The Ministry of Finance does not "undercut" the business preference

| The Ministry of Finance proposed to abolish 2 conditional business sectors | |

| Guidance on the management of value-added tax refund | |

| Supporting business startups: Reduced taxes- Creating Motivation |

|

| Circular 83/2016 / TT-BTC has been reviewed thoroughly before promulgation. |

Only using the most profitable preference

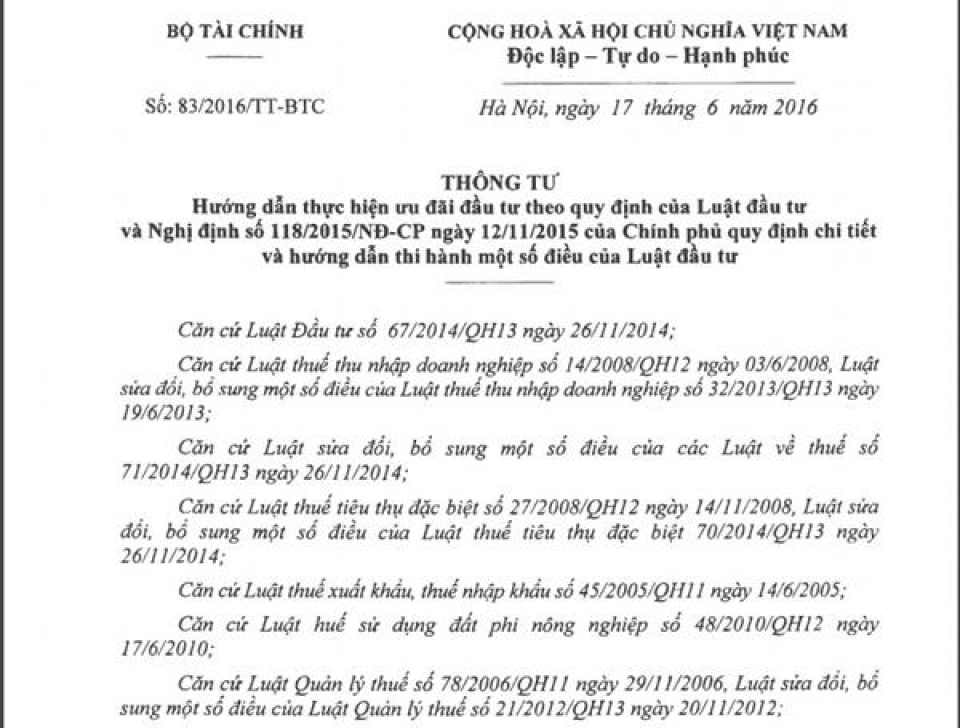

After the Investment Law 2014 was approved and took effect from July 1, 2015, the Government issued Decree No. 118/2015/ ND-CP of the Government regulating details and guidance of the implementation of some provisions of the Investment Law, effective from November 27, 2015. At the same time, the Ministry of Finance issued Circular No. 83/2016/ TT-BTC guiding the implementation of investment incentives as defined in two above documents and took effect from August 1, 2016.

However, after the new circular was introduced, some articles have shown that the new rules and regulations were not consistent with the Investment Law 2014 and undercut the business incentives and preference.

Specifically, many articles stated there were two unreasonable contents, including: The new investment projects which meet the requirements of preferential conditions for company income tax (CIT) have the right to enjoy the best preferential level; The investment projects which were licensed before July 1, 2015 still were entitled to enjoy preference under the new rules for the remaining time.

Regarding the first content, a representative of the Tax Policy Department commented: Paragraph 3 of Article 15 of the Investment Law 2014 stipulated the specific investment incentives which were applied to each type of new investment projects according to the provisions of the tax law.

Meanwhile, in the tax law, especially Clause 4 of Article 18 of the Vietnam Enterprise Income Tax Law in 2013 stated quite clearly: At the same time, if enterprises enjoy many different levels of tax incentives for the same income, enterprises may choose to apply the most favorable tax incentives.

Thus, the investment projects enjoy the most favorable tax incentives if enterprises simultaneously satisfy several conditions of tax incentives under Circular No. 83 of the Ministry of Finance, consistent with the Investment Law and Enterprise Income Tax Law.

Ensure the legal rights when the laws change

Regarding contents that allow the investment projects licensed before July 1, 2015 to enjoy tax incentives under the new rules for the remaining time, a representative of the Tax Policy Department said that it ensures the legal rights of enterprises when the laws have changed.

This priority was regulated in the Investment Law 2014 and Decree 118 on the spirit of "incentives which investors were entitled to under the provisions of the legislation prior to the new legislation taking effect".

Thus, the statement: "The Ministry of Finance’s guidelines were seriously against the law, undercut the business preference in the field of investment” did not fully take into account the content of the guidance under Circular No. 83.

The Ministry of Finance also confirmed the issue that the guidelines for “new investment projects enjoying tax incentives if they meet the requirements of CIT incentives stipulated by the CIT Law" under Circular 83 was right, in accordance with the provisions of the Investment Law, the current Enterprise Income Tax Law, not undercutting the business preference.

| Creation of a mechanism for online tax declaration for personal house rental VNC - According to the General Department of Taxation has proposed to the Ministry of Finance a ... |

In conclusion, the content of Circular 83/2016 / TT-BTC has been reviewed thoroughly to ensure conformity with the provisions of the Investment Law and the current tax law.

Same topic: Investment Environment

Related News

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance

"One law amending four laws" on investment to decentralize and ease business challenges

16:44 | 01/11/2024 Regulations

Removing difficulties in public investment disbursement

09:30 | 31/10/2024 Finance

Ensuring reasonableness upon enforcement of regulations in "1 law amending 7 laws"

00:00 | 19/10/2024 Regulations

Latest News

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

More News

Striving for average CPI not to exceed 4%

16:41 | 01/11/2024 Finance

Delegating the power to the government to waive, lower, or manage late tax penalties is suitable

16:39 | 01/11/2024 Finance

State-owned commercial banking sector performs optimistic growth, but more capital in need

09:28 | 31/10/2024 Finance

Stipulate implementation of centralized bilateral payments of the State Treasury at banks

09:29 | 29/10/2024 Finance

Rush to finalize draft decree on public asset restructuring

09:28 | 29/10/2024 Finance

Inspection report on gold trading activities being complied: SBV

14:37 | 28/10/2024 Finance

Budget revenue in 2024 is estimated to exceed the estimate by 10.1%

10:45 | 28/10/2024 Finance

Ensure timely and effective management and use of public asset

11:31 | 27/10/2024 Finance

Accelerating decentralization in public asset management

11:26 | 26/10/2024 Finance

Your care

M&A activities show signs of recovery

13:28 | 04/11/2024 Finance

Fiscal policy needs to return to normal state in new period

09:54 | 04/11/2024 Finance

Ensuring national public debt safety in 2024

17:33 | 03/11/2024 Finance

Removing many bottlenecks in regular spending to purchase assets and equipment

07:14 | 03/11/2024 Finance

Continue to handle cross-ownership in banks

10:35 | 02/11/2024 Finance