State Budget gives priority to education and training

| The state budget spends VND228.2 trillion | |

| How to get 2% interest rate support from the state budget? |

|

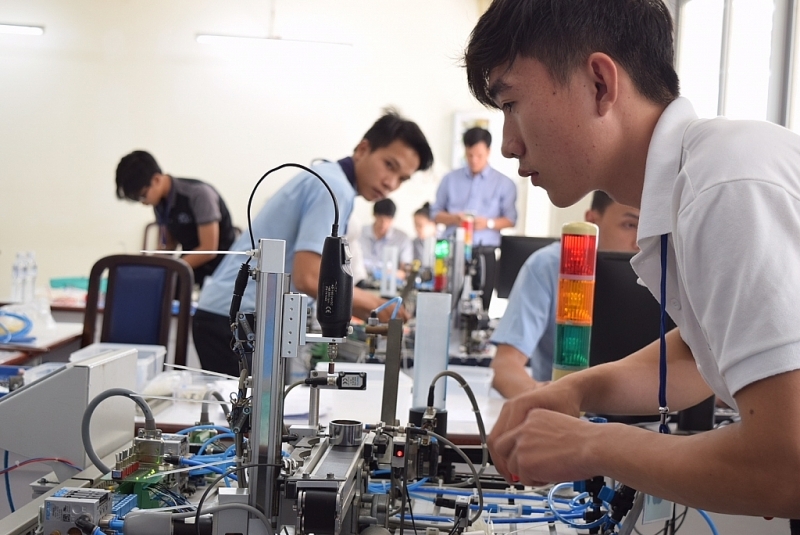

| The Party, State and Government identifies education and training as a national policy, and investment in education and training as an investment in development. Photo: Internet. |

Recently, the Ministry of Finance has received petitions from voters on contents related to education.

Accordingly, voters in Da Nang suggested that the Government should consider adding financial resources to invest in education because the current investment is still limited and has not met the requirements for the educational development of the whole country.

Hai Phong voters also suggested that the Government pay attention to budget allocation, adjust investment in education and training to ensure the quality of education and training, improve the capacity to respond to Covid-19 pandemic prevention and control.

According to the Ministry of Finance, the Party, State and Government have always identified education and training as a national policy, and investment in education and training as an investment in development. Therefore, education and training is given the top priority in the overall investment of state financial resources.

The State has issued many policies to increase investment in education and training, gradually meeting the requirements for educational development of the whole country. The National Assembly promulgated the Law on Public Investment 39/2019/QH14 to regulate public investment, including public investment in education and training.

The National Assembly, the Government and the Prime Minister have issued many policies prioritizing the use of the state budget for education and training, such as using revenue from lottery activities for investment and development goals, in which priority is given to investment in education, training and vocational training, public health, and additional investment in the procurement of teaching equipment for program innovation, general education books; the program to repair schools, classrooms and public houses for teachers in the 2014-2015 period and the roadmap to 2020; credit policy for pupils and students; policies on granting scholarships, tuition fee exemption and reductions, funds for school fees and accommodation for pupils, in which priority is given to students from ethnic minorities; policies on salaries and allowances for teachers and education administrators; policies for public education and training institution and non-public education institutions.

According to the Ministry of Finance, the Government has submitted to the National Assembly Standing Committee for approval Resolution 01/2021/UBTVQH15 stipulating principles, criteria and norms for allocation of recurrent expenditure estimates of the state budget.

The Prime Minister issued Decision 30/2021/QD-TTg dated October 10, 2021 on promulgating principles, criteria and norms for allocation of recurrent expenditure estimates of the State budget in 2022.

Accordingly, the regulations on budget allocation have taken into account the priorities for education and training and health.

The Government has also issued or submitted to competent authorities for promulgation guidelines and policies to support laborers, including employees in the education-training sector, pupils; students and workers in vocational training; education and training institutions affected by the Covid-19 pandemic.

Related News

Director General Nguyen Van Tho: streamlining apparatus to meet the requirements of customs modernization

15:53 | 02/01/2025 Customs

Proposal to reduce 30% of land rent in 2024

14:58 | 25/12/2024 Regulations

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Ministry of Finance stands by enterprises and citizens

15:30 | 13/12/2024 Finance

Latest News

SBV makes significant net withdrawal to stabilise exchange rate

07:59 | 15/01/2025 Finance

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

More News

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Your care

SBV makes significant net withdrawal to stabilise exchange rate

07:59 | 15/01/2025 Finance

Việt Nam could maintain inflation between 3.5–4.5% in 2025: experts

06:19 | 11/01/2025 Finance

Banking industry to focus on bad debt handling targets in 2025

14:38 | 03/01/2025 Finance

State Bank sets higher credit growth target for 2025

15:22 | 31/12/2024 Finance

Outlook for lending rates in 2025?

15:20 | 31/12/2024 Finance