Overseas suppliers web portal is coming soon

|

| Overseas suppliers web portal is ready to launch |

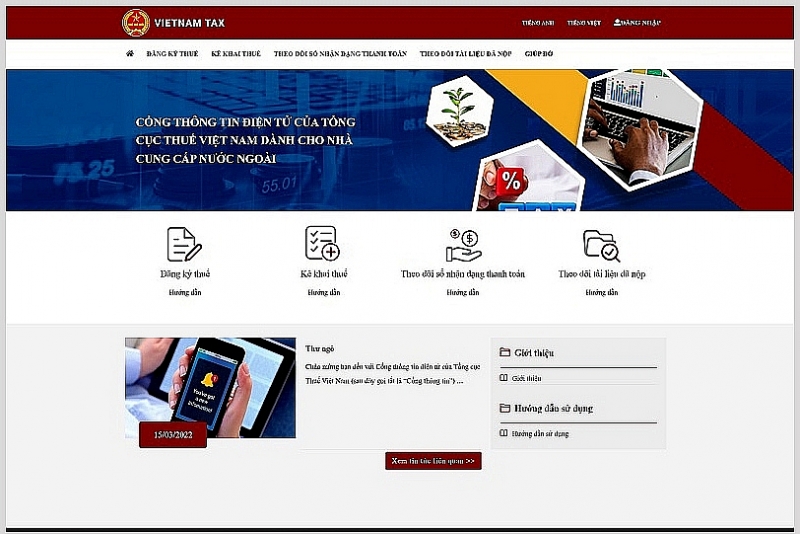

The web portal is built with the goal of creating the best conditions for overseas suppliers who do not have a permanent establishment in Vietnam to conveniently implement tax laws and policies.

The General Department of Taxation said that up to this point, the construction and trial operation of the web portal has been completed and is ready for official operation. After being put into operation, all transactions from registration, declaration, tax payment, etc. are done online through the portal, and overseas suppliers do not have to submit hard copies of documents to Vietnamese tax authorities.

A representative of the Large Corporate Tax Department (General Department of Taxation) noted that when registering for an electronic tax transaction, overseas suppliers register an electronic tax transaction together with the first tax registration through the Portal. At the same time, overseas suppliers must ensure that they have the ability to access and use the internet, and have an email address to conduct transactions with tax authorities directly managing them. Procedures are authenticated by electronic transaction authentication codes. The code is sent to the email that the taxpayer registered with the Vietnamese tax authority when making the first tax registration and registering to change information (if any).

The overseas suppliers are only allowed to register an official email address to receive all notifications during the transaction with the tax authority. After successfully completing the tax registration procedure for the first time, the portal will send information about the electronic transaction account and tax identification number to the registered taxpayer's email address in order to carry out tax procedures.

Tax identification numbers for cases where overseas suppliers directly or are authorized to register, declare and pay tax shall comply with the provisions of Circular No. 105/2020/TT-BTC dated December 3, 2020 of the Ministry of Finance on tax registration.

Along with that, the overseas suppliers make direct tax registration following Form No. 01/NCCNN issued together with Appendix I of this Circular on the web portal for overseas suppliers. In case changing tax registration information according to Form No. 01-1/NCCNN issued together with Appendix I of the circular, the tax authority can directly manage it on the web portal. To authenticate when registering for tax payment, overseas suppliers shall use the electronic transaction authentication code issued by the tax authority through the web portal.

In addition, Circular No. 80/2021/TT-BTC also clearly stipulates the responsibilities of tax authorities in tax administration for e-commerce, businesses on digital platforms, and other services performed by overseas suppliers.

Accordingly, the General Department of Taxation is the tax authority that directly manages overseas suppliers, is responsible for granting tax identification numbers to overseas suppliers following the regulations, receives tax returns, and performs tasks related to tax declaration and payments.

The General Department of Taxation is responsible for updating the list of overseas suppliers directly or authorized for tax registration and tax declaration on the overseas suppliers website; coordinating with relevant agencies in identifying and announcing the name and web address of overseas suppliers who have not yet registered, declared and paid tax but the goods and service buyers have transacted in Vietnam.

Besides that, tax authorities in Vietnam have the right to coordinate with tax authorities from abroad to exchange and urge overseas suppliers to declare and pay taxes; collecting tax arrears against overseas suppliers if it is proved that the overseas suppliers’ declaration and payment of tax are not correct; working with competent agencies to implement and handle in accordance with the law in case of non-compliance with tax obligations by overseas suppliers in Vietnam.

According to the Large Corporate Tax Department, for tax declaration, overseas suppliers make quarterly tax declarations, using form No. 02/NCCNN (issued together with Circular No. 80/2021/TT-BTC). The revenue subject to value-added tax and corporate income tax is the revenue received by overseas suppliers. The tax payable includes value-added tax and corporate income tax as a percentage of the revenue received by the overseas suppliers.

In case the overseas suppliers belong to a country or territory that has signed a tax agreement with Vietnam, they may carry out procedures for tax exemption or reduction under the Agreement on avoidance of double taxation as prescribed.

Regarding tax payment, a representative of the Large Corporate Tax Department said, for overseas suppliers, after receiving the identification code of the amount payable to the state budget announced by the General Department of Taxation, the overseas suppliers would pay taxes in a foreign currency converted into the state budget revenue account, in which the correct identification code of the amount payable to the state budget sent by the General Department of Taxation is ensured. Taxpayers who declare tax in any foreign currency shall pay tax in that freely convertible foreign currency.

On March 21, 2022, the General Department of Taxation will officially launch the portal for overseas suppliers.

Related News

Amendments to the Value-Added Tax Law passed: Fertilizers to be taxed at 5%

13:43 | 28/11/2024 Regulations

Amending the Law on Corporate Income Tax, not giving preferential treatment to overlapping and spreading industries

08:53 | 26/11/2024 Finance

Tax declaration and payment by e-commerce platforms reduces declaration points and compliance costs

09:19 | 17/11/2024 Finance

Amending Law on Corporate Income Tax must ensure budget revenue and overcome tax evasion

08:58 | 25/09/2024 Finance

Latest News

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

More News

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance

Bank stocks drive market gains as VN-Index closes final Friday of 2024 on a positive note

17:59 | 28/12/2024 Finance

Banks still "struggling" to find tools for handling bad debt

13:47 | 28/12/2024 Finance

Forecast upbeat for banking industry in 2025

14:30 | 27/12/2024 Finance

Ensuring financial capacity of bonds issuers

11:09 | 26/12/2024 Finance

Finance ministry announces five credit rating enterprises

14:54 | 25/12/2024 Finance

The capital market will see positive change

09:44 | 25/12/2024 Finance

Corporate bond issuance value rises by 60 per cent

13:51 | 24/12/2024 Finance

Slower mobilization than credit may put pressure on interest rates

09:02 | 24/12/2024 Finance

Your care

Tax policies drive strong economic recovery and growth

07:55 | 31/12/2024 Finance

E-commerce tax collection estimated at VND 116 Trillion

07:54 | 31/12/2024 Finance

Big 4 banks estimate positive business results in 2024

13:49 | 30/12/2024 Finance

Flexible and proactive when exchange rates still fluctuate in 2025

11:03 | 30/12/2024 Finance

Issuing government bonds has met the budget capital at reasonable costs

14:25 | 29/12/2024 Finance