Without a uniform legal framework, money launderers wolfed down cryptocurrency

|

| Money laundering through virtual assets is increasingly sophisticated and complex. Photo: Internet |

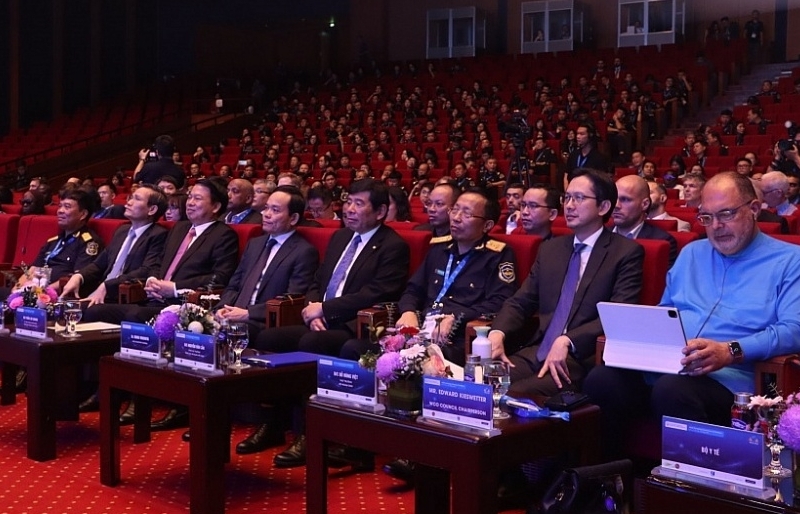

Speaking at the conference "Regulations on preventing and combating money laundering and the role of preventing and combating money laundering in cryptocurrency transactions" held on September 20, 2023, Mr. Nguyen Doan Hung, Vice Chairman of the Association Vietnam Blockchain Association, former Vice Chairman of the State Securities Commission, said that blockchain technology has opened a new era of technology and has a profound impact on many areas of the economy, from finance and banking to e-commerce, healthcare, insurance, logistics and many other service industries... thanks to important features such as security and privacy.

Grand View Research's report said that, in spite of spring market, the global blockchain technology market is estimated to reach a value of more than 1,400 billion USD by 2030 with a compound annual growth rate (CAGR) of nearly 86%/year in the period 2022-2030.

| According to the International Monetary Fund (IMF), the scale of global money laundering activities can reach 1,600-4,000 billion USD/year, equivalent to 2-5% of the total world GDP. Meanwhile, according to figures from the Bank for International Settlements (BIS), the scale of these illegal activities could be even higher, from 2,000-5,000 billion USD/year. Regarding the cryptocurrency and digital asset market, according to CoinmarketCap, the total cryptocurrency market capitalization peaked at more than 3,000 billion USD in November 2021, the peak 24-hour trading volume was 169.4 billion USD in November 9, 2021. Currently, this total market capitalization fluctuates around the 1,000 billion USD mark and the 24-hour trading volume is about 31 billion USD. Meanwhile, data from Chainalysis - the world's leading blockchain data analysis company revealed that illegal addresses laundered nearly 23.8 billion USD worth of cryptocurrency in 2022, an increase of 68% compared to 2021. |

However, according to Dr. Nguyen Quoc Hung, Vice President and General Secretary of the Vietnam Banking Association, Money laundering techniques have become more sophisticated over the years alongside technological innovation, especially in the field of digital currency and virtual currency (cryptocurrency) due to lack of fully legal corridor.

A representative of the Vietnam Blockchain Association said that Vietnam has no specific law governing cryptocurrency trade while the actual transaction volume ranks 15th in the world.

Specifically, according to data from Chainalysis recently shared by the US Department of Justice during a training program at the Supreme People's Court of Vietnam at the end of August 2023, the total value of Vietnamese cryptocurrencies received in the period from October 2021 to October 2022 was 90.8 billion USD. Of which, illegal activities were 956 million USD.

In terms of internet access address, the most used platform for cryptocurrency trading by users in Vietnam is the Binance.com exchange with nearly 42 million visits from October 1, 2021 - 1 October 2022, followed by Exness.com with 21.89 million visits during the same period.

The Law on Prevention and Combat of Money Laundering was passed by the National Assembly and takes effect from March 2023, immediately after that the Government issued Decree 19/2023/ND-CP regulating details a number of articles of the Law on Prevention and Combat of Money Laundering. The State Bank (SBV) has issued Circular No. 09/2023/TT-NHNN guiding the implementation of a number of articles of the Law on Prevention and Combat of Money Laundering.

However, according to Mr. Nguyen Doan Hung, due to the lack of a specific legal framework and the lack of processes and senior personnel in cryptocurrency and digital assets, despite current regulations on prevention and anti-money laundering as above, credit institutions and state agencies are still confused in handling acts related to this new type of asset.

According to experts, cryptocurrency is "attractive" to money launderers thanks to its anonymous nature, instant cross-border transactions and lack of uniform regulations. In particular, the lack of uniformity makes it difficult to identify and handle cross-border money laundering. For example, money laundering criminals transferring cryptocurrency from the European Union (EU) are easily condemned as stipulations; however, in Vietnamese market, it will be difficult to verify the violation because Vietnam has not yet recognized cryptocurrency.

Therefore, financial institutions are recommended to commit to promoting governance principles such as compliance with international practices from the highest standards of Basel as well as the provisions of the Law on Prevention and Control of Money Laundering, anti-money laundering AML/CFT by the Financial Action Task Force (FATF) as well as international organizations. At the same time, relevant agencies must aim at high-quality human resources who expertise on economics, technology and law. Credit institutions need to identify and learn how to classify digital assets according to IFRS international accounting rules and standards.

Related News

2023 WCO Technology and Exhibition officially opened

13:03 | 10/10/2023 Customs

Blockchain facilitates international trade

15:39 | 09/04/2023 Headlines

It is necessary to improve the legal framework for cryptocurrency market

10:58 | 25/02/2023 Finance

Blockchain industry faces talent shortage

18:55 | 16/07/2022 Import-Export

Latest News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Your care

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance