Two scenarios for risk management in May

|

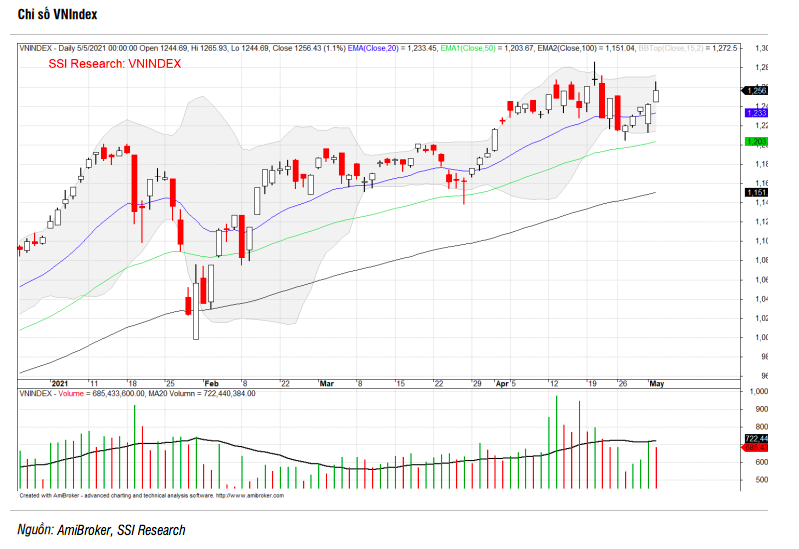

| Movement of VN-Index. |

The fourth wave of Covid-19 pandemic is emerging in some localities and Vietnam's resilience is once again tested. For the risk of inflation, the price index of raw materials, fuels and materials used for production jumped by 4.64% in the first four months of the year, of which the price index of raw material, fuel and materials used for agricultural production, forestry and fishery increased by 6.77%; used for industrial production increased 4.95%; for construction by 1.95% and by the time of quarter two of 2021, gasoline and oil price are expected to increase by more than 50% compared to the same period in 2020.

Experts of SSI Securities Company believed that the CPI will return to positive growth in May. However, it is forecasted that the increase rate is not high because the proportion of oil prices in the current CPI basket is 3.6-4.1%. At the same time, it is tough for enterprises to increase output prices relative to input prices, not to mention the impact of the Government’s policies on price stabilisation.

On the other hand, the last 2021 shareholder meeting season showed the trend of increasing capital of listed firms and this was also demonstrated clearly in the two largest capitalised groups that were banking and real estate sector. According to SSI's statistics, 14 of 15 listed banks planned to raise capital by 2021. In particular, seven banks planned to raise capital by issuing new shares. The plan to raise capital was also clear in the real estate group through issuing shares and bonds and in securities companies. These could be moves to support the market from now to the end of the year.

Facing risks in May, SSI experts realised the need for risk management with two recommended scenarios for investing in short-term transactions.

In scenario 1 which is highly appreciated - the VN-Index will keep its upturn momentum, investors should gradually increase their stock proportion as the VN-Index surpasses the current important resistance level of 1,260 -1,262 points, along with an increase in liquidity. The proportion of shares is raised further when the index surpasses the old peak of 1,286 points. At this point, the VN-Index is more likely to head to the next target price range at 1,350-1,400 points.

Meanwhile, in the second scenario, the VN-Index reverses again due to potential risk factors, it proposed that investors must wait for market's reaction at support areas. The close support zone is 1,220 points and the strong support zone 1,200 points. Disbursement may be considered at these support levels, especially when the index recovers with high liquidity.

Related News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Diversify and innovate securities products to attract foreign investors

15:30 | 20/10/2024 Finance

Latest News

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

More News

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Your care

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance