There are some risks in the banking sector

|

| Prof. Dr. Pham Hong Chuong |

The banking system still plays an important role in the capital supply of the economy. But in your opinion, what are the risks of instability in the current context?

First of all, it must also be recognized that the banking sector has had good results such as maintaining stable development, total assets doubled after five years. In addition, most banks have applied the capital adequacy ratio according to Basel II standards and have achieved the minimum standard capital adequacy (CAR); banks have also increased their risk provisioning and bad debt coverage ratio; abundant liquidity, high income and profit help improve the bank's cost-income ratio (CIR) efficiency.

However, according to the "Annual Economic Review of Vietnam - Macroeconomic stability and financial soundness in the context of the Covid-19 pandemic" of the National Economics University, there are some risks and instability in the banking sector.

Firstly, the level of capital adequacy is threatened by the deterioration of asset quality and the portfolio of potentially risky assets from 2020. Second, bad debts tend to increase, especially during the Covid-19 period. On-balance sheet bad debt in 2021 is at 1.9%, up 0.21% compared to 2020. On-balance sheet bad debt and unresolved debt sold to Vietnam Asset Management Company (VAMC) is 3.79%, if including contingent debt structured according to Circulars 01, 03 and 14, it is about 8.2%.

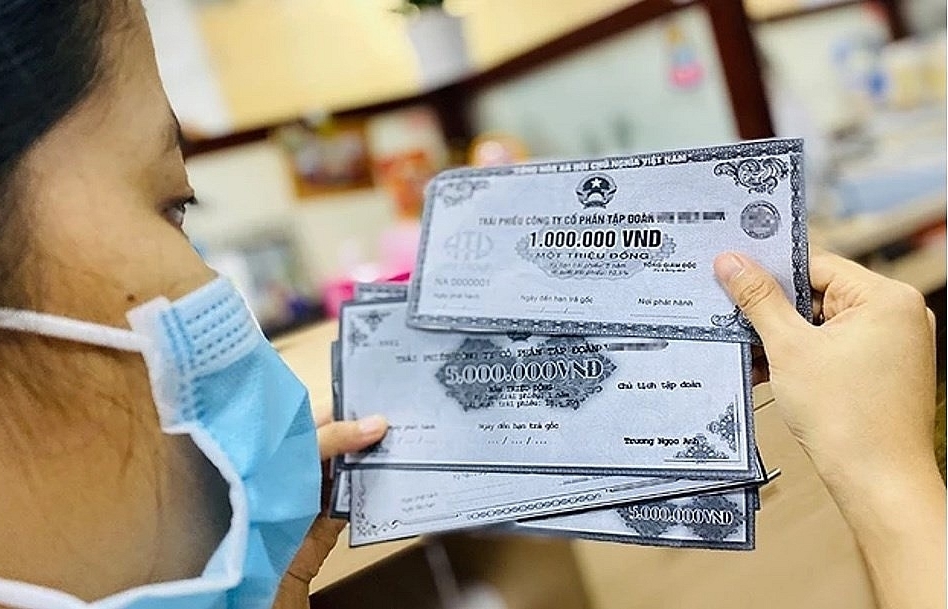

Third, credit capital flows have not yet entered the manufacturing sector and poured into the asset market, retail credit and investment in corporate bonds increased rapidly; retail credit accounts for 42% of total outstanding loans, with a focus on home loans and auto loans. The warming of asset markets such as real estate and securities is part of the reason behind the increase in retail credit.

In particular, commercial banks have participated in the corporate bond market quite large, with direct holdings of 27.3% of total bonds and buying through member securities companies. These bonds have high risk because they are mainly of real estate businesses, with collateral assets mainly being investment projects, assets to be formed in the future or stocks and shares of the issuing company itself. The proportion of enterprises issuing unsecured bonds is relatively high, including many unlisted enterprises.

Fourthly, the receivables and accrued interest of banks are high, making bank profits high but not substantial.

Could you tell us what caused these problems?

The problem of increasing bad debt, the current policy of restructuring and delaying the due debt is a temporary solution, necessary in the short term, with the main goal of supporting businesses and people facing difficulties during the pandemic.

However, the extension of time to restructure the repayment term has turned short-term loans into medium and long-term ones, as well as temporarily not recognizing the actual risk level of customers, which will pose potential risks to the banking system in the medium term such as increasing term risk and liquidity risk.

In addition, many other reasons can be mentioned such as the legal framework still has some shortcomings, especially the regulations on handling bad debts and handling collaterals of bad debts, the regulations on network safety and security.

Along with that, there are still situations where some banks have not yet been able to apply Basel II standards, and risk management is not professional; digital transformation strategy has not been strongly implemented, and there is still an "inactive" factor in some state-owned banks and small-scale joint-stock banks.

What is your recommendation to make the banking system healthier in the current context?

The quality of economic growth in 2022 is forecast to be at a higher level but also faces many great challenges.

Not only that, the ratio of money supply M2/GDP and credit/GDP of Vietnam is very high compared to other countries in the region, while economic growth is far below the potential output level, increasing inflation risk. Therefore, it is necessary to develop the banking market in the direction of improving competitiveness, increasing transparency and complying with international standards and practices in the governance and operation of credit institutions such as Basel III and IFRS 9.

The State Bank of Vietnam (SBV) needs to continue to require the banking system to reduce interest rates for deep and mass lending by implementing selective preferential credit policies with two differences: the participation of the state budget and focusing on economic sectors with high pervasiveness.

The SBV also needs to ensure the safety of banking operations, strengthen the handling of bad debts, continue to correct and restructure weak banks to make them healthier and improve their financial capacity in terms of both size and quality, ensuring system safety.

In addition, regulatory agencies need to strengthen stability and continue to create conditions to support capital development, in which it is necessary to ensure that the stock market is an important medium and long-term capital supply channel for the economy, reducing the burden on the banking sector; develop the corporate bond market in the direction of transparency associated with credit ratings.

Related News

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Bad debt at banks continues to rise in both amount and ratio

09:20 | 25/11/2024 Finance

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance