Strengthening management and supervision of the corporate bond market

|

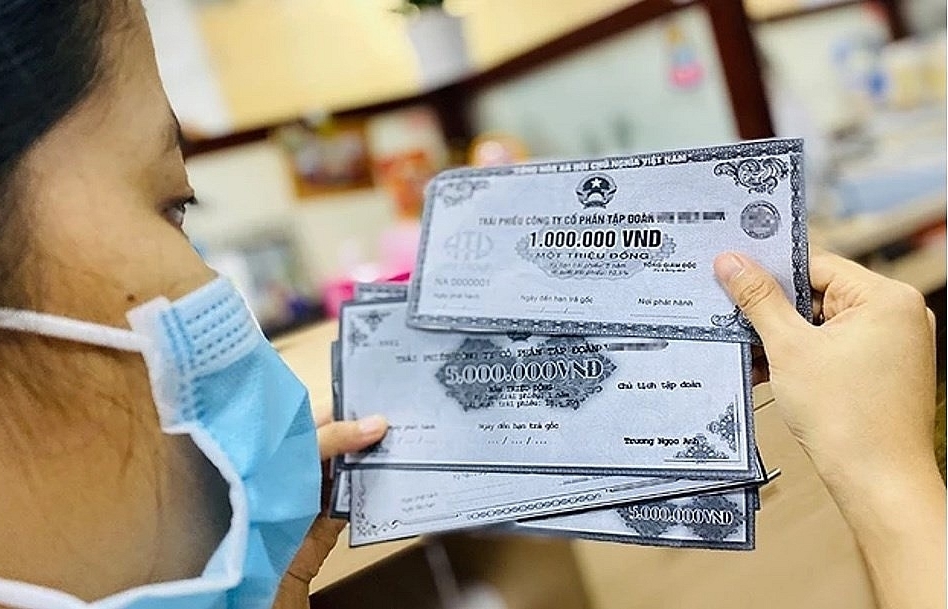

| The corporate bond market has grown strongly since 2018 . Source: Internet |

The volume of private placement corporate bonds reached VND357,000 billion

Established in 2000, the corporate bond market has grown strongly since 2018 in order to meet the capital needs for production and business of enterprises in the context of a downtrend in credit growth.

In order to limit risks and create a synchronous legal framework for the development of the corporate bond market, the Ministry of Finance has submitted to the Government to report to the National Assembly uniform regulations on corporate bond issuance in the Law on Securities in 2019 and the Law on Enterprises in 2020 and submit to the Government for promulgation Decree No. 153/2020/ND-CP and Decree No. 155/2020/ND-CP regulating the issuance of corporate bonds, guiding the Law on Securities and the Law on Enterprises.

Accordingly, from January 1, 2021, only professional securities investors can buy and trade corporate bonds private placement while public offering bonds must have a certificate of registration granted by the State Securities Commission and request a credit rating according to the roadmap.

After nine months of implementing the new regulation that only professional securities investors could buy and trade corporate bonds private placement, the volume of corporate bonds increased, reaching VND357,000 billion (up 5.6% over the same period in 2020). The volume of corporate bond public offering was VND17,375 billion (down 14% compared to the same period in 2020).

In the individual corporate bond market, credit institutions had the largest issuance volume, accounting for 37.3%, and real estate businesses accounted for 31.1%. The proportion of professional individual investors buying corporate bonds under private placement decreased sharply compared to 2020 (buying 5.5% of the issuance volume in the first nine months of 2021 while the whole year of 2020 was 12.7%).

Besides the achieved results, through management and supervision, the market still has some issues to note. Most of the collateral of bonds are real estate, future projects or corporate shares, the value of the collateral is affected by market movements; some cases have not fully complied with the provisions of the law on professional securities investors when buying corporate bonds under private placement; there are businesses with issuance volume that is many times greater than equity.

Applying solutions to strengthen market supervision and management

Implementing the provisions of the Law on Securities, the Law on Enterprises and guiding documents, the Ministry of Finance has been strengthening the management and supervision of the corporate bond market.

Specifically, the Ministry of Finance focused on communication and dissemination of new regulations on offering and trading corporate bonds, warning about risks to entities when participating in the market, and orienting solutions to develop the corporate bond market that has been carried out periodically, proactively and effectively.

Accordingly, in the first nine months of 2021, the Ministry of Finance held three conferences and dialogues on disseminating the policy of corporate bonds, and published information in the press. In the future, the Ministry of Finance will continue to actively inform and disseminate the situation of the corporate bond market; timely warning risks to investors, issuers and service providers.

Besides that, in order to limit risks and strengthen management and supervision of the corporate bond market, the Ministry of Finance has directed the State Securities Commission to deploy four inspection teams in October 2021 at 10 securities companies on the situation of service provision of corporate bonds; conduct inspection of some enterprises that have large bond issuance volume; issue unsecured bonds; and weak financial situation.

Regarding mechanisms and policies, on the basis of management, supervision and inspection results on the issuance and provision of services on corporate bonds, the Ministry of Finance is evaluating to propose amendments to Decree No. 153/2020/ND-CP in the direction of restricting enterprises from issuing bonds in large volumes that does not serve production and business, enhancing publicity and transparency in raising capital.

The Ministry of Finance has also actively coordinated with ministries and sectors to strengthen the management and supervision of the corporate bond market. Accordingly, requesting the State Bank to inspect and supervise the mobilization of credit institutions capital from bond issuance and coordinating to share information on inspection and supervision results; request the Ministry of Construction to have solutions to manage the real estate market, coordinate management, monitor and warn real estate businesses about the risks of growth; organize to work with the Ministry of Public Security on the legal framework and issue of corporate bonds to enhance coordination and information sharing.

In order to increase publicity, transparency and strengthen management and supervision of secondary trading activities of corporate bonds under private placement, the Ministry of Finance is urgently developing a Circular and preparing to establish a private placement corporate bond market for professional securities, and at the same time upgrade the information page on corporate bonds and the system of listing and trading corporate bonds under public offering.

Related News

Transparency evates the standing of listed companies

09:47 | 21/11/2024 Finance

Industrial real estate - "Magnet" attracting foreign capital

09:01 | 07/09/2024 Import-Export

Many positive signals in the corporate bond market

10:20 | 25/08/2024 Finance

Transparent and stable legislation is needed to develop renewable energy

13:45 | 01/08/2024 Import-Export

Latest News

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

More News

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Your care

Fed’s foreseen rate cuts affect foreign exchange rate

14:12 | 23/12/2024 Finance

Untying the knot for green finance

11:08 | 23/12/2024 Finance

Ensuring efficiency and transparency in use and management of houses and land at State enterprises

13:54 | 22/12/2024 Finance

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance