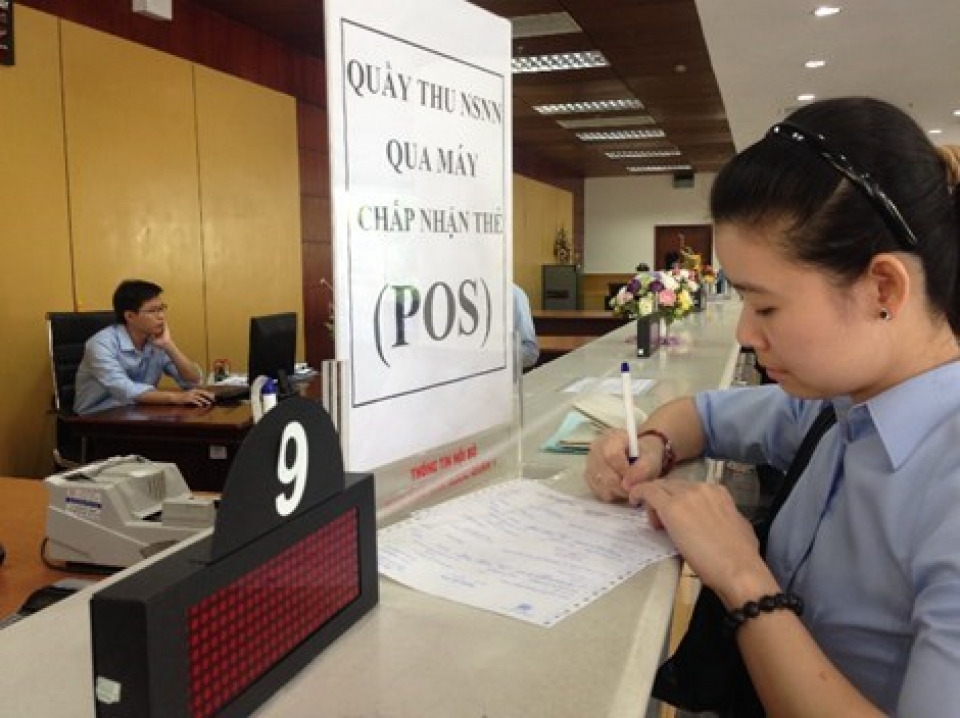

The State Treasury accepts payment for State budget through Vietinbank POS machines

| 2017-2020: Striving for electronic State Treasury | |

| Cash withdrawal of more than 100 million vnd must register with the State Treasury | |

| The State Treasury conducts re-trading of government bonds |

|

| Customers who conduct payment for the State budget at the State Treasury may use bank cards issued by Vietinbank or other local credit institutions instead of cash. |

According to the State Treasury, with the goal of expanding and enhancing electronic payment through the system of commercial banks to create favourable conditions for the people, the State Treasury together with commercial banks, including Vietinbank as the leading unit in the successful research, development and implementation of the project "Upgrading and implementing the Information System for State Budget Revenues and Bilateral Payment through Commercial Banks".

This was also the aim for quick revenues and performance of timely and accurate safeguarding state budget expenditures, thereby limiting cash flow in the economy.

Till now, the coordination for the State budget revenues between the State Treasury and Vietinbank has been implemented stably and efficiently, bringing many practical benefits. State budget revenues have been quickly and fully concentrated and State budget expenditures have been paid in a timely, accurate and secure manner, contributing to ensuring full and timely benefits and fulfilling responsibilities for the State budget of organizations and individuals.

Currently, the State Treasury system is cooperating with Vietinbank to install POS card payment equipment at the offices of the State Treasury.

Therefore, from 26th April 2017, customers who conduct payment for the State budget at the State Treasury may use bank cards issued by Vietinbank or other local credit institutions instead of cash. Specifically, customers only need to provide a list of tax payment (or administrative fines for violations) and give a bank card to the State Treasury's accounting officer, enter the PIN code POS, print and sign on the receipt. After that, information for payment to the State budget will be transmitted directly to the collecting agency in a timely fashion for recognition of the fulfillment of the customer's tax obligations to implement Customs clearance of goods, saving time and costs for taxpayers.

According to the State Treasury, with the implementation of State budget revenues through POS machines, payers can use bank cards instead of cash to pay to the State budget through the POS system of Vietinbank located in State Treasury offices. As a result, customers can reduce the difficulties of using cash such as trading a large amount of money, counterfeit money, unqualified cash, ensuring safety and security without paying any fees.

In order to replicate State budget collection and payment through POS nationwide, the State treasury system has also cooperated with relevant units to carry out many activities such as business development, software upgrading, standardization of infrastructure and training to prepare the best conditions for connection infrastructure in payment through POS as well as timely handling problems, ensuring smooth, safe and effective operations. Also, actively guiding State budget payers to pay through POS machines located at the offices or points at State Treasury units.

In the context of Vietnam's economic integration into the world economy, the Finance sector in general and the State Treasury system in particular always strive to innovate, carry out administrative procedure reform as well as apply information technology effectively in the application programs to create more favourable conditions for taxpayers.

| The State Treasury: Disbursement of capital construction investment reaches a high rate VCN- According to the report on the disbursement implementation of capital construction investment in December 13th, 2016, ... |

The State Treasury has also cooperated with commercial banks to operate effectively in the expansion of technologies to raise the e-revenue collection mode to meet the requirements of the socio-economic development trend, thereby creating the most favourable conditions for taxpayers.

Related News

Vietnam, Korea Customs sign AEO MRA

11:07 | 26/12/2024 Customs

Achievements in revenue collection are a premise for breakthroughs in 2025

09:57 | 18/12/2024 Customs

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Prioritizing semiconductor workforce training

09:16 | 15/12/2024 Headlines

Latest News

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

More News

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

Your care

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance