Progress of administrative procedures in NSW is uneven

|

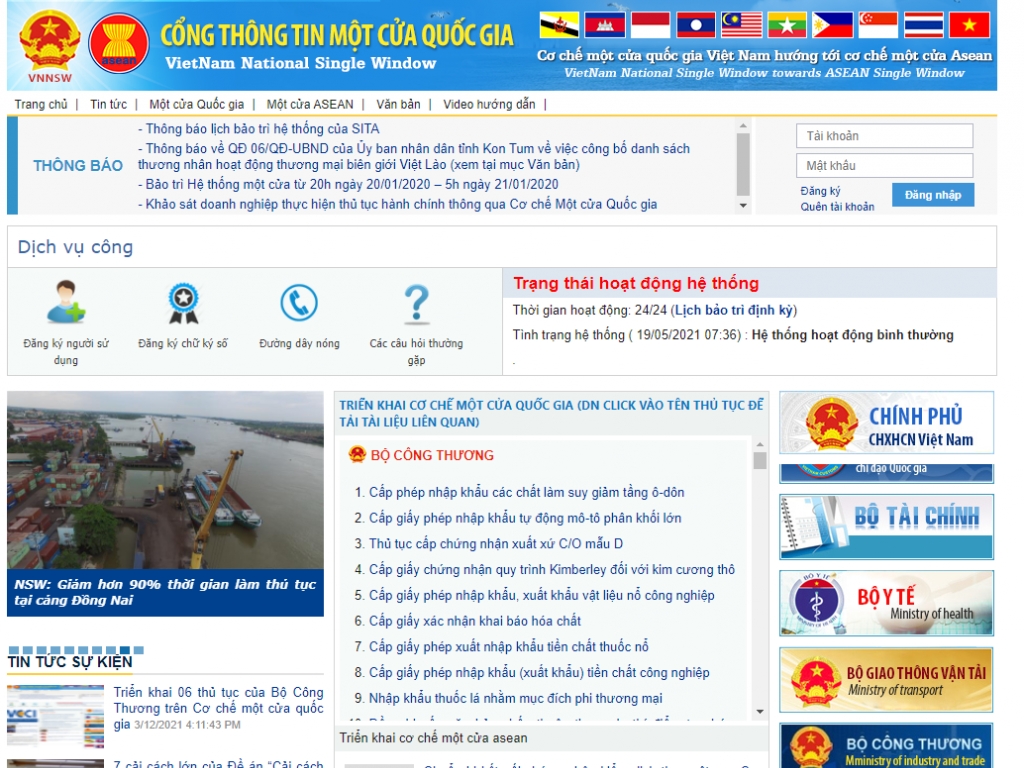

| The National Single Window Portal |

Procedures in the medical field are processed slowly

In a recent survey by the Vietnam Chamber of Commerce and Industry (VCCI), businesses assessed that implementing administrative procedures on the National Single Window is more difficult than the 2019 survey with 10 of 12 surveyed procedures. This is because from January 2020 until the end of the first quarter of 2022, Vietnam was severely affected by the Covid-19 pandemic, and the social distancing policy was applied nationwide, the implementation of administrative procedures in general, including import and export procedures, was also greatly affected.

The rate of businesses facing difficulties implementing procedures about "Granting import permits of medical equipment and "Granting Receipt Numbers for the announcement of imported cosmetic products" rose 21% and 20%, respectively.

In contrast, the rate of businesses facing difficulties in implementing procedures "Granting a Certificate of quality, technical safety and environmental protection for imported motor vehicles", "Granting a Certificate of quality inspection, technical safety and environmental protection for special-use motorcycles" of the Ministry of Transportation reduced 4% and 3% respectively.

Thus, according to VCCI's assessment, the launching of NSW has brought positive changes in the processing time of administrative procedures.

Specifically, it is assessed that 10 of 12 surveyed procedures processed on the NSW portal are faster than a traditional submission of paper documents. The processing time was reduced from 5 hours to 25 hours. Of which the procedure that recorded the most reduction of processing time of 25 hours is the procedure for "registration of inspection and certification of quality of imported animal feed" of the Ministry of Agriculture and Rural Development

However, the processing time for granting import permits of medical equipment in the NSW is up to 632 hours, 84 hours longer than the paper document submission. Similarly, the processing time for granting receipt numbers for the announcement of imported cosmetic products also prolongs 25 hours (from 153 hours for direct submission at the Ministry of Health's office to 178 hours for online submission to the NSW).

