The safe prevention of the exchange rate from the economy

| The M&A market has cooled down during the Covid period | |

| Global Business Outlook believes local economy could surpass Singapore | |

| Innovation should be stepped up to achieve high economic growth: experts |

|

| The plentiful supply of foreign currency helps the exchange rate to remain stable. |

Stable psychology, firm belief

As of November 11, the USD Index (DXY) – an index that measures the value of the dollar with six major currencies in the world (Euro, Japanese Yen, British Pound, Canadian Dollar, Swiss Krona Sweden and Swiss Franc) – was at about 92.6 points, down more than 4% compared to the index in early 2020. This index is also at the lowest level in the past two years.

In Vietnam, the State Bank of Vietnam (SBV) assessed that the exchange rate is actively and flexibly controlled, combined with reasonable liquidity solutions, proactive communication and reductions of the selling intervention rateand willingness to sell foreign currencies, intervene to stabilize the market and contribute to macroeconomic stability.The exchange rate and the foreign exchange market were basically stable, market sentiment wasnot disturbed, especially the balance of supply and demand wasstill quite favorable, and the liquidity is smooth, contributing to improving the position of the VND, reducingspeculation to hold foreign currencies.

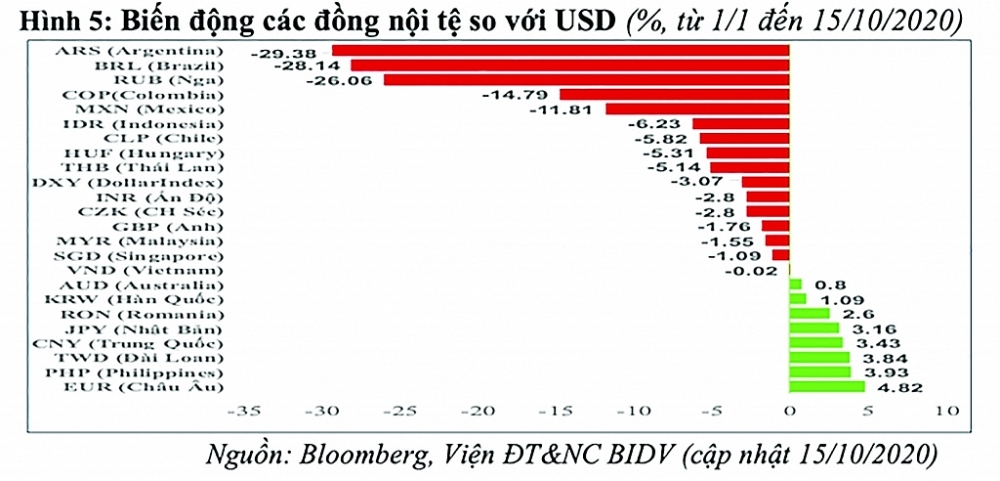

Therefore, up to the beginning of November, the VND only slightly decreased by 0.02% against the USD while many regional and world currencies declined sharply.The VND/USD exchange rate continued to fluctuate in a narrow band with quite a stable value thanks to the "good health" of the economy.

As at Vietcombank, over the past three months, the buying - selling price of the USD has been "locked" at 23,060 - 23,270 VND / USD (buy - sell).

This advantage comes from many factors, such as foreign exchange reserves, import-export balance and FDI disbursement.According to SBV's estimates, foreign exchange reserves have reached about US$92 billion and may reach US$100 billion by the end of 2020. This is a record number of foreign reserves, equivalent to about four months of imports.In particular, although the Covid-19 pandemicheavily affectedinternational trade, in the first 10 months of 2020, the country's merchandise trade balance was estimated to have a record trade surplus of US$18.72 billion.The disbursement of FDI capital, though decreasing year-on-year, has reached nearly US$16 billion.

