Top 500 fastest growing enterprises 2024: Determination to recover after experienced "headwinds"

Strong resilience of the private enterprise sector

According to a survey report by Vietnam Report, the Purchasing Managers' Index (PMI) of the Vietnamese manufacturing industry announced by S&P Global in 10 out of 12 months of 2023 (except February and August) was continuously below the threshold of 50 points. In addition, 51.7 percent and 46.7 percent of the interviewed companies said they failed to achieve last year’s revenue and profit targets, respectively. Both the rates of companies reaching and surpassing the two targets were lower than in 2021-2022 period. Notably, the rates of those with declined revenue and profits increased almost twice and 1.5-fold compared to the same period of 2021-2022.

Statistics showed its total trade turnover in the year was estimated at US$683 billion, a year-on-year decrease of 6.6 percent. Specifically, exports dropped by 4.4 percent, and imports down 8.9 percent.

This shows the gloomy picture of businesses under the "headwinds" in 2023 such as: the weakening of domestic and world demand, a decline in orders, no market for products, outstanding debt, lack of capital... The growth rate of Vietnam's average export and import turnover experienced negative growth for the first time since 2009.

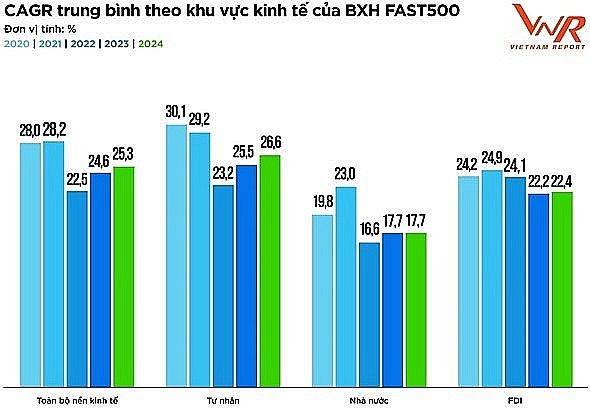

|

| Statistics on the Ranking of Top 500 Fastest Growing Enterprises in Vietnam (FAST500) from 2020 to present. Source: Vietnam Report |

In that context, the private business sector is still strong, leading in Compound Annual Growth Rate (CAGR) of 1.1 percent compared to the previous period, while this growth rate in the state-owned enterprise and FDI sectors has not seen much improvement.

In the period 2019-2022, the average CAGR of the Top 500 Fastest Growing Enterprises in Vietnam reached 25.3 percent, of which, the private sector reached 26.6 percent, the foreign invested sector reached 22.4 percent and the State sector reached 17.7 percent.

In particular, although the list of Top 10 fastest growing enterprises in Vietnam in 2024 has many fluctuations compared to 2023, there is one thing in common. The common point is the presence of private sector enterprises such as: Binh Thuan Plastic Group JSC; HD Securities JSC; Tien Phong Securities JSC; Imedia Technology and Services JSC; SOL E&C Construction Investment JSC; Vitadairy Vietnam Dairy Products JSC; Taseco Real Estate Investment JSC; Stellapharm Joint Venture Company Limited; CNC Technology Solutions JSC; Bee Logistics JSC (Bee Logistics).

Determined to overcome obstacles

Though grey still dominated the panorama, it was encouraging that business optimism has improved in part. In the survey, conducted in January - February, businesses rated the economic prospect 3.5 out of 5, higher than last year.

Enterprise optimism can create a positive cycle, it also reflects their readiness to face challenges and seek opportunities in all circumstances, along with their confidence and adaptability in a challenging business environment.

Furthermore, signs of recovery, although slow and uneven, have been gradually appearing in many fields and industries. GDP growth rate tends to increase gradually over the quarters while exports decreased by 4.6 percent compare the last year, but in the last quarter of 2023 alone, this sector has recovered nearly 8.8 percent compared to the same period last year.

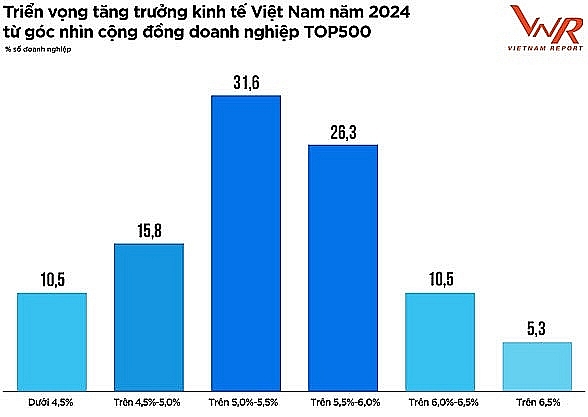

|

| Results of a business community survey conducted in January 2024. Source: Vietnam Report |

According to survey, the growth scenario of 5-5.5 percent is the scenario chosen by the largest number of businesses with a voting rate of 31.6 percent. This scenario is lower than the average GDP growth rate in the pre-Covid period, but significantly higher than the global growth rate in 2024 as the forecasts of 3.1 percent of the International Monetary Fund (IMF – January 2024) and the number of 2.4 percent of the World Bank (WB – January 2024).

According to experts, 2024 will be a "stepping stone" for the following years with major changes both on a Vietnamese and world scale, with factors reshaping the business environment. 2024 is the year that more than 50 countries will hold elections, the largest in history, and accounting for more than 60 percent of global GDP. 2024 is also a breakthrough year to complete the Government's 5-year Plan 2021-2025. This is also a pivotal year before laws related to key economic sectors take effect in 2025 such as: Land Law, Credit Institutions Law, Housing Law, Real Estate Business Law...

Therefore, for businesses to overcome obstacles, according to experts, they still need to rely on the "four-in-hand carriage" including: promoting innovation, perfecting the legal corridor, and ensuring institutional uniformity and legal environment for economic development; stimulating consumption demand in the domestic market; increasing public investment - quickly and effectively implementing public investment capital, creating spillovers to non-state investment; promoting export of goods and services.

In particular, the most important thing is the initiative and flexibility of businesses to enhance competitiveness and resilience. Besides, it is necessary to have the Government's companionship because a stable macroeconomy, reduction in lending interest rates and policies to overcome difficulties and free up resources will be an important foundation for businesses to invest and do business, rebuild a new growth trajectory.

Related News

Continue to publicly disburse public investment capital, many key projects have low rates

09:01 | 07/09/2024 Finance

Slow disbursement of public investment capital due to obstacles from policies

14:57 | 28/08/2024 Finance

More than VND241 trillion of public investment capital has been paid through the State Treasury

10:10 | 26/08/2024 Finance

Numerous factors behind the non-allocation of over VND 17.6 trillion in public investment capital

21:59 | 09/06/2024 Headlines

Latest News

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

More News

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export

Rice export prices drop, but decline expected to be short-term

08:10 | 17/02/2025 Import-Export

Key agro products expected to maintain export growth this year

08:08 | 17/02/2025 Import-Export

EU issues 12 warnings against Việt Nam’s food and agricultural exports

08:07 | 17/02/2025 Import-Export

Việt Nam to impose VAT on low-value express-imported goods

08:06 | 17/02/2025 Import-Export

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Vietnam kicked off the year with a strong start in trade, exceeding US$63 billion in the first month

16:30 | 15/02/2025 Import-Export

Import and export turnover reaches about US$29 billion in the second half of January 2025

14:52 | 14/02/2025 Import-Export

Market edges up slightly as liquidity remains low

14:48 | 14/02/2025 Import-Export

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export