The reduction rate of processing time on the NSW portal compared to the traditional method for 10 of 12 surveyed procedures is 26% - 54%. Notably, the procedure for granting import/export permits of industrial precursors reduces more than half of the processing time.

Launching the NSW also helps reduce expenses for businesses at almost administrative procedures compared to the traditional method. For example, 10 of 12 surveyed procedures record reduced costs when processed on the NSW. The costs reduce from VND148,000 to VND3,845,000. The procedure for Vietnamese and foreign ships exiting from international seaports sees the highest reduced cost of VND3,845,000.

Contrary to the above trend, two procedures increase costs when they are processed on the NSW Portal are the procedure for "Granting a certificate of quality, technical safety and environmental protection for special-use motorcycles " of the Ministry of Transport and the procedures for "registration for inspection and certification of quality of imported animal feed" of the Ministry of Agriculture and Rural Development. Specifically, the cost of performing these two procedures on the NSW Portal is higher than that of the traditional VND408,000 VND and VND93,000, respectively.

10 of 12 procedures reduce costs from 18% to 82%. Notably, up to seven administrative procedures reduces at least half of the costs. The highest cost reduction is the procedure for " Granting import/export permits of industrial precursors" (down by 82%), followed by the procedures for" Granting preferential C/O" (down 81%), "Quality inspection of imported goods" (75%), "Granting a certificate of quality, technical safety and environmental protection of imported motor vehicles" (down 70%).

However, the procedures for "Granting a certificate of quality, technical safety and environmental protection for special-use motorcycles" and "Registration for inspection and certification of quality of imported animal feed" double in cost by 47% and 53%, respectively.

It is necessary to expand the utilities

To improve the efficiency of the NSW Portal, VCCI also suspected that the NSW Portal should soon be integrated with services and utilities like in many other countries, such as: electronic payment or integrating the electronic phytosanitary certificate system (ePhyto) with other countries in ASEAN. In the long term, the NSW Portal provides public services and business-to-business connection platforms. Therefore, an enterprise accessing the NSW Portal will not only be able to solve administrative procedures but also find partners and service networks for its production and business activities.

A Vietnam Association of Small and Medium Enterprises representative said that the NSW Portal is a push to help small and medium enterprises reduce compliance costs. Small and medium-sized enterprises are very responsive and flexible in converting business purposes. Therefore, the NSW portal helps them develop more sustainably.

| Six ministries complete the connection of administrative procedures to National Single Window VCN – Up to now, there are only 12 administrative procedures that need to connect to the ... |

According to the representative, under the report of the mobile world market in 2021, Vietnam had 70% of the population using mobile phones, of which 95% accessed the internet by mobile phones. However, up to now, the NSW Portal still has not had a mobile phone interface or version. The NSW portal was developed with technology over 10 years ago, so it is necessary to develop a new version to meet the practical requirements. The ministries and agencies unified the NSW portal are one of the solutions to help the Government accelerate digital transformation and support businesses more.

Related News

Proactive plan to meet customs management requirements at Long Thanh International Airport

18:30 | 21/12/2024 Customs

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

Necessary conditions for operating a "natural flavor" business

19:28 | 14/12/2024 Import-Export

Mong Cai: Smuggling concerns amid sluggish business activities

09:43 | 08/12/2024 Anti-Smuggling

Latest News

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations

More News

Review of VAT exemptions for imported machinery and equipment

10:31 | 05/12/2024 Regulations

Customs tightens oversight on e-commerce imports

13:39 | 04/12/2024 Regulations

Bringing practical experience into customs management policy

13:48 | 03/12/2024 Regulations

Businesses anticipate new policies on customs procedures and supervision

15:41 | 29/11/2024 Regulations

Do exported foods need iodine supplementation?

11:06 | 29/11/2024 Regulations

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Proposal to change the application time of new regulations on construction materials import

08:52 | 26/11/2024 Regulations

Ministry of Finance proposed to reduce VAT by 2% in the first 6 months of 2025

09:00 | 24/11/2024 Regulations

Hanoi Customs resolves tax policy queries for enterprises

09:26 | 22/11/2024 Regulations

Your care

Resolve problems related to tax procedures and policies for businesses

13:54 | 22/12/2024 Regulations

New regulations on procurement, exploitation, and leasing of public assets

09:17 | 15/12/2024 Regulations

Actively listening to the voice of the business community

09:39 | 12/12/2024 Customs

Step up negotiations on customs commitments within the FTA framework

09:44 | 08/12/2024 Regulations

Proposal to amend regulations on goods circulation

13:45 | 06/12/2024 Regulations