Payment deadlines extended for domestic automobiles

| Impose special consumption tax on pick-up car | |

| Preferential tax policies issued for development of small cars |

|

| Extended payment deadlines ahead for special consumption tax, arising in October and November 2021. Photo: Internet. |

The payment deadline for special consumption tax, arising in October and November 2021 for domestically-manufactured or assembled automobiles, will be extended. For October it will be extended to no later than December 20, and for November no later than December 30, 2021.

If the tax payer makes additional declarations in the extended tax term, which lead to an increase in the payable special consumption tax, and sends their application before the extended tax payment deadline, then the deferred amount will include the additional tax payable.

If the taxpayer is subject to an extension of special consumption tax (SCT), they shall not pay the SCT payable on the declared CIT declaration.

If enterprises have branches and affiliated units that make CIT declarations to the Tax agency, these branches and affiliated units are subject to extension of the CIT payment deadline. If the branches and affiliated units do not engage in auto assembling and manufacturing then they are not subject to the extension of the CIT payment deadline.

The Decree took effect on December 4, 2021.

Related News

Automobile localization: rapid development from internal strength

07:44 | 31/12/2024 Headlines

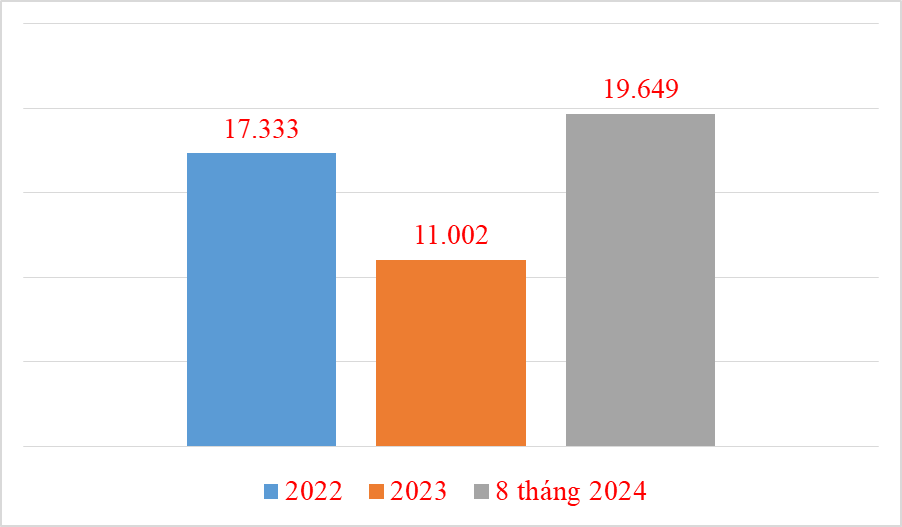

20,000 Chinese cars imported in 8 months

09:13 | 30/09/2024 Import-Export

Tax increase for alcohol, beer, tobacco should go with combat against smuggling and tax evasion

09:35 | 11/09/2024 Regulations

Alcohol and beer are subject to special consumption tax

19:06 | 02/09/2024 Regulations

Latest News

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

More News

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance

Fiscal, monetary policies support demand stimulation, price stabilisation

14:49 | 14/02/2025 Finance

Vietnam secures VND 157 billion from state enterprise divestment in 2024

09:16 | 14/02/2025 Finance

Vietnam gears up for potential inflation impact in 2025

14:26 | 11/02/2025 Finance

VN’s credit conditions in 2025 expected to be stable

14:24 | 11/02/2025 Finance

State revenue in first month of the year equal to 14% of the estimate

10:12 | 11/02/2025 Finance

Securities 2025 expects a breakthrough in scale and quality

14:37 | 10/02/2025 Finance

Cash reserves in stock accounts at six-quarter low amid margin rise

08:23 | 10/02/2025 Finance

Five solutions for developing stock market in 2025

10:01 | 07/02/2025 Finance

Your care

The system has not recorded your reading habits.

Please Login/Register so that the system can provide articles according to your reading needs.

Personal income tax proposed for interest on some bank savings accounts

10:31 | 20/02/2025 Finance

Banks set for aggressive bond issuance in 2025 to fuel growth

16:20 | 19/02/2025 Finance

Central bank cuts interest rate on bills for first time in 2025

15:30 | 18/02/2025 Finance

Focusing on inspecting inventory of public assets at units with large and complex assets

16:31 | 15/02/2025 Finance

The government seeks approval for revised GDP, CPI targets

16:28 | 15/02/2025 Finance