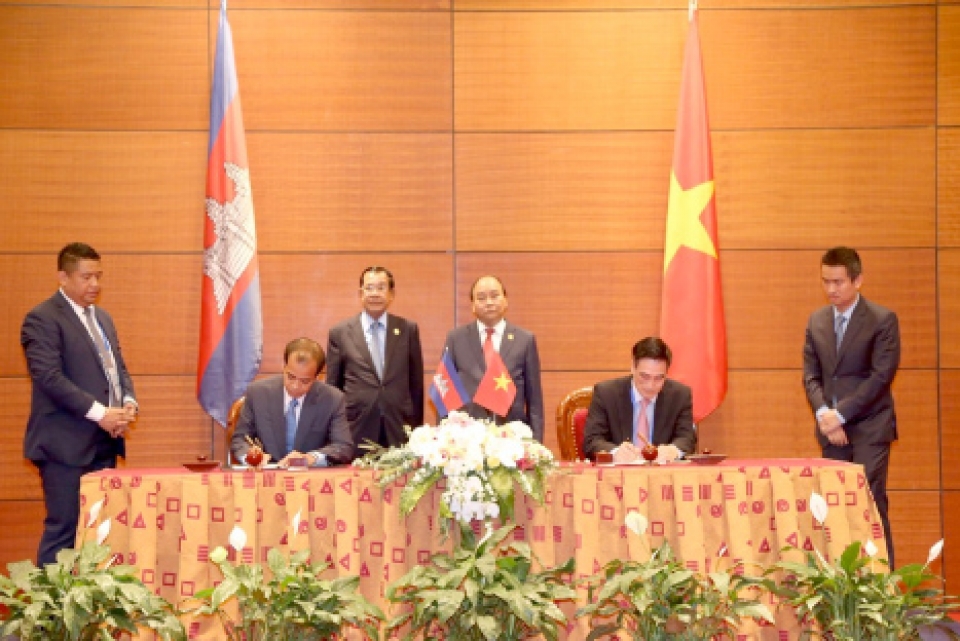

Signing agreement on double taxation avoidance between Vietnam and Cambodia

|

| In 2017, the total trade turnover of Vietnam and Cambodia reached $US 3.8 billion, increased by 30% compared to the year of 2016. Photo: TCT |

On the occasion of the 6th Greater Mekong Sub-region Summit (GMS) and the 10th Cambodia-Laos-Vietnam Development Triangle Area Summit, the Ministry of Finance Vietnam, and the Ministry of Economy and Finance of Cambodia, have officially signed the Agreement on double taxation avoidance to prevent the evasion of taxes on income taxes between the two governments.

In recent years, the friendly cooperative relations between Vietnam and Cambodia have developed comprehensively, economic cooperation between the two countries has been growing more and more powerful. Vietnam is Cambodia's third largest trading partner among more than 140 countries and territories that have trade relations with the country.

In 2017, the total trade turnover of Vietnam-Cambodia reached $US 3.8 billion, increased by 30% compared to 2016. In that, Vietnam's export turnover to Cambodia reached $US 2.8 billion, an increase of 26.2 %; Vietnam's import turnover from Cambodia is about $US 1 billion, increased by nearly 41% compared to 2016. Both sides are striving to increase bilateral turnover to $US 5 billion in the future.

Up to now, Vietnam has 190 investment projects in Cambodia, with a total registered investment of $US 2.89 billion, mainly in agriculture and forestry. Up to 20th March, 2018, Cambodia has 19 projects with a total investment capital of $US 64.9 million, ranked 56th in 126 countries and territories that have invested in Vietnam, and ranked 8th in the number of ASEAN countries investing in Vietnam.

With the economic trade and investment situation between the two countries, the signing of the Agreement on double taxation avoidance between Vietnam and Cambodia will contribute promoting trade and investment cooperation between them, creating a clear, stable tax environment for Vietnamese and Cambodian investors to develop and expand their business-investment activities. At the same time, indirectly enhancing the comprehensive cooperation in the fields between Vietnam and other Asian countries in general and ASEAN countries in particular.

Related News

Expansionary fiscal policy halts decline, boosts aggregate demand

19:27 | 14/12/2024 Finance

Ministry of Finance stands by enterprises and citizens

15:30 | 13/12/2024 Finance

Ministry of Finance proposes comprehensive amendments to the Personal Income Tax Law

11:23 | 16/12/2024 Finance

Tax authorities crack down on invoice fraud to legalize smuggled goods

09:41 | 12/12/2024 Anti-Smuggling

Latest News

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

More News

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance

PM urges stronger measures to manage interest rates

16:53 | 17/12/2024 Finance

Six SOEs to be transferred back to industry ministry

16:48 | 17/12/2024 Finance

Vietnamese products: Conquering foreign customers in supermarket systems

16:45 | 17/12/2024 Finance

Answering many questions from businesses at dialogue conference on tax and customs policies

10:01 | 17/12/2024 Finance

Enterprises face difficulties in tax refunds due to partners closing

10:01 | 17/12/2024 Finance

Strengthen the management and use of electronic invoices for e-commerce

11:24 | 16/12/2024 Finance

Banks face difficulties in balancing capital raising and lending

15:29 | 13/12/2024 Finance

Credit continues to increase at the end of the year, room is loosened to avoid "surplus in some places - shortage in others"

10:23 | 13/12/2024 Finance

Your care

Vietnam's stock market to develop strongly and sustainably

19:08 | 21/12/2024 Finance

Tax sector achieves revenue target of about VND1.7 million billion

18:32 | 21/12/2024 Finance

General inventory of public assets raises efficiency of use and management of country's resources

09:29 | 20/12/2024 Finance

Publicizes progress of public investment disbursement for important national projects

15:21 | 19/12/2024 Finance

Six SOEs to be transferred back to industry ministry

15:38 | 18/12/2024 Finance