In particular, the more confidence of people and investorshave the more stable the foreign currency market is.This is due to the operating mechanism of the State Bank of Vietnam. In a recent meeting with representatives of the US Treasury Department, Deputy Governor of the State Bank Nguyen Thi Hong said that the State Bank operates the exchange rate policy – within the framework of the general monetary policy – to control inflation and macroeconomic stability, not to create a competitive advantage in international trade, support policies for each manufacturing industry or cause damage tocommercial partners.

Figure 5: fluctuations in domestic currencies compared to USD (%, 1/1 to 15/10/2020)

|

| Volatility of some currencies against the USD. |

Pay attention to pressure on VND

Domestic and international experts said that the post-election fluctuations of the US, the decisions of quantitative easing and maintaining low interest rates of the US Federal Reserve (FED), the possibility of the USD will still weaken, at least until the middle or end of 2021. According to a report by the BIDV Research and Training Institute, the role of the dollar is not yet irreplaceable and the risk of devaluation of the pegged currencies,the value of USD is still standing by the pressure of current balance deficit, debt risks and the decline in important supply sources such as remittances, investment, tourism, international funding.

The benefits of a devaluation with exports seem unlikely to come true due to the heavy influence of Covid-19, although global trade is showing signs of recovery.

Therefore, despite achieving many positive results in the first 10 months of 2020, according to financial and banking expert PhD.Can Van Luc, taking into account the risk of a decline in some foreign currency supply (remittances, foreign direct and indirect investment, export, tourism) due to the impact of the Covid-19 pandemic,the pressure to devalue VND will still be a problem, but not as worrying as many emerging markets.

It is forecasted that the depreciation of VND against USD will not exceed 1% in 2020 and about 1-2% in 2021 and the risk will not be as great as in 2008 and 2011 when there was a devaluation of nearly 10%.

Sharing the same point of view, experts of MBS Securities Company stated that with GDP growth this year expected to reach 3% thanks to good pandemiccontrol, the VND will be under pressure of appreciation compared to other currencies.Besides, the increase in accumulating foreign exchange reserves in order to stabilise the exchange rate of the State Bank is also a factor supporting the strength of the VND, although the USD can recover thanks to positive GDP data.But the dynamic economic resilience is diversified; the VND will maintain stable in the near future.

It can be seen that the end of the year is always the peak season for trading and import-export activities, however, thanks to the abundant supply of foreign currencies, the exchange rate path will still "go sideways".However, experts still emphasized that it is necessary to continue to increase foreign exchange reserves and pay attention to the impact of financial risks and the US-China trade war.

Related News

Exchange rate risks need attention in near future

16:31 | 15/02/2025 Import-Export

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Industrial production maintains rapid and throughout bounceback

15:20 | 31/12/2024 Import-Export

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Latest News

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

More News

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export

Rice export prices drop, but decline expected to be short-term

08:10 | 17/02/2025 Import-Export

Key agro products expected to maintain export growth this year

08:08 | 17/02/2025 Import-Export

EU issues 12 warnings against Việt Nam’s food and agricultural exports

08:07 | 17/02/2025 Import-Export

Việt Nam to impose VAT on low-value express-imported goods

08:06 | 17/02/2025 Import-Export

Vietnam kicked off the year with a strong start in trade, exceeding US$63 billion in the first month

16:30 | 15/02/2025 Import-Export

Import and export turnover reaches about US$29 billion in the second half of January 2025

14:52 | 14/02/2025 Import-Export

Market edges up slightly as liquidity remains low

14:48 | 14/02/2025 Import-Export

Business regulations must be trimmed for development of enterprises: Experts

14:46 | 14/02/2025 Import-Export

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Embracing green exports: a pathway to enter global supply chains

10:33 | 20/02/2025 Import-Export

New policy proposed to prevent transfer pricing, tax evasion of FDI enterprises

10:32 | 20/02/2025 Import-Export

Việt Nam’s durian exports to China plummet by 80%

16:18 | 19/02/2025 Import-Export

Coconut exports reach 14-year high

15:29 | 18/02/2025 Import-Export

Shrimp exports grow in the first month of 2025

15:28 | 18/02/2025 Import-Export