes; ensuring legality and consistency with the legal system; not violate international commitments, ensuring compatibility with relevant international treaties to which Vietnam is a member.

Regarding this issue, the Vietnam Automobile Manufacturers Association (VAMA) has recently proposed a tax incentive policy for both types of vehicles, including self-charging hybrid electric vehicles and separately charged electric vehicles. Accordingly, VAMA proposed that self-charging hybrid electric vehicles have a tax rate equal to 70% of the tax rate applied to gasoline and diesel vehicles of the same type (currently 100%). Separately charged hybrid electric vehicles are proposed to have a tax rate equal to 50% of the tax rate applied to gasoline and diesel vehicles of the same type (currently 70%). According to VAMA's calculations, if the incentives proposed by VAMA are applied, the state budget revenue during this period will be nearly VND 758,387 trillion, a decrease of nearly VND 23,55 trillion compared to the current plan.

Explaining VAMA's proposal, a representative of the international auditing firm KPMG said that the proposed incentives may reduce budget revenue, but bring environmental benefits by reducing CO2 emissions. In the context of the current difficulties of the automobile industry, the incentive policy creates opportunities to develop the value chain of the automobile industry, increasing the competitiveness of domestic enterprises with foreign low-cost car manufacturers.

Need to ensure achieving multi-dimensional goals

According to experts, in efforts to respond to climate change, towards the goal of zero net emissions by 2050, the synchronous and comprehensive implementation of tax and fee policies for the automobile industry, environmental protection, reduction of greenhouse gas emissions and reduction of fuel consumption to implement green transformation needs to ensure even development, maintain enterprise resources and the country's revenue.

At the Workshop on the draft Special Consumption Tax on Automobiles recently held, Ms. Pham Thuy Hanh, Deputy Director of the Legal Department, Government Office, said that in terms of progress, the Special Consumption Tax Law project will be included in the Government meeting in August 2024 and will be submitted to the National Assembly in early September; in terms of content, during the process of drafting this law, from the time of proposing the law, there have been many different opinions.

According to Ms. Hanh, tax policy must be a synthesis of benefits, from the benefits of the state, the community, the people to consumers and businesses, each subject has different impacts and the Ministry of Finance has carefully considered these impacts when submitting them to the Ministry of Justice for appraisal. The drafting agency must also consider the long-term and short-term impacts of the policy, therefore, agencies and subjects also need to share the multi-dimensional impacts of the policies in the coming time. “In my opinion, in addition to long-term policies, such as policies related to urban development and environmental protection, we should also consider studying other policies that are consistent with the special consumption tax policy to have impacts on business development and support consumers. Tax policies and other policies need to be consistent and have a roadmap so that businesses can anticipate and calculate long-term plans,” Ms. Hanh suggested.

Associate Professor, Dr. Nguyen Quoc Viet, Deputy Director of the Vietnam Institute for Economic and Policy Research (VEPR), said that the amendment of tax laws, including the Special Consumption Tax Law, has ensured publicity, transparency, and clarity in the amendment roadmap. We need a separate approach to the Special Consumption Tax Law as well as other tax laws, which is to assess multi-dimensional impacts, integrating many issues, not just one-dimensional. For the automobile sector, in order to meet environmental and emission requirements in the coming time when we limit vehicles using fossil fuels. Therefore, there needs to be a comprehensive solution of incentives in the direction of priority, incentives and restrictive solutions that go together, in accordance with practical conditions.

Emphasizing that taxation is inevitable but the more scientific the better, Associate Professor Dr. Nguyen Thuong Lang, lecturer at the National Economics University, said that, technically, there should be a clear and accurate classification of automobile types in advance, then propose a tax policy on a scientific basis in a reliable manner.

Related News

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

Director General Nguyen Van Tho: streamlining apparatus to meet the requirements of customs modernization

15:53 | 02/01/2025 Customs

Latest News

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

More News

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Consulting on customs control for e-commerce imports and exports

14:50 | 14/02/2025 Regulations

Flexible tax policy to propel Việt Nam’s economic growth in 2025

14:14 | 06/02/2025 Regulations

Brandnew e-commerce law to address policy gaps

18:44 | 29/01/2025 Regulations

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations