Worries about credit standards with increase of bad debts

|

| Banks want to expand credit but it must go hand in hand with quality. Photo: collected |

No credit quality decrease

Overall credit risk identified by credit institutions shows signs of increasing in 2020 and will only decrease slightly in 2021. Therefore, in the first six months of the year and the whole of 2021, credit institutions expect to slightly loosen credit standards for groups of customers, based on positive macroeconomic prospects, in accordance with policies and orientations of the Government, the State Bank of Vietnam (SBV) to support economic growth.

However, credit ratings of customers and other terms and conditions are still subject to additional attention by credit institutions in contracts in order to limit credit risks.

In fact, in 2020, banks sharply reduced lending rates, helping to create cheap capital sources for enterprises to borrow. However, many enterprises still complain because it is difficult to access capital.

The finance - banking specialist, PhD. Nguyen Tri Hieu said that banks were worried about increasing bad debts, so it was reasonable to be cautious in granting credit.

Therefore, the "open valve" for credit growth was not interest rates, but how can banks dare to lend more.

On the side of the banks, a representative of a commercial bank said that the bank was still looking for many solutions to support customers, but credit granting should be implemented cautiously because the bank's point of view was to reduce interest rates, but credit quality cannot be reduced.

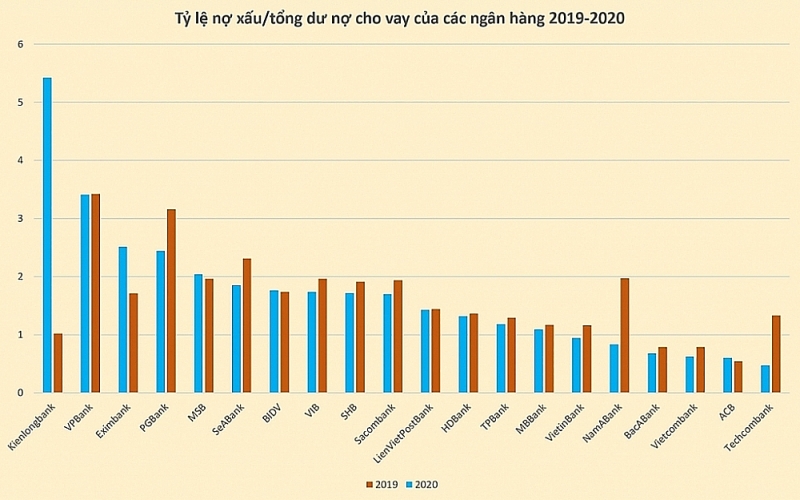

The financial statements of the fourth quarter and the whole of 2020 of banks show that concerns of increasing bad debts in the banking sector is completely grounded.

According to a survey from the fourth quarterly financial statements of about 20 banks, by the end of 2020, the total internal bad debt of 20 banks was at VND83.4 trillion, up slightly by 4.5%compared with the beginning of the year.

In which, total debt of group 5 (debts with potential loss of capital) increased about 11.7% compared to the beginning of 2020, to over VND52.3 trillion, accounting for 63% of total bad debt.

Some banks have a very high increase in bad debt. For example, KienLongBank with an increase of more than 5 times, mainly increased in debt group 5.

Kienlongbank's leaders said that the majority of these potentially losing debts are related to loans of a group of customers whose collateral are STB shares of Sacombank.

|

| Non-performing loans to total outstanding loans of banks in 2019 and 2020. Sketched by: H. Diu |

There must be a choice

At a recent meeting with the State Bank of Vietnam on the enterprise support plan, Prime Minister Nguyen Xuan Phuc said that although the State Bank and credit institutions had made great efforts in reducing lending interest rates, they had not met the expectations of enterprises and people.

Therefore, the Prime Minister said that the banking sector should not focus on profit, they should continue to share with investors, enterprises and people to support production development. The SBV's leaders also said that they would direct credit institutions to reduce costs and profit targets in order to reduce lending interest rates and expand credit in a safe and efficient manner.

Therefore, in order to offer suitable credit solutions, banks cannot choose rashly to receive risks but must have choices in potential sectors and fields such as consumer goods and retail; agricultural products, aquatic products, depending on the risk appetite of each bank.

The leader of a commercial bank said that, in the last two months, the bank focused on financing credit for export enterprises when the motivation of this bloc was increasing when the Free Trade Agreement of Vietnam and the European Union (EVFTA) came into effect and the Regional Comprehensive Economic Partnership (RCEP) had just been signed.

Meanwhile, a representative of LienViet Commercial Joint Stock Bank (LienVietPostBank) said that in 2021, LienVietPostBank would continue to be consistent with its retail strategy and focus on lending products that were the strength of the bank such as rural agriculture, clean agriculture, high-tech agriculture. Because this was an area less affected by the Covid-19 pandemic, the efficiency of lending was still quite high.

However, entering 2021, with the trend of bad debt expected to increase, the pandemic is still complicated, banks still face many challenges.

According to data from the State Bank, by the end of 2020, credit institutions have restructured the repayment term for about 270,000 customers affected by Covid-19 with a loan balance of nearly VND355 trillion.

This figure is equivalent to 4% of the total customer loans of the whole industry that has been restructured and not converted to the bad debt group. Therefore, experts also worry about this potential bad debt block. But the good news is that there are about 20 "debt free" banks at the Asset Management Company of credit institutions (VAMC), helping to increase the financial capacity for the banks' defense.

But enterprises hope that if banks want to keep lending standards to ensure quality, the regulator should provide more capital options for enterprises. For example, from the third quarter of 2021, small and medium-sized enterprises can also seek capital from the Small and Medium Enterprise Development Fund of the Ministry of Planning and Investment, with the interest rate for short-term loans of 2.16% per year and for the medium and long term is 4% per year, the loan terms will be "more open" for enterprises. This fund's effective implementation will help enterprises that cannot afford loans, are still in difficulties or disadvantaged, have more cash flow for investment and production.

Related News

Four challenges that put pressure on monetary policy management

13:48 | 28/11/2024 Finance

Enterprises develop sustainably thanks to effective trade defense

13:43 | 23/10/2024 Import-Export

Businesses flexibly navigate exchange rate fluctuations

11:00 | 09/06/2024 Import-Export

Responding to the market, export enterprises are willing to spend more on "green practices"

17:52 | 11/05/2024 Import-Export

Latest News

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

More News

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Your care

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance