Tax incentives for battery-powered electric cars

|

| Each country in the world has its own tax incentives for battery-powered electric vehicles. Photo: Internet. |

Various tax incentives

According to the Ministry of Finance, climate change and environmental pollution from vehicle emissions are an urgent issue and concern for all countries around the world. Many nations are tending to gradually limit/eliminate fossil fuel vehicles, and encourage clean fuel vehicles through tax preferential policies and financial support to prioritise the development of production and use of battery-powered electric cars.

In Ukraine, battery-powered electric cars are free from excise tax.

In South Korea, battery-powered electric cars and hydrogen fuel cell cars are free from excise and vehicle tax.

In addition, South Korea has launched a programme to encourage the use of battery-powered electric cars since 2011 with a lot of subsidies and tax incentives nationwide. The government has also offered a US$13,000 price subsidy for fully electric vehicles, but this subsidy gradually fell from 2014 to 2020.

In terms of tax incentives, in 2015, South Korea issued a preferential framework for battery-powered electric cars such as amaximum reduction of US$2,000 for personal consumption tax (one-time payment); a maximum reduction of US$1,400 for car purchase tax.

China also exempts consumption tax on the purchase of battery-powered electric cars, and reduces registration fees by half for battery-powered electric cars.

Indonesia reduces or exempts luxury goods tax for battery-powered electric cars. From this year, the excise tax rate for plug-in hybrid electric vehicles will increase by 5%. For other hybrid vehicles (full hybrid and mild hybrid), will increase from 2% - 12% to 6% - 12%. There is a 0% tax rate for battery-powered electric cars. Indonesia also plans to increase the tax rate to 8% for plug-in hybrid electric vehicles, and 10% - 14% for other hybrid vehicles.

In addition, Indonesia also offers credit incentives for qualified organisations/individuals including: Import duty exemption for battery-powered electric cars in completely knocked down (CKD) or incomplete knocked down (IKD) and for main components used for battery-powered electric cars in a certain quantity in a certain period of time; reduction or exemption of sales tax on luxury goods; reduction or the exemption of taxes imposed by regional or central government, including tax reduction or exemption for motor vehicles or transfer of motor vehicle ownership; exemption from import tax on machinery, supplies and equipment used for the production of battery-powered electric cars; incentives for the production of equipment for battery-powered electric car charging stations and parking fee incentives issued by the regional government.

Since 2016 Thailand has reduced the excise tax rate for battery-powered electric cars according to the level of CO2 emissions. If the CO2 emission is below 100g/km, the tax rate will fall from 10% to 5%; if the CO2 emission is below 150g/km, the tax rate will fall from 20% to 10%; and if the CO2 emission is under 200g/km, the tax rate will be 12.5%.

In addition, investment projects in production of battery-powered electric cars are exempt from corporate income tax for 5-8 years.

In the US, at the state level, preferential policies are applied (exemption or reduction of excise tax, tax deduction, refund, registration fee reduction, parking fee reduction and support for the installation of electric charging stations) to encourage the purchase and use of hybrid and battery-powered electric cars.

Finland also levies a 3% tax on the registration of battery-powered electric cars.

Vietnam encourages the production of environmentally friendly cars

According to documents provided by the Ministry of Industry and Trade, ASEAN countries all offer tax incentives for environmentally friendly and low-emission cars, said the Ministry of Finance.

Regarding the orientations of Vietnam’s Government in the development of electric cars, the Political Bureau’s Resolution No. 23-NQ/TW dated March 22, 2018, on the national industrial development policy orientations through 2030, with a vision to 2045,states that priority is given to developing a number of industries and fields, including the automotive industry, implement a policy of tax exemption and reduction at a reasonable rate and with an appropriate time limit for industries prioritised for development.

Clause 7, Article 65 of the Law on Environmental Protection No. 72/2 provides that: “The Government shall promulgate policies to provide incentives for, assistance in and encourage the use of public transport, and renewable energy, fuel-efficient, low emission or zero emission vehicles; a roadmap for converting or removing vehicles using fossil fuels and causing environmental pollution.”

The Prime Minister’s Decision No. 1168/QD-TTg dated July 16, 2014 approving the strategy to develop Vietnam's automotive industry to 2025, orientation towards 2035, the orientation was given toencourage the production of environmentally friendly vehicles (fuel-saving cars, hybrid cars, vehicles using biofuels, electric vehicles), meeting the requirements of emission standards according to a roadmap approved by the Prime Minister.

In Notice No. 135/TB-VPCP, the Deputy Prime Minister assigned the Ministry of Finance to assume the prime responsibility and coordinate with the Ministry of Industry and Trade, the Ministry of Justice, the Ministry of Natural Resources and Environment, the Ministry of Transport and the VCCI, to note opinions at the meeting, synthesise and complete the evaluation content of Vingroup's proposal. It is necessary to clarify the need, evaluate and introduce specific solutions to report to the Prime Minister before June 10 this year.

Related News

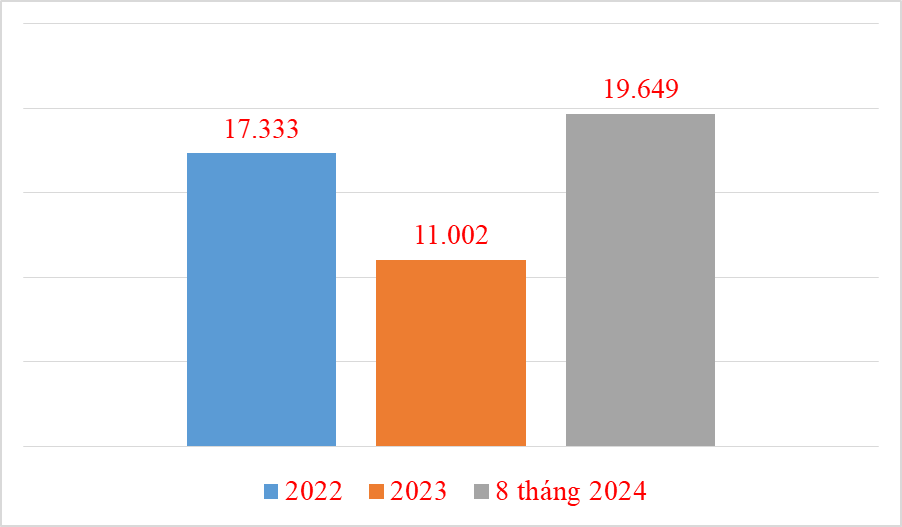

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

From case of illegally importing three cars in Hai Phong: What are conditions for doing business of car import?

10:13 | 19/08/2024 Customs

Hai Phong Customs detects 3 smuggled cars hidden inside empty container

14:20 | 15/08/2024 Anti-Smuggling

Proposal to reduce registration fees to restore growth of domestic automobile industry

09:33 | 07/07/2024 Regulations

Latest News

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

More News

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Your care

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance