Suggest separate regulations on customs procedures for goods transactions via e-commerce

|

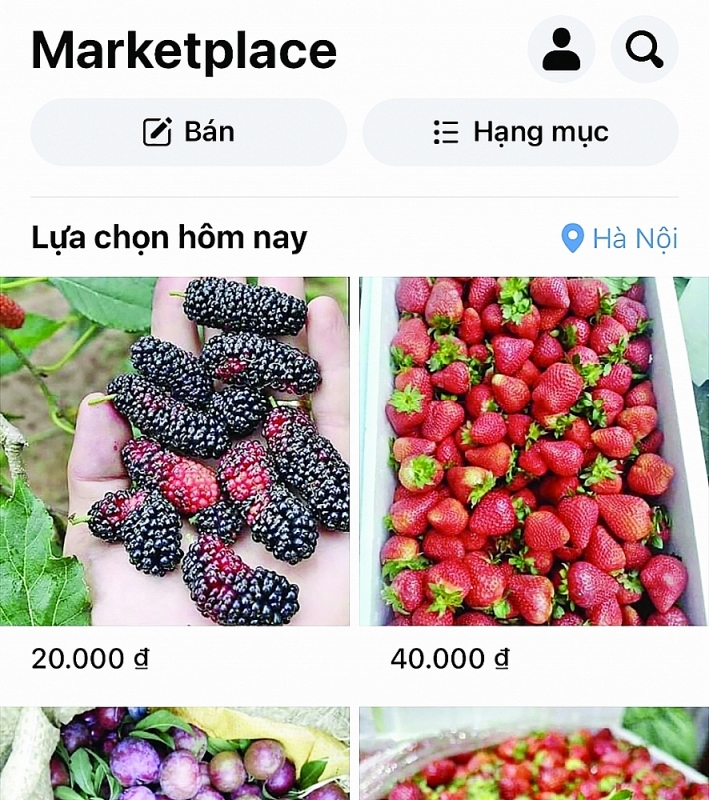

| The advertising images in the Marketplace of Facebook. Photo: H.Dịu |

The law is out of date

Social media has become an effective channel to support e-commerce with low cost, especially for small businesses and individual business households. E-commerce on social networks is diverse and plentiful, can take place on the ads section of forums, on personal pages or on groups on social networks. The goods are also very diverse in types, including products subject to high quality standards control such as medicines, cosmetics and supplementary foods.

In terms of legal aspects, frameworks for e-commerce activities and social networking activities have been built mainly since 2013. Therefore, many issues have not been mentioned or are very general and out of date.

According to the report "E-commerce on social networks in Vietnam: Some legal issues" conducted by the Vietnam Chamber of Commerce and Industry (VCCI), current legal regulations tend to apply the same management measures for the two forms of e-commerce in social networks and on e-commerce exchanges, although these two types have their own specialties.

Besides that, tax administration for activities engaged in e-commerce elements on social networks still face many difficulties.

According to representatives of the VCCI's research team, tax administration focuses on two major issues, firstly, value added tax and the income tax of individuals and organisations selling goods and services on social networks; secondly, withholding taxes on social networks that provide cross-border services. Research shows that traditional tax collection methods are not feasible when applied to domestic and cross-border individuals and organisations operating business on social networks, due to their small nature and lack of a physical business location.

How to manage cross-border e-commerce?

The law for domestic activities management is difficult, the management of e-commerce activities on cross-border social networks in Vietnam is also causing a headache for management authorities. According to the survey, in Vietnam, besides Zalo, the top social networking platforms are all cross-border platforms, such as Facebook, YouTube, Twitter, Instagram, Tiktok and Pinterest. The activities of buying and selling goods and services on these cross-border platforms are quite common and contribute significantly to the development of e-commerce in Vietnam.

According to Nguyen Minh Duc, VCCI Legal Department, although e-commerce activities with foreign elements have many positive aspects, they also create many difficulties, problems and shortcomings for the market. For example, it is difficult for State management authorities to contact the operators of cross-border social networks to coordinate legal violations due to geographical distance, time delay and jurisdiction issues.

The current legal framework has not regulated the management of e-commerce activities with foreign elements in general and e-commerce activities on cross-border social networks in particular. Nguyen Minh Duc said that when building legal regulations to manage e-commerce activities with foreign elements in Vietnam, the first issue is to identify who belongs to the scope of regulation. Currently, there are millions of e-commerce websites globally, including many e-commerce exchange and social networks accessed by users from Vietnam. Managing all these websites is not possible. Therefore, there should be criteria to easily determine which websites fall under the scope of the regulations of Vietnam.

Regarding the management of import and export goods, the Ministry of Finance is drafting a decree on customs management for import and export goods traded via e-commerce. These activities have been carried out based on normal importing and exporting goods activities. However, due to the complexity of customs procedures, it usually has an intermediary to help to carry out the import and export of goods. It is expected the new policy of the Ministry of Finance will make customs procedures simpler and ordinary individual shoppers and e-commerce exchanges will be able to implement by themselves without assistance.

This policy is designed as follows: E-commerce exchange will connect to the website of the General Department of Vietnam Customs to transfer information to the Customs system. This information is used to fill in the customs declaration, the person who opens the declaration only needs to confirm without losing the declaration. The customs system will automatically classify the goods, determine the amount of tax and associated obligations. Orders with low value and low risk of causing negative impacts on society may be exempt from specialised inspection.

However, the representative of VCCI said for e-commerce elements on social networks, it is very difficult to enjoy the convenience of this new policy asthis policy is only apply for commercial platforms that have the function of online ordering, even supporting shipping and payment. Therefore, these platforms could connect and transmit information to Customs authority.

Therefore, the VCCI's report on e-commerce recommended clear regulations be developed on content that needs to be censored and eliminated. In addition, tax administration needs to build a clear and flexible mechanism for individuals and organisations to sell goods on social networks. At the same time, it is also necessary to build separate regulations on customs procedures for e-commerce goods to facilitate the import and export of these goods.

Related News

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Amending regulations on enforcement measures in tax administration

10:05 | 08/11/2024 Regulations

Customs sector proactively manages cross-border e-commerce

09:08 | 13/10/2024 Customs

For sustainable development of cross-border e-commerce

14:43 | 04/09/2024 Headlines

Latest News

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

More News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Your care

From January 1, 2025: 13 product codes increase export tax to 20%

14:23 | 29/12/2024 Regulations

Export tax rates of 13 commodity codes to increase to 20% from January 1, 2025

13:46 | 28/12/2024 Regulations

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations